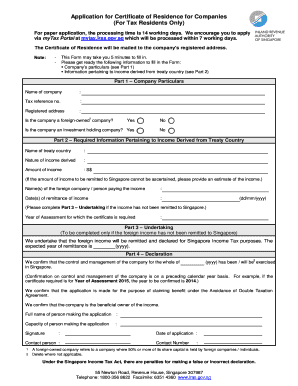

Certificate of Residence Iras Form

What is the letter of undertaking iras?

The letter of undertaking IRAS is a formal document that serves as a commitment from a taxpayer to fulfill specific obligations related to tax residency. This letter is particularly relevant for individuals or entities seeking to clarify their tax status with the Inland Revenue Authority of Singapore (IRAS). It outlines the responsibilities of the taxpayer and may include details about residency status, income sources, and compliance with tax regulations. Understanding the purpose and implications of this document is crucial for ensuring compliance with tax laws.

Key elements of the letter of undertaking iras

A well-structured letter of undertaking IRAS typically includes several key components:

- Taxpayer Information: Full name, address, and tax identification number of the individual or entity.

- Statement of Intent: A clear declaration of the taxpayer's intention to comply with tax obligations.

- Details of Obligations: Specific responsibilities the taxpayer agrees to undertake, including reporting income and filing tax returns.

- Duration of Commitment: The time frame during which the commitments are valid.

- Signatures: Signatures of the taxpayer and any relevant witnesses or representatives to validate the document.

Steps to complete the letter of undertaking iras

Completing the letter of undertaking IRAS involves several important steps to ensure accuracy and compliance:

- Gather Required Information: Collect all necessary personal and financial details, including tax identification numbers and residency information.

- Draft the Document: Use a clear and concise format to draft the letter, ensuring all key elements are included.

- Review for Accuracy: Carefully review the document for any errors or omissions that could affect its validity.

- Obtain Signatures: Ensure that all required parties sign the document to confirm their agreement to the terms outlined.

- Submit the Document: Follow the appropriate submission process, whether online or by mail, to ensure it reaches IRAS.

Legal use of the letter of undertaking iras

The legal use of the letter of undertaking IRAS is paramount for establishing the taxpayer's compliance with tax regulations. This document serves as a binding agreement that can be referenced in case of disputes or audits. It is essential that the letter is drafted in accordance with legal standards and contains all necessary information to be considered valid. Failure to comply with the commitments outlined in the letter may result in penalties or legal repercussions.

Who issues the letter of undertaking iras?

The letter of undertaking IRAS is typically issued by the taxpayer themselves, as it is a self-declaration of intent to comply with tax obligations. However, it may also be prepared by tax professionals or legal advisors who assist in ensuring that the document meets all necessary legal requirements. It is important for the issuer to have a thorough understanding of the tax laws and regulations applicable to their situation.

Examples of using the letter of undertaking iras

There are various scenarios in which the letter of undertaking IRAS may be utilized:

- Tax Residency Confirmation: Individuals seeking to confirm their tax residency status for compliance with international tax treaties.

- Business Operations: Companies operating in multiple jurisdictions may use the letter to clarify their tax obligations in Singapore.

- Loan Applications: Financial institutions may require the letter as part of the documentation for assessing the tax status of applicants.

Quick guide on how to complete certificate of residence iras

Complete Certificate Of Residence Iras effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Manage Certificate Of Residence Iras across any platform using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

How to alter and eSign Certificate Of Residence Iras with ease

- Obtain Certificate Of Residence Iras and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your eSignature with the Sign feature, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, tedious form searching, or inaccuracies that necessitate reprinting new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Certificate Of Residence Iras and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the certificate of residence iras

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a letter of undertaking for IRAs?

A letter of undertaking for IRAs is a formal document that outlines the obligations and commitments related to an Individual Retirement Account. It often serves to clarify terms between the account holder and the trustee, ensuring compliance with IRS regulations. Using airSlate SignNow, you can easily create and eSign your letter of undertaking for IRAs, streamlining the process.

-

How does airSlate SignNow help with letters of undertaking for IRAs?

airSlate SignNow provides a user-friendly platform to prepare, send, and eSign letters of undertaking for IRAs. Its features include customizable templates, secure storage, and instant tracking of document status. This efficiency can save time and ensure that all required documentation is properly handled.

-

Is there a cost associated with using airSlate SignNow for letters of undertaking IRAs?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The costs may vary depending on the features you select, but the service is designed to be cost-effective and beneficial for creating letters of undertaking for IRAs. You can choose a plan that suits your volume and requirements.

-

Can I integrate airSlate SignNow with other tools for managing letters of undertaking for IRAs?

Absolutely! airSlate SignNow offers integrations with various platforms such as CRM systems, document management tools, and more. This makes it easier to manage workflows related to letters of undertaking for IRAs and ensures that you can connect all your essential tools in one place.

-

What security features does airSlate SignNow provide for letters of undertaking for IRAs?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure authentication processes to protect your letters of undertaking for IRAs. You can rest assured that your sensitive information is safe while sharing and storing electronic documents.

-

How can airSlate SignNow improve the efficiency of processing letters of undertaking for IRAs?

By utilizing airSlate SignNow, businesses can signNowly enhance the efficiency of processing letters of undertaking for IRAs. The platform enables automated workflows, reducing manual entry and potential errors, while ensuring quick access and turnaround times for document approvals. This means you can focus on what truly matters—growing your business.

-

Are there templates available for letters of undertaking for IRAs in airSlate SignNow?

Yes, airSlate SignNow provides various customizable templates for letters of undertaking for IRAs. These templates can be easily tailored to fit your specific needs and requirements. Utilizing these templates saves time and ensures that you don't miss any critical information in your documents.

Get more for Certificate Of Residence Iras

- Pa rattlesnake permit form

- Nc crime control public safety bingo license form

- Children impacted by crime form

- Form s national association of forensic counselors

- Sales questionner in real estate form

- St 120 2011 form

- Julian jan hester memorial scholarship printable form

- National general insurance company ivantage information

Find out other Certificate Of Residence Iras

- eSignature Louisiana Real Estate LLC Operating Agreement Myself

- Can I eSignature Louisiana Real Estate Quitclaim Deed

- eSignature Hawaii Sports Living Will Safe

- eSignature Hawaii Sports LLC Operating Agreement Myself

- eSignature Maryland Real Estate Quitclaim Deed Secure

- eSignature Idaho Sports Rental Application Secure

- Help Me With eSignature Massachusetts Real Estate Quitclaim Deed

- eSignature Police Document Florida Easy

- eSignature Police Document Florida Safe

- How Can I eSignature Delaware Police Living Will

- eSignature Michigan Real Estate LLC Operating Agreement Mobile

- eSignature Georgia Police Last Will And Testament Simple

- How To eSignature Hawaii Police RFP

- Can I eSignature Minnesota Real Estate Warranty Deed

- How Do I eSignature Indiana Police Lease Agreement Form

- eSignature Police PPT Kansas Free

- How Can I eSignature Mississippi Real Estate Rental Lease Agreement

- How Do I eSignature Kentucky Police LLC Operating Agreement

- eSignature Kentucky Police Lease Termination Letter Now

- eSignature Montana Real Estate Quitclaim Deed Mobile