Uniform Loan Application 2004-2026

What is the Uniform Residential Loan Application

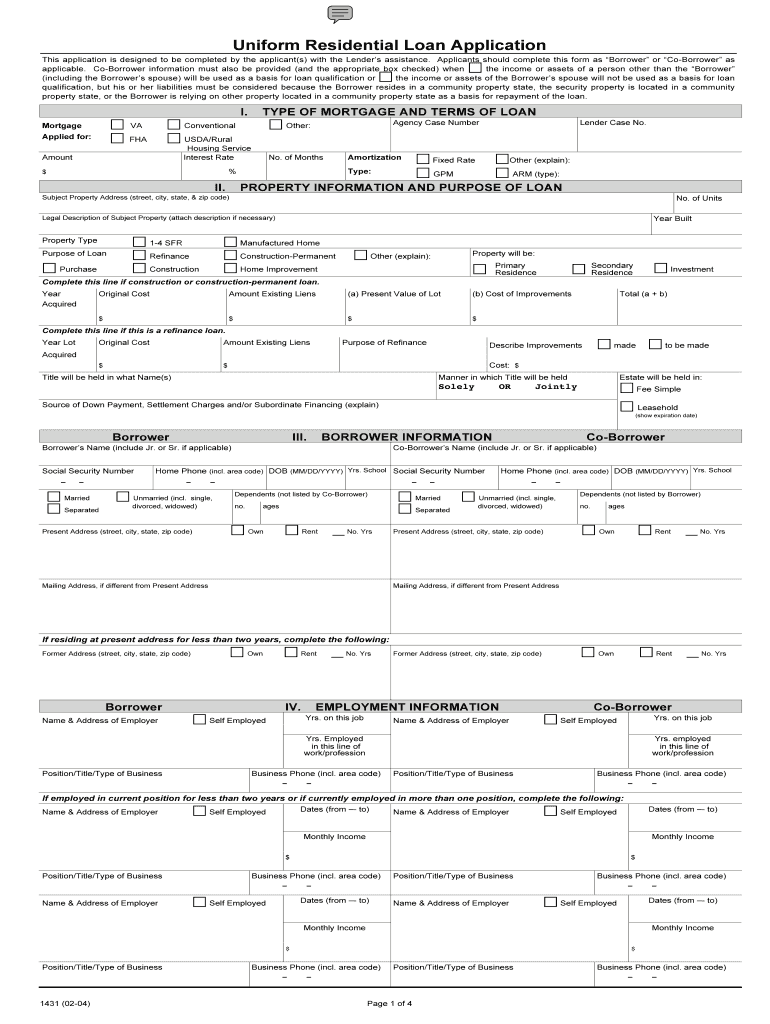

The Uniform Residential Loan Application, commonly referred to as the 1003 form, is a standardized document used by lenders to assess an applicant's eligibility for a mortgage. This form collects essential information about the borrower, including personal details, financial status, and property information. The 1003 form is crucial for ensuring that lenders have a comprehensive understanding of the borrower's financial situation, which aids in the decision-making process for loan approval.

Key Elements of the Uniform Residential Loan Application

The form comprises several key sections that gather pertinent information. These include:

- Borrower Information: Personal details such as name, address, and Social Security number.

- Employment History: Information about current and previous employment, including job titles and income.

- Financial Information: Details regarding assets, liabilities, and monthly income.

- Property Information: The address and type of property being financed.

- Loan Details: Information about the loan amount, type, and purpose.

These elements help lenders evaluate the risk associated with the loan application and determine the borrower's ability to repay the loan.

Steps to Complete the Uniform Residential Loan Application

Completing the Uniform Residential Loan Application involves several straightforward steps:

- Gather Required Information: Collect personal, employment, and financial details before starting the application.

- Fill Out the Form: Input the gathered information into the appropriate sections of the application.

- Review for Accuracy: Ensure all information is correct and complete to avoid delays in processing.

- Sign and Submit: Sign the application electronically or by hand and submit it to your lender.

Following these steps can help streamline the application process and improve the chances of approval.

Legal Use of the Uniform Residential Loan Application

The Uniform Residential Loan Application is legally recognized and must be completed accurately to ensure compliance with lending regulations. Lenders are required to adhere to guidelines set forth by government agencies, which mandate the use of this standardized form. By using the 1003 form, both borrowers and lenders can ensure that the application process is transparent and fair, minimizing the risk of legal disputes.

How to Obtain the Uniform Residential Loan Application

The Uniform Residential Loan Application can be easily obtained through various channels:

- Online: Many lenders provide the form on their websites for easy access.

- Financial Institutions: Banks and credit unions often have physical copies available at their branches.

- Government Websites: Official government resources may also offer downloadable versions of the form.

Accessing the form through these channels ensures that you are using the most current version of the application.

Form Submission Methods

Submitting the Uniform Residential Loan Application can be done through various methods, depending on lender preferences:

- Online Submission: Many lenders allow applicants to complete and submit the form electronically.

- Mail: Applicants can print the completed form and send it via postal service.

- In-Person: Some borrowers may choose to submit the application directly at a lender's office.

Each submission method has its advantages, and applicants should choose the one that best fits their needs and the lender's requirements.

Quick guide on how to complete uniform residential loan application fillable

The simplest method to discover and sign Uniform Loan Application

On the scale of an entire organization, ineffective procedures regarding document approval can consume a signNow amount of productive time. Signing documents like Uniform Loan Application is an inherent aspect of operations in any organization, which is why the efficiency of each agreement's lifecycle signNowly impacts the overall efficiency of the company. With airSlate SignNow, signing your Uniform Loan Application is as straightforward and quick as it can be. You will find on this platform the latest version of virtually any form. Even better, you can sign it instantly without needing to install external software on your computer or printing anything as physical copies.

Steps to acquire and sign your Uniform Loan Application

- Browse our collection by category or use the search function to find the form you require.

- View the form preview by selecting Learn more to ensure it is the correct one.

- Click Get form to begin editing immediately.

- Fill out your form and add any required information using the toolbar.

- When finished, click the Sign tool to endorse your Uniform Loan Application.

- Select the signature option that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to finalize editing and proceed to document-sharing options if necessary.

With airSlate SignNow, you have everything required to manage your documents effectively. You can find, complete, modify, and even send your Uniform Loan Application all within a single tab without any hassle. Optimize your procedures by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How do I fill out a fillable PDF on an iPad?

there is an app for that !signNow Fill & Sign on the App Store

-

How do I fill out the application form for an educational loan online?

Depending on which country you are in and what kind of lender you are going for. There are bank loans and licensed money lenders. If you are taking a large amount, banks are recommended. If you are working, need a small amount for your tuition and in need of it fast, you can try a licensed moneylender.

-

How does one get invited to the Quora Partner Program? What criteria do they use, or is it completely random?

I live in Germany. I got an invite to the Quora partner program the day I landed in USA for a business trip. So from what I understand, irrespective of the number of views on your answers, there is some additional eligibility criteria for you to even get an email invite.If you read the terms of service, point 1 states:Eligibility. You must be located in the United States to participate in this Program. If you are a Quora employee, you are eligible to participate and earn up to a maximum of $200 USD a month. You also agree to be bound by the Platform Terms (https://www.quora.com/about/tos) as a condition of participation.Again, if you check the FAQ section:How can other people I know .participate?The program is invite-only at this time, but we intend to open it up to more people as time goes on.So my guess is that Quora is currently targeting people based out of USA, who are active on Quora, may or may not be answering questions frequently ( I have not answered questions frequently in the past year or so) and have a certain number of consistent answer views.Edit 1: Thanks to @Anita Scotch, I got to know that the Quora partner program is now available for other countries too. Copying Anuta’s comment here:If you reside in one of the Countries, The Quora Partner Program is active in, you are eligible to participate in the program.” ( I read more will be added, at some point, but here are the countries, currently eligible at this writing,) U.S., Japan, Germany, Spain, France, United Kingdom, Italy and Australia.11/14/2018Edit 2 : Here is the latest list of countries with 3 new additions eligible for the Quora Partner program:U.S., Japan, Germany, Spain, France, United Kingdom, Italy, Canada, Australia, Indonesia, India and Brazil.Thanks to Monoswita Rez for informing me about this update.

-

When I fill out a loan application form at a bank, how does the bank know if I am lying about my total assets and liabilities?

Your credit report has more than the score, because part of what makes up you score is the amount of liabilities and how they are handled. Liabilities that will show areCar payments and balanceCredit cardsDepartment store cardsStudent loansChild support/alimony Judgements And many more.For assetsBank statementsBrokerage accounts401k statements etc.If an applicant is sufficiently strong (20% down-payment and a few months mortgage payments reserved) then all assets are usually not verified.But as a mortgage broker I've even used a car and boat title to boost an otherwise shaky application.

-

I'm trying to fill out a free fillable tax form. It won't let me click "done with this form" or "efile" which?

From https://www.irs.gov/pub/irs-utl/... (emphasis mine):DONE WITH THIS FORM — Select this button to save and close the form you are currently viewing and return to your 1040 form. This button is disabled when you are in your 1040 formSo, it appears, and without them mentioning it while you're working on it, that button is for all forms except 1040. Thank you to the other response to this question. I would never have thought of just clicking the Step 2 tab.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

How did you learn to fill out a job application?

First you must be truthful. Look at your assets, what do you do best, then look at what the future employer’s needs and fit the two together as best you can. On any job application or any correspondence try to master the King’s English to your very best ability. This is especially important if the new job requires communication interfacing with other people outside your company.

Create this form in 5 minutes!

How to create an eSignature for the uniform residential loan application fillable

How to make an electronic signature for the Uniform Residential Loan Application Fillable in the online mode

How to make an electronic signature for the Uniform Residential Loan Application Fillable in Google Chrome

How to create an electronic signature for putting it on the Uniform Residential Loan Application Fillable in Gmail

How to make an eSignature for the Uniform Residential Loan Application Fillable from your mobile device

How to generate an eSignature for the Uniform Residential Loan Application Fillable on iOS

How to make an eSignature for the Uniform Residential Loan Application Fillable on Android

People also ask

-

What is a uniform residential loan application?

The uniform residential loan application is a standardized form used by lenders to evaluate a borrower's qualifications for a mortgage. It gathers essential information about the borrower's income, assets, debts, and property details. Using this form helps streamline the loan application process for both the applicant and the lender.

-

How can airSlate SignNow assist with the uniform residential loan application process?

airSlate SignNow simplifies the submission of the uniform residential loan application by providing a secure platform for electronic signing and document management. With user-friendly features, businesses can send the application for eSignature and track its status efficiently. This accelerates the mortgage approval process while ensuring compliance with industry regulations.

-

Is airSlate SignNow a cost-effective solution for handling uniform residential loan applications?

Yes, airSlate SignNow offers cost-effective pricing plans that cater to businesses of all sizes looking to manage uniform residential loan applications efficiently. The platform eliminates the need for traditional, costly paper processing by enabling digital document management. This not only saves money but also improves overall productivity.

-

What features does airSlate SignNow provide for uniform residential loan applications?

airSlate SignNow provides several features that enhance the handling of uniform residential loan applications, including customizable templates, secure eSigning, and real-time tracking. Users can easily integrate conditional fields and workflows to streamline approval processes. These features save time and reduce errors associated with manual processing.

-

Can airSlate SignNow integrate with other loan processing software?

Absolutely! airSlate SignNow offers seamless integrations with various loan processing software and CRM systems. This flexibility allows users to manage their uniform residential loan applications within their existing workflows. Such integrations enhance productivity and ensure a smooth loan processing experience.

-

How secure is the uniform residential loan application process with airSlate SignNow?

AirSlate SignNow prioritizes security with advanced encryption and compliance with industry standards, ensuring that all uniform residential loan applications are handled securely. The platform also provides audit trails and encrypted storage to protect sensitive borrower information. Users can confidently submit and sign documents, knowing their data is safeguarded.

-

What are the benefits of using airSlate SignNow for my business?

Using airSlate SignNow for your business provides numerous benefits for managing uniform residential loan applications, including increased efficiency, reduced turnaround times, and cost savings. The platform also enhances customer experiences by allowing borrowers to complete applications from anywhere, at any time. Adopting this digital solution positions businesses for growth in a competitive market.

Get more for Uniform Loan Application

Find out other Uniform Loan Application

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free