Direct Deposit Authorization Letter Form

What is the Direct Deposit Authorization Letter

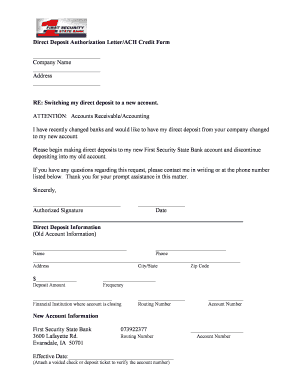

The Direct Deposit Authorization Letter is a formal document that allows an employer or financial institution to deposit funds directly into an individual's bank account. This letter serves as a request for the bank to process the direct deposit transactions on behalf of the employee or account holder. It typically includes essential information such as the account holder's name, bank account number, routing number, and the type of account (checking or savings). This letter is crucial for ensuring timely and secure payments, such as salaries, benefits, or reimbursements.

Steps to complete the Direct Deposit Authorization Letter

Completing the Direct Deposit Authorization Letter involves several straightforward steps to ensure accuracy and compliance. First, gather all necessary personal information, including your name, address, and Social Security number. Next, provide your bank details, including the account number and routing number. It's essential to double-check these numbers to prevent any errors that could delay payments. Then, clearly state your authorization for the direct deposit, specifying the amount or type of payments to be deposited. Finally, sign and date the letter to validate your request. Once completed, submit the letter to your employer or the relevant financial institution.

Key elements of the Direct Deposit Authorization Letter

Several key elements must be included in the Direct Deposit Authorization Letter to ensure its effectiveness. These elements include:

- Account Holder Information: Full name, address, and Social Security number.

- Bank Information: Name of the bank, account number, and routing number.

- Authorization Statement: A clear statement authorizing the direct deposit.

- Signature and Date: The account holder's signature and the date of signing.

Including all these elements ensures that the letter is complete and meets the requirements of the bank or employer processing the direct deposit.

How to use the Direct Deposit Authorization Letter

Using the Direct Deposit Authorization Letter is a straightforward process. After completing the letter with accurate information, it should be submitted to the employer or financial institution that will be processing the direct deposit. Depending on the organization's policies, this submission can often be done electronically or in person. Ensure to keep a copy of the letter for your records. Once the authorization is processed, you should receive confirmation from the employer or bank regarding the setup of your direct deposit.

Legal use of the Direct Deposit Authorization Letter

The Direct Deposit Authorization Letter is legally binding once signed by the account holder. It grants permission to the employer or financial institution to deposit funds directly into the specified bank account. Compliance with relevant laws, such as the Electronic Funds Transfer Act (EFTA), ensures that the authorization process is secure and protects the rights of the account holder. Both parties must adhere to the terms outlined in the letter, and any changes to the deposit arrangements should be documented with a new authorization letter.

Examples of using the Direct Deposit Authorization Letter

There are various scenarios in which the Direct Deposit Authorization Letter is utilized. For instance, employees may use this letter to set up direct deposit for their salaries, ensuring timely payments without the need for physical checks. Freelancers and contractors can also use it to receive payments directly from clients, streamlining the payment process. Additionally, individuals receiving government benefits, such as Social Security or unemployment payments, often need to submit this letter to facilitate direct deposits into their bank accounts.

Quick guide on how to complete direct deposit authorization letter

Complete Direct Deposit Authorization Letter effortlessly on any device

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal eco-friendly substitute for traditional printed and signed paperwork, enabling you to obtain the requisite form and securely save it online. airSlate SignNow provides you with all the tools necessary to create, alter, and eSign your documents swiftly without delays. Manage Direct Deposit Authorization Letter on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to edit and eSign Direct Deposit Authorization Letter with minimal effort

- Locate Direct Deposit Authorization Letter and click on Get Form to initiate the process.

- Utilize the tools we offer to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred way to send your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your preference. Modify and eSign Direct Deposit Authorization Letter and guarantee effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the direct deposit authorization letter

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an isolved direct deposit form?

The isolved direct deposit form is a document that allows employees to authorize their employers to deposit their paychecks directly into their designated bank accounts. This streamlined process enhances convenience and ensures timely payments, making payroll management much simpler for businesses.

-

How can I access the isolved direct deposit form?

To access the isolved direct deposit form, visit the isolved platform or your company's HR portal. Typically, employers provide this form to new employees during the onboarding process, and it can also be requested from the HR department for current employees.

-

What are the benefits of using the isolved direct deposit form?

Using the isolved direct deposit form greatly benefits both employees and employers by providing a secure, reliable, and efficient way to process payroll. It eliminates the need for physical checks, reduces administrative costs, and helps ensure that employees receive their funds on time.

-

Is there a fee for using the isolved direct deposit form?

There is typically no fee for employees to use the isolved direct deposit form, as it is part of the payroll process provided by employers. However, employers should verify any potential transaction fees that may be associated with their banking services.

-

Can the isolved direct deposit form be integrated with other HR systems?

Yes, the isolved direct deposit form can often be integrated with various HR and payroll systems to streamline operations. This ensures that employee information is automatically updated and reduces the risk of errors in the payroll process.

-

What information is needed to complete the isolved direct deposit form?

To complete the isolved direct deposit form, employees need to provide their bank account information, including the account number, routing number, and the name of the bank. It's essential to ensure that all details are accurate to avoid payment issues.

-

How does the isolved direct deposit form enhance security?

The isolved direct deposit form enhances security by eliminating the need for physical checks, which can be lost or stolen. Direct deposits go directly into the employee's bank account, providing a secure and efficient method for payroll processing.

Get more for Direct Deposit Authorization Letter

- Hot work permit required precautions checklist thi form

- Pwc offer form

- Beth clay musings memos and news form

- Parliamentary procedure cheat sheet form

- Abbott redemption form 611470180

- Officequestions email officecollegiatewaterpol form

- Je soussigne atteste sur lhonneur que form

- Photosynthesis diagrams worksheet answer key form

Find out other Direct Deposit Authorization Letter

- How Can I Electronic signature Louisiana Courts LLC Operating Agreement

- How To Electronic signature Massachusetts Courts Stock Certificate

- Electronic signature Mississippi Courts Promissory Note Template Online

- Electronic signature Montana Courts Promissory Note Template Now

- Electronic signature Montana Courts Limited Power Of Attorney Safe

- Electronic signature Oklahoma Sports Contract Safe

- Electronic signature Oklahoma Sports RFP Fast

- How To Electronic signature New York Courts Stock Certificate

- Electronic signature South Carolina Sports Separation Agreement Easy

- Electronic signature Virginia Courts Business Plan Template Fast

- How To Electronic signature Utah Courts Operating Agreement

- Electronic signature West Virginia Courts Quitclaim Deed Computer

- Electronic signature West Virginia Courts Quitclaim Deed Free

- Electronic signature Virginia Courts Limited Power Of Attorney Computer

- Can I Sign Alabama Banking PPT

- Electronic signature Washington Sports POA Simple

- How To Electronic signature West Virginia Sports Arbitration Agreement

- Electronic signature Wisconsin Sports Residential Lease Agreement Myself

- Help Me With Sign Arizona Banking Document

- How Do I Sign Arizona Banking Form