ANNUAL RECONCILIATION of EMPLOYER WAGE TAX Phila Form

What is the Annual Reconciliation of Employer Wage Tax Phila

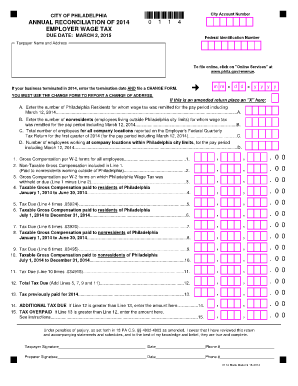

The Annual Reconciliation of Employer Wage Tax Phila is a crucial document that employers in Philadelphia must complete to reconcile the wage taxes withheld from their employees throughout the year. This form ensures that the correct amount of wage tax has been collected and submitted to the city. It serves as a summary of all wage tax payments made by the employer on behalf of their employees, reflecting the total wages paid and the corresponding tax withheld. Proper completion of this form is essential for compliance with local tax regulations.

Steps to Complete the Annual Reconciliation of Employer Wage Tax Phila

Completing the Annual Reconciliation of Employer Wage Tax Phila involves several key steps:

- Gather all payroll records for the year, including total wages paid and taxes withheld.

- Fill out the form accurately, ensuring all employee information and wage details are correct.

- Calculate the total wage tax owed based on the reported wages.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline, either electronically or by mail.

Legal Use of the Annual Reconciliation of Employer Wage Tax Phila

For the Annual Reconciliation of Employer Wage Tax Phila to be legally binding, it must adhere to specific requirements set forth by local tax authorities. This includes ensuring that the form is signed by an authorized representative of the business. Additionally, employers must maintain accurate records to support the information reported on the form. Compliance with these legal stipulations is essential to avoid potential penalties and ensure the validity of the submitted information.

Filing Deadlines / Important Dates

Employers must be aware of the critical deadlines associated with the Annual Reconciliation of Employer Wage Tax Phila. Typically, the form is due by the end of February following the tax year. It is important to check for any updates or changes to these deadlines to ensure timely submission. Missing the deadline can result in penalties and interest on unpaid taxes, making it essential for employers to stay informed about these important dates.

Form Submission Methods (Online / Mail / In-Person)

The Annual Reconciliation of Employer Wage Tax Phila can be submitted through various methods, providing flexibility for employers. Options typically include:

- Online submission via the official city tax portal, which allows for faster processing.

- Mailing a hard copy of the completed form to the designated tax office.

- In-person submission at local tax offices, where employers can receive assistance if needed.

Required Documents

To complete the Annual Reconciliation of Employer Wage Tax Phila, employers need to prepare several essential documents. These may include:

- Payroll records detailing employee wages and tax withholdings for the year.

- Previous tax returns that may provide context for the current year's filings.

- Any correspondence from the tax authority regarding previous filings or payments.

Quick guide on how to complete annual reconciliation of employer wage tax phila

Complete ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila effortlessly on any device

Online document control has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed documents, allowing users to locate the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, alter, and electronically sign your documents rapidly without delays. Manage ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila on any device with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and electronically sign ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila with ease

- Locate ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides for that purpose.

- Generate your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a traditional ink signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to deliver your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, monotonous form searches, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from your preferred device. Edit and electronically sign ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the annual reconciliation of employer wage tax phila

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

The ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila is a process in which employers reconcile the withheld wage taxes from employees with the amounts reported to the city. This ensures compliance with local tax regulations and helps prevent penalties. Using airSlate SignNow, businesses can efficiently manage their documentation and eSign necessary forms to complete this process.

-

How can airSlate SignNow assist with the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

airSlate SignNow provides an intuitive platform that allows businesses to easily prepare, send, and eSign documents pertinent to the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila. This streamlines the documentation process, ensuring that all necessary forms are completed accurately and submitted on time, reducing the risk of errors or penalties.

-

What are the pricing options for airSlate SignNow when managing the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

airSlate SignNow offers flexible pricing plans that cater to businesses of all sizes. When managing the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila, you can choose a plan that meets your specific needs without overspending. Each plan includes essential features necessary for efficient document management and eSigning.

-

What features does airSlate SignNow offer for the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

Key features of airSlate SignNow for the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila include document templates, automated workflows, and secure cloud storage. These tools help streamline the reconciliation process by ensuring that employers can access and manage all necessary documents swiftly and securely.

-

How does airSlate SignNow enhance compliance for the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

By using airSlate SignNow, businesses can enhance compliance with the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila through accurate documentation and timely filing. The platform includes features like reminders for important tax deadlines and audit trails for tracking document changes, which help maintain compliance with local tax laws.

-

Is airSlate SignNow suitable for small businesses handling the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

Absolutely! airSlate SignNow is designed to be cost-effective and user-friendly for small businesses. It provides all the necessary tools to efficiently manage the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila without requiring extensive resources, making it an ideal solution for growing enterprises.

-

What integrations does airSlate SignNow offer to assist with the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila?

airSlate SignNow offers various integrations with popular accounting and HR software to facilitate the ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila. These integrations help automate data transfer between platforms, reducing manual entry and minimizing errors in your reconciliation process.

Get more for ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila

Find out other ANNUAL RECONCILIATION OF EMPLOYER WAGE TAX Phila

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later