MONTHLY Sales Tax Return and Instructions Town of Carbondale Carbondalegov Form

What is the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

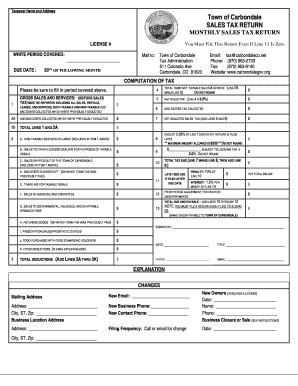

The MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov is a crucial document for businesses operating within the Town of Carbondale. This form is designed to report sales tax collected during the month and ensure compliance with local tax regulations. It provides detailed instructions on how to accurately complete the return, including the necessary calculations and reporting requirements. Understanding this form is essential for maintaining good standing with local authorities and avoiding potential penalties.

Steps to complete the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

Completing the MONTHLY Sales Tax Return involves several key steps to ensure accuracy and compliance. First, gather all sales records for the month, including invoices and receipts. Next, calculate the total sales tax collected during this period. Once you have this information, fill out the form by entering the required details in the appropriate sections. Be sure to double-check your calculations for accuracy. Finally, submit the completed form by the specified deadline to avoid late fees.

Legal use of the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

The legal use of the MONTHLY Sales Tax Return And Instructions is paramount for businesses to avoid non-compliance issues. This form serves as an official record of sales tax obligations and must be completed in accordance with local laws. Proper completion and submission of this form can protect businesses from legal repercussions, including fines and audits. It is essential to follow the guidelines provided in the instructions to ensure that the form is legally valid.

Form Submission Methods for the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

The MONTHLY Sales Tax Return can be submitted through various methods to accommodate different business needs. Businesses have the option to file the form online, which is often the most efficient method. Alternatively, the form can be mailed or submitted in person at designated local government offices. Each submission method has its own set of guidelines and deadlines, so it is important to choose the one that best fits your operational workflow.

Filing Deadlines / Important Dates for the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

Filing deadlines for the MONTHLY Sales Tax Return are critical for compliance. Typically, the return is due on the last day of the month following the reporting period. For example, the return for sales made in January would be due by the end of February. It is advisable to mark these important dates on your calendar to avoid any late submissions, which could incur penalties or interest charges.

Key elements of the MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

Key elements of the MONTHLY Sales Tax Return include sections for reporting total sales, taxable sales, and the amount of sales tax collected. Additionally, there may be areas for exemptions and deductions, which can affect the total tax liability. Understanding these elements is vital for accurate reporting and ensuring that all required information is included on the form.

Quick guide on how to complete monthly sales tax return and instructions town of carbondale carbondalegov

Prepare [SKS] effortlessly on any device

Web-based document management has gained traction among enterprises and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed papers, allowing you to obtain the necessary form and securely archive it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without any delays. Handle [SKS] on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process starting today.

The simplest way to alter and eSign [SKS] with ease

- Locate [SKS] and then click Get Form to initiate.

- Make use of the tools we offer to fill out your document.

- Emphasize important sections of your documents or redact sensitive information with the features that airSlate SignNow provides specifically for that purpose.

- Formulate your signature using the Sign tool, which takes moments and carries the same legal validity as a traditional wet ink signature.

- Review all the details and then click on the Done button to preserve your changes.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your requirements in document management in just a few clicks from any device you choose. Modify and eSign [SKS] to ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly sales tax return and instructions town of carbondale carbondalegov

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are the key features of the MONTHLY Sales Tax Return and Instructions for the Town of Carbondale?

The MONTHLY Sales Tax Return and Instructions for the Town of Carbondale provide detailed guidance on how to accurately complete and submit your sales tax returns. It includes requirements for reporting, payment deadlines, and common errors to avoid. These features are designed to simplify the process for businesses operating in Carbondale.

-

How do I access the MONTHLY Sales Tax Return and Instructions for the Town of Carbondale?

You can access the MONTHLY Sales Tax Return and Instructions for the Town of Carbondale directly through the Carbondale government website or by visiting the appropriate municipal offices. The instructions are readily available for download, ensuring you have easy access to the necessary documentation to stay compliant.

-

Is there a cost associated with filing the MONTHLY Sales Tax Return with the Town of Carbondale?

Filing the MONTHLY Sales Tax Return for the Town of Carbondale typically does not involve direct fees; however, businesses should ensure they are on time to avoid late penalties. It is important to review the fee schedule provided in the instructions to understand any potential costs related to payment processing or late filings.

-

What are the benefits of using the MONTHLY Sales Tax Return and Instructions for my business?

Utilizing the MONTHLY Sales Tax Return and Instructions for the Town of Carbondale helps ensure compliance with local tax regulations. It provides clarity on how to report sales taxes, consequently reducing the risk of errors and penalties. This tool not only saves time but also helps maintain your business's good standing with the municipality.

-

Can I file the MONTHLY Sales Tax Return electronically?

Yes, the MONTHLY Sales Tax Return and Instructions for the Town of Carbondale may be submitted electronically through the town's official e-filing system. This option allows businesses to streamline their filing process and receive immediate confirmation of submission, enhancing efficiency and record-keeping.

-

What integrations are required for using the MONTHLY Sales Tax Return process?

The MONTHLY Sales Tax Return and Instructions necessitate that businesses maintain accurate sales records, which can often be managed through various accounting software. Many compatible platforms offer seamless integration with the Carbondale filing system, allowing for smoother data transfer and reporting.

-

What should I do if I make a mistake on my MONTHLY Sales Tax Return?

If you discover an error after submitting your MONTHLY Sales Tax Return for the Town of Carbondale, it's important to correct it as soon as possible. You should follow the instructions provided for adjustments or amendments. Contact the local tax authority for guidance to ensure sustainable compliance moving forward.

Get more for MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

- University letter appreciation form

- Annual inspection of swinging fire door assemblies healthandwelfare idaho form

- Interview guide linda toupinpdf amy stokes mary kay form

- Eft authorization form calpers long term care

- Adaorg caries risk assessment 0 6 american dental association form

- Driver nomination form icbc

- F11278 pncc outreach mgmt planfinal 0612doc dhs wisconsin form

- Scotcourts applying for excusal form

Find out other MONTHLY Sales Tax Return And Instructions Town Of Carbondale Carbondalegov

- How Do I Electronic signature Illinois Declaration of Trust Template

- Electronic signature Maryland Declaration of Trust Template Later

- How Can I Electronic signature Oklahoma Declaration of Trust Template

- Electronic signature Nevada Shareholder Agreement Template Easy

- Electronic signature Texas Shareholder Agreement Template Free

- Electronic signature Mississippi Redemption Agreement Online

- eSignature West Virginia Distribution Agreement Safe

- Electronic signature Nevada Equipment Rental Agreement Template Myself

- Can I Electronic signature Louisiana Construction Contract Template

- Can I eSignature Washington Engineering Proposal Template

- eSignature California Proforma Invoice Template Simple

- eSignature Georgia Proforma Invoice Template Myself

- eSignature Mississippi Proforma Invoice Template Safe

- eSignature Missouri Proforma Invoice Template Free

- Can I eSignature Mississippi Proforma Invoice Template

- eSignature Missouri Proforma Invoice Template Simple

- eSignature Missouri Proforma Invoice Template Safe

- eSignature New Hampshire Proforma Invoice Template Mobile

- eSignature North Carolina Proforma Invoice Template Easy

- Electronic signature Connecticut Award Nomination Form Fast