Ia Form 843

What is the IA Form 843

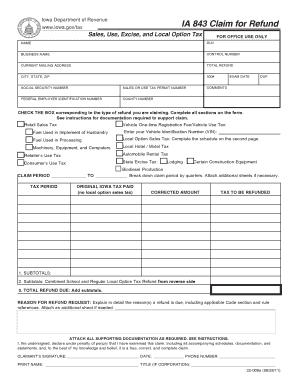

The IA Form 843 is a document used for specific tax-related purposes within the United States. It is primarily utilized to request a refund or adjustment of certain taxes. This form is crucial for taxpayers who believe they have overpaid their taxes or are entitled to a refund based on specific circumstances. Understanding the purpose and function of the IA Form 843 is essential for ensuring compliance with tax regulations and effectively managing one’s tax obligations.

How to Obtain the IA Form 843

To obtain the IA Form 843, individuals can visit the official website of the relevant tax authority or agency. The form is typically available for download in a PDF format, allowing users to print and fill it out manually. Additionally, some tax offices may provide physical copies of the form upon request. It is important to ensure that you are using the most current version of the form to avoid any issues during submission.

Steps to Complete the IA Form 843

Completing the IA Form 843 involves several key steps to ensure accuracy and compliance. Here are the steps to follow:

- Begin by carefully reading the instructions provided with the form to understand the requirements.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Clearly state the reason for your request, providing any necessary details to support your claim.

- Attach any required documentation that may substantiate your request for a refund or adjustment.

- Review the completed form for accuracy before signing and dating it.

Legal Use of the IA Form 843

The IA Form 843 must be used in accordance with specific legal guidelines to ensure its validity. This includes adhering to the rules set forth by the Internal Revenue Service (IRS) and any state-specific regulations. When filled out correctly, the form serves as a legally binding request for a tax refund or adjustment. It is essential to maintain compliance with all applicable laws to avoid potential penalties or issues with the tax authorities.

Key Elements of the IA Form 843

Several key elements are essential for the proper completion of the IA Form 843. These include:

- Taxpayer Information: Accurate personal details, such as name, address, and identification number.

- Reason for Request: A clear explanation of why the refund or adjustment is being requested.

- Supporting Documentation: Any relevant documents that substantiate the claim must be attached.

- Signature: The form must be signed and dated by the taxpayer or their authorized representative.

Form Submission Methods

The IA Form 843 can be submitted through various methods, depending on the requirements of the tax authority. Common submission methods include:

- Online Submission: Some tax authorities may allow electronic submission of the form through their official website.

- Mail: The completed form can be mailed to the appropriate tax office address as specified in the instructions.

- In-Person: Taxpayers may also have the option to submit the form in person at designated tax offices.

Quick guide on how to complete ia form 843

Complete Ia Form 843 effortlessly on any device

Web-based document management has become increasingly popular among companies and individuals alike. It offers a superb eco-friendly substitute for conventional printed and signed papers, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without any delays. Manage Ia Form 843 on any platform using airSlate SignNow's Android or iOS applications, and simplify any document-centered task today.

The simplest method to modify and electronically sign Ia Form 843 with minimal effort

- Obtain Ia Form 843 and select Get Form to begin.

- Leverage the tools we provide to finalize your document.

- Emphasize important sections of the documents or redact sensitive information with tools designed specifically for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Verify all details and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worry of lost or mislaid documents, tedious form searching, or errors that require printing new copies. airSlate SignNow addresses all your document management needs with just a few clicks from any device you choose. Modify and electronically sign Ia Form 843 to guarantee excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ia form 843

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ia form 843 and how is it used?

The ia form 843 is a specific form used for requesting certain adjustments related to taxes. This form allows users to formally request a refund or abatement of penalties and interest. Understanding how to complete the ia form 843 is essential for effectively managing your tax situation.

-

How can airSlate SignNow help me with the ia form 843?

airSlate SignNow simplifies the process of completing and signing the ia form 843. With our user-friendly platform, you can easily fill out the form, add necessary signatures, and send it electronically, ensuring a smooth transaction. Our service helps streamline your document management, especially for forms like ia form 843.

-

Is there a cost associated with using airSlate SignNow for the ia form 843?

Yes, airSlate SignNow offers various pricing plans designed to fit different needs, including handling the ia form 843. Our plans are cost-effective, providing excellent value for businesses looking to manage their documents efficiently. Explore our pricing options to find a suitable solution for your requirements.

-

What features does airSlate SignNow offer for managing the ia form 843?

airSlate SignNow provides a variety of features such as templates for the ia form 843, e-signature capabilities, and document tracking. These features enhance your document workflow, making it simple to send, sign, and store your forms. You'll appreciate the efficiency and effectiveness of our platform when handling essential documents like the ia form 843.

-

Can I integrate airSlate SignNow with other software for the ia form 843?

Absolutely! airSlate SignNow offers numerous integrations with popular applications to help you streamline your workflow regarding the ia form 843. Whether it’s CRM tools, storage services, or project management platforms, our integrations enable you to manage documents seamlessly across different platforms.

-

What are the benefits of using airSlate SignNow for the ia form 843?

Using airSlate SignNow for the ia form 843 brings numerous benefits, including time savings, increased accuracy, and reduced paperwork. Our electronic solution minimizes the risk of errors while ensuring timely submissions. Additionally, you can manage all your documents in one place with ease.

-

Is airSlate SignNow compliant with regulations when handling the ia form 843?

Yes, airSlate SignNow is fully compliant with industry regulations to ensure secure handling of documents, including the ia form 843. We prioritize confidentiality and data protection, giving users peace of mind when managing sensitive information. Compliance is a key aspect of our service.

Get more for Ia Form 843

- Print formflex elect reimbursement claim formreset

- Olive view ucla medical center adult volunteer application file lacounty form

- Describe the problem in detail form

- Medical treatment amp health history form california state fair

- Dental board of california portfolio examination form

- Staying healthy assessment form

- Na 841 1006 notice of action california department of social cdss ca form

- Last covered date form

Find out other Ia Form 843

- How To Sign Nebraska Car Dealer Resignation Letter

- How Can I Sign New Jersey Car Dealer Arbitration Agreement

- How Can I Sign Ohio Car Dealer Cease And Desist Letter

- How To Sign Ohio Car Dealer Arbitration Agreement

- How To Sign Oregon Car Dealer Limited Power Of Attorney

- How To Sign Pennsylvania Car Dealer Quitclaim Deed

- How Can I Sign Pennsylvania Car Dealer Quitclaim Deed

- Sign Rhode Island Car Dealer Agreement Safe

- Sign South Dakota Car Dealer Limited Power Of Attorney Now

- Sign Wisconsin Car Dealer Quitclaim Deed Myself

- Sign Wisconsin Car Dealer Quitclaim Deed Free

- Sign Virginia Car Dealer POA Safe

- Sign Wisconsin Car Dealer Quitclaim Deed Fast

- How To Sign Wisconsin Car Dealer Rental Lease Agreement

- How To Sign Wisconsin Car Dealer Quitclaim Deed

- How Do I Sign Wisconsin Car Dealer Quitclaim Deed

- Sign Wyoming Car Dealer Purchase Order Template Mobile

- Sign Arizona Charity Business Plan Template Easy

- Can I Sign Georgia Charity Warranty Deed

- How To Sign Iowa Charity LLC Operating Agreement