Vat7 2014-2026

What is the VAT7?

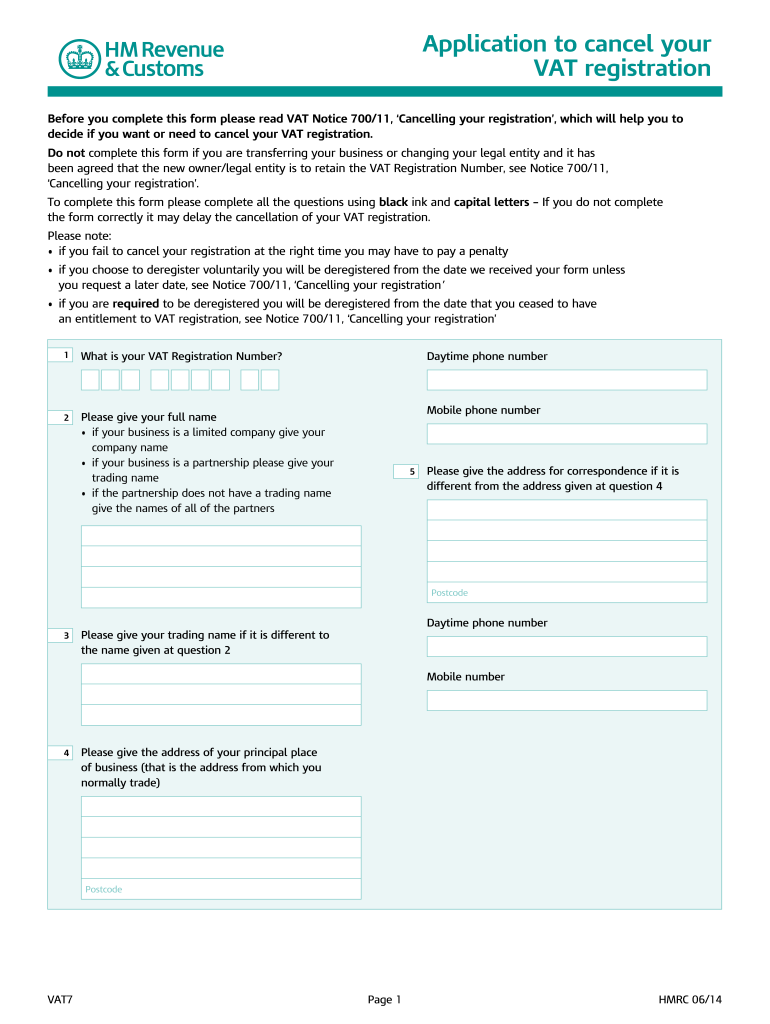

The VAT7 form is a crucial document used in the United Kingdom for VAT (Value Added Tax) deregistration. This form is typically submitted by businesses that no longer meet the threshold for VAT registration or have ceased trading. Completing the VAT7 allows businesses to officially cancel their VAT registration with HM Revenue and Customs (HMRC). Understanding the purpose of the VAT7 is essential for ensuring compliance with tax regulations and avoiding potential penalties.

Steps to Complete the VAT7

Filling out the VAT7 form requires careful attention to detail. Here are the essential steps to ensure accuracy:

- Gather necessary information, including your VAT registration number and business details.

- Indicate the reason for deregistration, such as ceasing trading or falling below the VAT threshold.

- Provide the date you wish to cancel your VAT registration.

- Review all information for accuracy before submission to avoid delays or complications.

Completing these steps correctly will help ensure that your application is processed smoothly.

How to Obtain the VAT7

The VAT7 form can be obtained directly from HMRC's official website or through authorized tax professionals. Additionally, businesses can request the form via mail if they prefer a physical copy. It is important to ensure that you are using the most current version of the VAT7 to comply with any updates in regulations.

Legal Use of the VAT7

The VAT7 form serves a legal purpose in the deregistration process. When filled out correctly and submitted to HMRC, it acts as an official request to cancel your VAT registration. This legal recognition is vital for businesses to avoid ongoing VAT obligations and potential penalties for non-compliance. Ensuring that the form is completed in accordance with HMRC guidelines is essential for its validity.

Required Documents

When preparing to submit the VAT7 form, certain documents may be required to support your application. These can include:

- Your VAT registration number.

- Details of your business activities and reasons for deregistration.

- Any relevant financial records that demonstrate your eligibility for deregistration.

Having these documents ready can expedite the processing of your VAT7 application.

Filing Deadlines / Important Dates

It is important to be aware of any deadlines associated with the VAT7 form. Typically, businesses should submit the VAT7 as soon as they decide to deregister. Delaying the submission may result in continued VAT obligations, which can lead to penalties. Keeping track of key dates related to your business operations can help ensure compliance.

Quick guide on how to complete vat7 application to cancel your vat registration stone co gwaccounting co

A brief manual on how to prepare your Vat7

Finding the appropriate template can be difficult when you need to present official foreign paperwork. Even if you possess the necessary form, it can be cumbersome to swiftly fill it out to comply with all the stipulations if you rely on printed copies instead of handling everything digitally. airSlate SignNow is the online eSignature platform that assists you in overcoming these obstacles. It allows you to select your Vat7 and efficiently complete and sign it on-site without reprinting documents if you make an error.

Here are the actions you should take to prepare your Vat7 using airSlate SignNow:

- Hit the Get Form button to add your document to our editor right away.

- Begin with the first blank field, enter information, and proceed with the Next tool.

- Fill in the empty spaces using the Cross and Check features from the menu above.

- Select the Highlight or Line options to emphasize the most critical information.

- Click on Image and upload one if your Vat7 needs it.

- Make use of the right-side panel to add more fields for you or others to populate if necessary.

- Review your responses and confirm the template by clicking Date, Initials, and Sign.

- Draw, type, upload your eSignature, or capture it with a camera or QR code.

- Conclude editing by clicking the Done button and selecting your file-sharing preferences.

Once your Vat7 is ready, you can distribute it according to your preferences - send it to your recipients via email, SMS, fax, or even print it directly from the editor. You can also securely store all your completed documentation in your account, organized into folders based on your choices. Don’t waste time on manual form filling; give airSlate SignNow a try!

Create this form in 5 minutes or less

FAQs

-

If you are filling out job applications, and they want professional references, does that include students that you went to school with, who are now professionals, or are they only referring to your past co-workers?

No. If you include fellow students and peers, or indeed family members in your professional references, then they will be discounted by any authority.Job application references from younger applicants (e.g. graduates) should include one academic reference (e.g. university tutor) and at least one work-related reference (e.g. previous employer(s).

Create this form in 5 minutes!

How to create an eSignature for the vat7 application to cancel your vat registration stone co gwaccounting co

How to create an electronic signature for your Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co in the online mode

How to create an electronic signature for your Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co in Google Chrome

How to make an electronic signature for signing the Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co in Gmail

How to generate an eSignature for the Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co straight from your smart phone

How to make an eSignature for the Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co on iOS

How to generate an eSignature for the Vat7 Application To Cancel Your Vat Registration Stone Co Gwaccounting Co on Android

People also ask

-

What is VAT7 in relation to airSlate SignNow?

VAT7 is a specific document that businesses need to file related to value-added tax. With airSlate SignNow, you can easily create and manage your VAT7 forms electronically, ensuring compliance while streamlining your documentation process.

-

How does airSlate SignNow handle VAT7 document signing?

airSlate SignNow offers a user-friendly platform that allows businesses to eSign their VAT7 documents securely. The electronic signature feature ensures that your VAT7 forms are signed swiftly and legally, reducing the time spent on manual processes.

-

What are the pricing options for airSlate SignNow for managing VAT7?

airSlate SignNow provides flexible pricing plans to cater to different business sizes focused on VAT7 document management. You can choose a plan that fits your needs, ensuring your team can efficiently handle VAT7 and other vital documents.

-

Can I integrate airSlate SignNow with other software for VAT7 management?

Yes, airSlate SignNow offers robust integrations with various software solutions such as accounting tools and document management systems, facilitating seamless management of your VAT7 documentation. This enhances productivity by centralizing your operations.

-

What features does airSlate SignNow provide for VAT7 documents?

airSlate SignNow includes features like reusable templates, automated workflows, and tracking for your VAT7 documents. These features are designed to simplify the management of your VAT7 forms, ensuring that your compliance tasks are efficient.

-

Is airSlate SignNow compliant with VAT7 regulations?

Absolutely, airSlate SignNow adheres to the latest regulations required for processing VAT7 documents. This compliance guarantees that your electronic signatures and document handling meet the legal standards necessary for VAT submissions.

-

How can airSlate SignNow benefit my business when dealing with VAT7?

Using airSlate SignNow for your VAT7 allows your business to save both time and resources. The platform's efficiency and ease of use help you manage VAT7 forms more effectively, minimizing errors and enhancing overall productivity.

Get more for Vat7

Find out other Vat7

- eSign Hawaii Contract Easy

- How Do I eSign Texas Contract

- How To eSign Vermont Digital contracts

- eSign Vermont Digital contracts Now

- eSign Vermont Digital contracts Later

- How Can I eSign New Jersey Contract of employment

- eSignature Kansas Travel Agency Agreement Now

- How Can I eSign Texas Contract of employment

- eSignature Tennessee Travel Agency Agreement Mobile

- eSignature Oregon Amendment to an LLC Operating Agreement Free

- Can I eSign Hawaii Managed services contract template

- How Do I eSign Iowa Managed services contract template

- Can I eSignature Wyoming Amendment to an LLC Operating Agreement

- eSign Massachusetts Personal loan contract template Simple

- How Do I eSign Massachusetts Personal loan contract template

- How To eSign Mississippi Personal loan contract template

- How Do I eSign Oklahoma Personal loan contract template

- eSign Oklahoma Managed services contract template Easy

- Can I eSign South Carolina Real estate contracts

- eSign Texas Renter's contract Mobile