00DP102311862 NH Department of Revenue Administration 2023-2026

Understanding the New Hampshire DP-10 Form

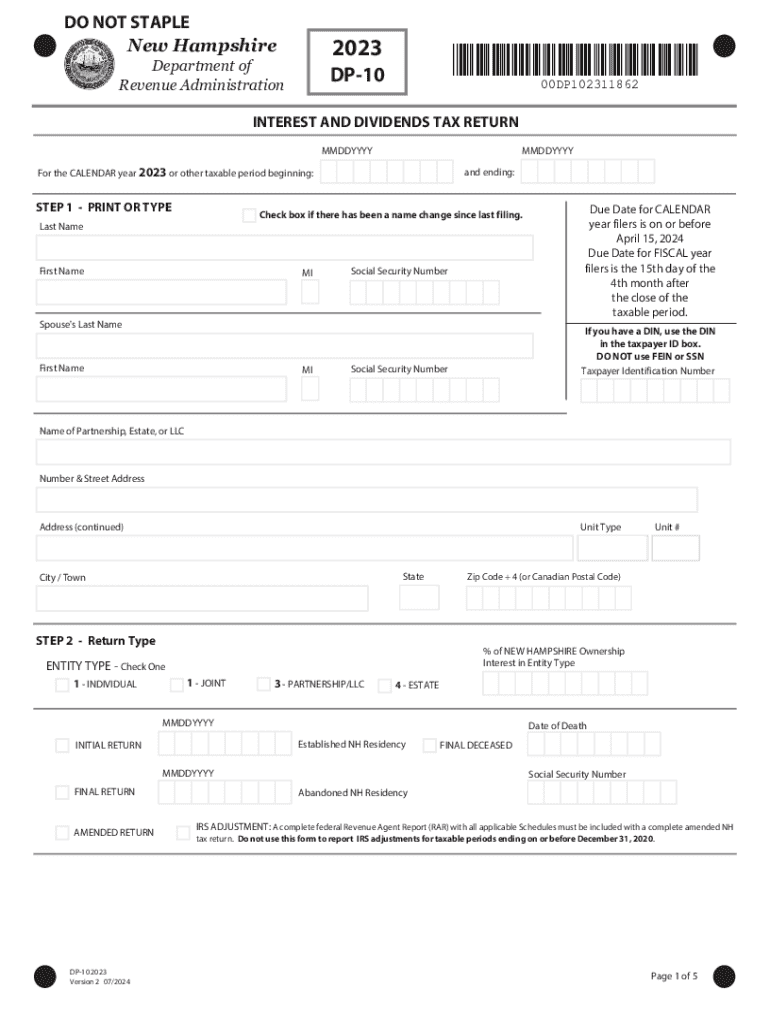

The New Hampshire DP-10 form, officially known as the NH DP-10 2024, is a tax document used by residents to report income and calculate their tax obligations. This form is essential for individuals who need to provide detailed information about their earnings and deductions to the New Hampshire Department of Revenue Administration. Understanding its purpose and requirements is crucial for accurate tax reporting.

Steps to Complete the NH DP-10 Form

Completing the NH DP-10 form involves several key steps. First, gather all necessary documentation, including W-2 forms, 1099s, and any other income statements. Next, follow these steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Report your total income from all sources accurately.

- List any deductions you are eligible for, such as student loan interest or retirement contributions.

- Calculate your total tax liability based on the provided rates and guidelines.

- Review your completed form for accuracy before submission.

Required Documents for the NH DP-10 Form

To successfully fill out the NH DP-10 form, you will need to gather specific documents that support your income and deductions. Key documents include:

- W-2 forms from employers to report wages.

- 1099 forms for any freelance or contract work.

- Records of any other income sources, such as rental income or dividends.

- Documentation for deductions, including receipts and statements for eligible expenses.

Filing Deadlines for the NH DP-10 Form

It is important to be aware of the filing deadlines associated with the NH DP-10 form to avoid penalties. Generally, the form must be filed by April fifteenth of the tax year. If this date falls on a weekend or holiday, the deadline is extended to the next business day. Keeping track of these dates ensures timely submission and compliance with state tax regulations.

Form Submission Methods for the NH DP-10

The NH DP-10 form can be submitted through various methods, providing flexibility for taxpayers. Options include:

- Online submission through the New Hampshire Department of Revenue Administration website.

- Mailing a printed copy of the completed form to the appropriate state office.

- In-person submission at designated state offices for those who prefer direct interaction.

Penalties for Non-Compliance with the NH DP-10 Form

Failure to file the NH DP-10 form on time or providing inaccurate information can result in penalties. These may include:

- Late filing fees, which can accumulate over time.

- Interest on any unpaid taxes, increasing the total amount owed.

- Potential legal action for severe cases of non-compliance.

Create this form in 5 minutes or less

Find and fill out the correct 00dp102311862 nh department of revenue administration

Create this form in 5 minutes!

How to create an eSignature for the 00dp102311862 nh department of revenue administration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the nh dp 10 2024 pricing structure for airSlate SignNow?

The nh dp 10 2024 pricing for airSlate SignNow is designed to be cost-effective, offering various plans to suit different business needs. You can choose from monthly or annual subscriptions, with discounts available for long-term commitments. Each plan includes essential features to streamline your document signing process.

-

What features does airSlate SignNow offer for nh dp 10 2024?

airSlate SignNow provides a range of features tailored for nh dp 10 2024, including customizable templates, real-time tracking, and secure eSigning capabilities. These features enhance productivity and ensure compliance with legal standards. Users can also automate workflows to save time and reduce errors.

-

How can airSlate SignNow benefit my business in relation to nh dp 10 2024?

By using airSlate SignNow for nh dp 10 2024, businesses can signNowly improve their document management processes. The platform allows for quick and secure eSigning, which accelerates transaction times and enhances customer satisfaction. Additionally, it reduces paper usage, contributing to a more sustainable business model.

-

Does airSlate SignNow integrate with other tools for nh dp 10 2024?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms relevant to nh dp 10 2024. This includes popular CRM systems, cloud storage services, and productivity applications. These integrations help streamline your workflow and ensure that all your tools work together efficiently.

-

Is airSlate SignNow secure for handling nh dp 10 2024 documents?

Absolutely, airSlate SignNow prioritizes security for all nh dp 10 2024 documents. The platform employs advanced encryption protocols and complies with industry standards to protect sensitive information. Users can trust that their documents are safe and secure throughout the signing process.

-

Can I customize my documents using airSlate SignNow for nh dp 10 2024?

Yes, airSlate SignNow allows for extensive customization of documents related to nh dp 10 2024. Users can create templates that reflect their branding and specific requirements. This feature ensures that your documents not only meet legal standards but also align with your company's identity.

-

What support options are available for airSlate SignNow users regarding nh dp 10 2024?

airSlate SignNow offers comprehensive support options for users dealing with nh dp 10 2024. This includes a detailed knowledge base, live chat, and email support to assist with any inquiries. The support team is dedicated to ensuring that users have a smooth experience with the platform.

Get more for 00DP102311862 NH Department Of Revenue Administration

Find out other 00DP102311862 NH Department Of Revenue Administration

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF

- How Can I eSignature New Jersey Police Document