Gas Mileage Reimbursement Log MTM, Inc Form

What is the gas mileage reimbursement log for MTM, Inc?

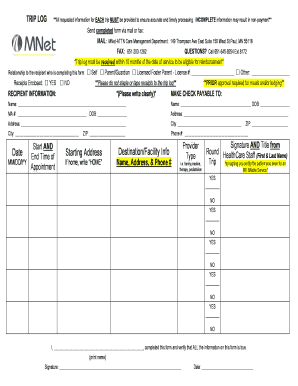

The gas mileage reimbursement log for MTM, Inc is a document used by individuals who provide transportation services for medical appointments or other approved activities. It tracks the miles driven for reimbursement purposes, ensuring that users are compensated fairly for their travel expenses. This log is essential for maintaining accurate records and adhering to reimbursement policies set by MTM, Inc.

How to use the gas mileage reimbursement log for MTM, Inc

Using the gas mileage reimbursement log effectively involves several steps. First, ensure you have the correct form, which can be obtained from MTM, Inc. Next, record the date of travel, the purpose of the trip, and the starting and ending odometer readings. Be diligent in noting any additional expenses related to the trip, such as tolls or parking fees. Finally, submit the completed log according to MTM, Inc's submission guidelines to ensure timely reimbursement.

Steps to complete the gas mileage reimbursement log for MTM, Inc

Completing the gas mileage reimbursement log requires careful attention to detail. Follow these steps:

- Obtain the gas mileage reimbursement log from MTM, Inc.

- Fill in your personal information, including your name and contact details.

- Document each trip by entering the date, purpose, starting odometer reading, and ending odometer reading.

- Calculate the total miles driven for each trip and include any related expenses.

- Review the log for accuracy before submission.

Key elements of the gas mileage reimbursement log for MTM, Inc

Several key elements must be included in the gas mileage reimbursement log to ensure it meets MTM, Inc's requirements. These elements include:

- Date: The date of each trip.

- Purpose: A brief description of why the trip was made.

- Odometer readings: Starting and ending readings to calculate total miles driven.

- Expenses: Any additional costs incurred during the trip, such as tolls or parking fees.

Legal use of the gas mileage reimbursement log for MTM, Inc

The gas mileage reimbursement log must be used in accordance with legal requirements to ensure compliance with tax regulations. It serves as a record that can be reviewed during audits or for reimbursement verification. Proper documentation helps protect against potential disputes regarding mileage claims and ensures that users receive the appropriate compensation for their travel.

State-specific rules for the gas mileage reimbursement log for MTM, Inc

Each state may have specific rules governing the use of gas mileage reimbursement logs. It is essential to be aware of these regulations, as they can affect reimbursement rates and tax implications. Users should consult local guidelines or MTM, Inc's resources to ensure compliance with state-specific requirements, which may include documentation standards or mileage reimbursement rates.

Quick guide on how to complete gas mileage reimbursement log mtm inc

Complete Gas Mileage Reimbursement Log MTM, Inc easily on any device

Digital document management has gained signNow traction among businesses and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed papers, allowing you to obtain the right form and securely archive it online. airSlate SignNow offers all the necessary tools to create, modify, and electronically sign your documents swiftly and without interruptions. Manage Gas Mileage Reimbursement Log MTM, Inc on any platform using airSlate SignNow's Android or iOS applications and enhance any document-centered task today.

The easiest method to alter and electronically sign Gas Mileage Reimbursement Log MTM, Inc effortlessly

- Obtain Gas Mileage Reimbursement Log MTM, Inc and click Get Form to begin.

- Make use of the features we offer to complete your document.

- Emphasize important portions of your documents or obscure sensitive information with tools specifically designed for that task by airSlate SignNow.

- Generate your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Gas Mileage Reimbursement Log MTM, Inc and ensure excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the gas mileage reimbursement log mtm inc

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is mtm mileage reimbursement?

MTM mileage reimbursement refers to the compensation given to employees for the miles they drive while performing tasks related to their work. airSlate SignNow simplifies the process of documenting and submitting these reimbursements, ensuring employees are accurately compensated for their mileage.

-

How can airSlate SignNow help with mtm mileage reimbursement?

airSlate SignNow allows users to easily create, sign, and manage mileage reimbursement forms electronically. This streamlines the reimbursement process, reduces paperwork, and ensures faster payments, making it a valuable tool for businesses looking to manage mtm mileage reimbursement efficiently.

-

What are the pricing options for airSlate SignNow regarding mtm mileage reimbursement?

airSlate SignNow offers various pricing plans that cater to businesses of different sizes, providing flexibility for managing mtm mileage reimbursement. Each plan includes features tailored to help you efficiently handle documentation, making it cost-effective for all your reimbursement needs.

-

Does airSlate SignNow integrate with accounting software for mtm mileage reimbursement?

Yes, airSlate SignNow seamlessly integrates with popular accounting software, allowing for easy synchronization of mtm mileage reimbursement records. This integration ensures that mileage reimbursements are accurately tracked and recorded in your financial systems, simplifying your accounting processes.

-

What key features does airSlate SignNow offer for mtm mileage reimbursement?

AirSlate SignNow includes features like customizable mileage reimbursement templates, eSignature capabilities, and automated workflows. These features enhance the efficiency of processing mtm mileage reimbursement requests, leading to timely approvals and hassle-free reimbursements.

-

How can I ensure compliance with tax regulations using airSlate SignNow for mtm mileage reimbursement?

airSlate SignNow helps ensure compliance with tax regulations by providing accurate records of mileage logged and reimbursement calculations. This keeps your reimbursement processes transparent and compliant, reducing the risk of errors during audits related to mtm mileage reimbursement.

-

Can airSlate SignNow handle large volumes of mtm mileage reimbursement requests?

Absolutely! airSlate SignNow is designed to handle high volumes of documents, including mtm mileage reimbursement requests. Its robust infrastructure and intuitive interface allow for efficient management of multiple submissions without compromising speed or accuracy.

Get more for Gas Mileage Reimbursement Log MTM, Inc

Find out other Gas Mileage Reimbursement Log MTM, Inc

- How To Electronic signature Florida CV Form Template

- Electronic signature Mississippi CV Form Template Easy

- Electronic signature Ohio CV Form Template Safe

- Electronic signature Nevada Employee Reference Request Mobile

- How To Electronic signature Washington Employee Reference Request

- Electronic signature New York Working Time Control Form Easy

- How To Electronic signature Kansas Software Development Proposal Template

- Electronic signature Utah Mobile App Design Proposal Template Fast

- Electronic signature Nevada Software Development Agreement Template Free

- Electronic signature New York Operating Agreement Safe

- How To eSignature Indiana Reseller Agreement

- Electronic signature Delaware Joint Venture Agreement Template Free

- Electronic signature Hawaii Joint Venture Agreement Template Simple

- Electronic signature Idaho Web Hosting Agreement Easy

- Electronic signature Illinois Web Hosting Agreement Secure

- Electronic signature Texas Joint Venture Agreement Template Easy

- How To Electronic signature Maryland Web Hosting Agreement

- Can I Electronic signature Maryland Web Hosting Agreement

- Electronic signature Michigan Web Hosting Agreement Simple

- Electronic signature Missouri Web Hosting Agreement Simple