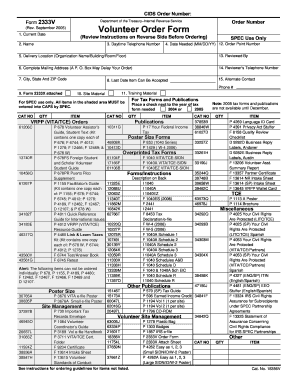

Form 2333 V

What is the Form 2333 V

The Form 2333 V is a document used by taxpayers in the United States to report specific information related to their tax obligations. This form is essential for ensuring compliance with IRS regulations and is often required for particular tax situations. Understanding the purpose of the Form 2333 V helps taxpayers navigate their financial responsibilities effectively.

How to use the Form 2333 V

Using the Form 2333 V involves several steps to ensure accurate completion. Taxpayers should first gather all necessary information, such as personal identification details and relevant financial data. Once the form is obtained, it can be filled out either digitally or by hand. After completing the form, it should be reviewed for accuracy before submission to the appropriate IRS office.

Steps to complete the Form 2333 V

Completing the Form 2333 V requires careful attention to detail. Follow these steps:

- Obtain the latest version of the form from the IRS website.

- Fill in your personal information, including your name, address, and Social Security number.

- Provide the necessary financial information as prompted by the form.

- Review the completed form for any errors or omissions.

- Sign and date the form to validate your submission.

Legal use of the Form 2333 V

The Form 2333 V is legally binding when completed correctly and submitted to the IRS. It is essential that all information provided is accurate and truthful, as any discrepancies may lead to penalties or legal issues. Using a reliable eSignature solution can enhance the legitimacy of the submission, ensuring compliance with relevant laws governing electronic signatures.

IRS Guidelines

The IRS provides specific guidelines regarding the use and submission of the Form 2333 V. Taxpayers should familiarize themselves with these guidelines to ensure compliance. This includes understanding the deadlines for submission, required documentation, and any updates to the form that may affect its use. Adhering to IRS guidelines helps prevent issues during the filing process.

Form Submission Methods (Online / Mail / In-Person)

The Form 2333 V can be submitted through various methods, depending on the taxpayer's preference and the requirements set by the IRS. Options include:

- Online submission through the IRS e-filing system.

- Mailing the completed form to the designated IRS address.

- In-person submission at local IRS offices, if applicable.

Penalties for Non-Compliance

Failure to submit the Form 2333 V or providing incorrect information can lead to significant penalties. These may include fines, interest on unpaid taxes, or other legal repercussions. It is crucial for taxpayers to understand the importance of compliance and to ensure that the form is completed accurately and submitted on time.

Quick guide on how to complete form 2333 v

Easily Prepare Form 2333 V on Any Device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the right template and securely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage Form 2333 V on any platform with the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

Simplifying the Editing and eSigning of Form 2333 V

- Obtain Form 2333 V and then click Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or redact sensitive details with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal significance as a conventional handwritten signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassles of missing or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Alter and electronically sign Form 2333 V and guarantee excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 2333 v

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 2333 v and how is it used?

Form 2333 v is a document used for specific administrative purposes, often requiring official signatures. With airSlate SignNow, you can easily fill out and eSign form 2333 v, ensuring a seamless and efficient process that eliminates paperwork delays.

-

How much does airSlate SignNow cost for processing form 2333 v?

Pricing for using airSlate SignNow varies based on your specific needs, but it is designed to be cost-effective. By choosing our plans, you can manage and eSign multiple documents like form 2333 v without incurring hefty fees, streamlining your operations.

-

What features does airSlate SignNow offer for form 2333 v?

AirSlate SignNow includes a variety of features tailored for documents like form 2333 v, including customizable templates, bulk eSigning, and secure cloud storage. These features enhance your productivity by simplifying how you prepare and manage your forms.

-

Can I integrate airSlate SignNow with other software for form 2333 v?

Yes, airSlate SignNow offers integrations with popular software tools that can help you streamline workflows involving form 2333 v. By connecting with platforms such as Google Drive and Dropbox, you can access your documents easily and manage them more effectively.

-

Is it safe to eSign form 2333 v using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, providing a safe environment for eSigning documents like form 2333 v. We use advanced encryption and compliance protocols to protect your sensitive information throughout the signing process.

-

How does airSlate SignNow facilitate collaboration on form 2333 v?

AirSlate SignNow allows multiple users to collaborate on form 2333 v easily. You can invite team members to review, edit, or eSign the document, ensuring everyone is on the same page and expediting the approval process.

-

Can I access form 2333 v on mobile with airSlate SignNow?

Yes, airSlate SignNow provides mobile access, so you can manage and eSign form 2333 v from anywhere. Our user-friendly mobile app keeps you connected and allows you to handle your documents on the go.

Get more for Form 2333 V

Find out other Form 2333 V

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now