Monthly Payroll Sample PDF Form

What is the Monthly Payroll Sample Pdf

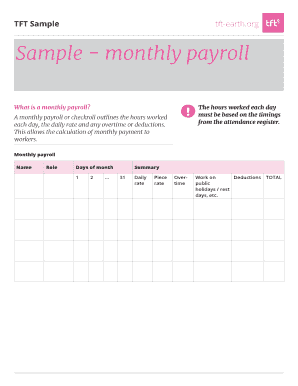

The monthly payroll sample pdf is a standardized document used by businesses to outline employee compensation for a given month. This form typically includes essential information such as employee names, hours worked, pay rates, deductions, and net pay. It serves as a record for both employers and employees, ensuring transparency and accuracy in payroll processing. By utilizing this sample, businesses can streamline their payroll operations and maintain compliance with applicable labor laws.

How to Use the Monthly Payroll Sample Pdf

Using the monthly payroll sample pdf involves several straightforward steps. First, download the sample from a reliable source. Next, fill in the required fields with accurate employee data, including names, positions, and payment details. Ensure that all calculations for gross pay, deductions, and net pay are correct. Once completed, the document can be printed for physical signatures or sent electronically for digital signing. This flexibility allows for efficient processing while maintaining legal validity.

Steps to Complete the Monthly Payroll Sample Pdf

Completing the monthly payroll sample pdf requires careful attention to detail. Follow these steps for accurate completion:

- Download the sample payroll pdf from a trusted source.

- Enter employee information, including full names and identification numbers.

- Record hours worked and applicable pay rates for each employee.

- Calculate gross pay by multiplying hours worked by the pay rate.

- Deduct applicable taxes and other withholdings to determine net pay.

- Review all entries for accuracy before finalizing the document.

- Sign the document, either digitally or in print, to validate it.

Legal Use of the Monthly Payroll Sample Pdf

The monthly payroll sample pdf can be legally binding when it meets specific criteria. To ensure compliance with U.S. laws, the document must include accurate information and signatures from both the employer and employee. Utilizing a trusted eSignature solution can enhance the legal standing of the document by providing an electronic certificate and ensuring compliance with regulations such as ESIGN and UETA. This makes the payroll sample pdf a reliable record for legal and financial purposes.

Key Elements of the Monthly Payroll Sample Pdf

Several key elements must be included in the monthly payroll sample pdf to ensure it serves its purpose effectively. These include:

- Employee details: full name, job title, and identification number.

- Pay period: the specific month for which payroll is calculated.

- Hours worked: total hours each employee has worked during the pay period.

- Pay rate: the hourly or salary rate for each employee.

- Deductions: taxes, benefits, and other withholdings from gross pay.

- Net pay: the final amount each employee receives after deductions.

Examples of Using the Monthly Payroll Sample Pdf

Businesses can utilize the monthly payroll sample pdf in various scenarios. For example, a small business may use it to manage payroll for its staff, ensuring timely payments and compliance with tax obligations. Additionally, non-profit organizations can adapt the sample to track volunteer stipends or reimbursements. Each use case highlights the document's versatility in maintaining accurate payroll records across different sectors.

Quick guide on how to complete monthly payroll sample pdf

Complete Monthly Payroll Sample Pdf effortlessly on any device

Online document management has gained popularity among businesses and individuals. It presents an ideal eco-friendly substitute for conventional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Monthly Payroll Sample Pdf on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign Monthly Payroll Sample Pdf without any hassle

- Locate Monthly Payroll Sample Pdf and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Mark important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to share your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Alter and eSign Monthly Payroll Sample Pdf and guarantee outstanding communication at any point in your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the monthly payroll sample pdf

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a monthly payroll sample pdf?

A monthly payroll sample pdf is a document that showcases the structure and details of monthly payroll calculations for employees. It typically includes information such as gross pay, deductions, and net pay. This sample can help businesses visualize how to organize and present their payroll data.

-

How can airSlate SignNow help with creating a monthly payroll sample pdf?

With airSlate SignNow, you can easily create and customize a monthly payroll sample pdf by utilizing our template feature. This allows you to streamline your payroll process and ensure compliance with your company’s standards. You can also save time by automating your payroll document handling with eSignature capabilities.

-

Is there a cost to using airSlate SignNow for payroll documents?

airSlate SignNow offers pricing plans tailored to different business sizes and needs, making it a cost-effective solution for creating payroll documents, including a monthly payroll sample pdf. Pricing is based on the features you select, ensuring you only pay for what you need. Check our website for the latest updates on pricing.

-

Can I integrate airSlate SignNow with my existing payroll software?

Yes, airSlate SignNow can integrate with various payroll software platforms, allowing you to streamline your workflow. By integrating with your existing systems, you can easily generate a monthly payroll sample pdf without manual data entry. This enhances efficiency and minimizes errors in your payroll process.

-

What features do I get with airSlate SignNow for payroll management?

airSlate SignNow offers a range of features for payroll management, including document templates, eSignature capabilities, and secure cloud storage. You can create a monthly payroll sample pdf quickly and efficiently, ensuring documents are signed and stored securely. Its user-friendly interface makes it easy to navigate and manage your payroll documents.

-

How does eSigning enhance the payroll process using airSlate SignNow?

eSigning with airSlate SignNow enhances the payroll process by allowing quick and secure signing of payroll documents, including a monthly payroll sample pdf. This eliminates the need for physical signatures and reduces turnaround time. Employees and managers can sign documents anytime, anywhere, improving overall efficiency in payroll administration.

-

Are there any templates available for a monthly payroll sample pdf?

Yes, airSlate SignNow provides several templates that you can customize to create a monthly payroll sample pdf. These templates can help you structure your document effectively and include all necessary payroll details. Utilizing templates also saves you time and ensures consistency in your payroll documentation.

Get more for Monthly Payroll Sample Pdf

Find out other Monthly Payroll Sample Pdf

- Help Me With eSign Nevada Police Living Will

- eSign New York Courts Business Plan Template Later

- Can I eSign North Carolina Courts Limited Power Of Attorney

- eSign North Dakota Courts Quitclaim Deed Safe

- How To eSign Rhode Island Sports Quitclaim Deed

- Help Me With eSign Oregon Courts LLC Operating Agreement

- eSign North Dakota Police Rental Lease Agreement Now

- eSign Tennessee Courts Living Will Simple

- eSign Utah Courts Last Will And Testament Free

- eSign Ohio Police LLC Operating Agreement Mobile

- eSign Virginia Courts Business Plan Template Secure

- How To eSign West Virginia Courts Confidentiality Agreement

- eSign Wyoming Courts Quitclaim Deed Simple

- eSign Vermont Sports Stock Certificate Secure

- eSign Tennessee Police Cease And Desist Letter Now

- Help Me With eSign Texas Police Promissory Note Template

- eSign Utah Police LLC Operating Agreement Online

- eSign West Virginia Police Lease Agreement Online

- eSign Wyoming Sports Residential Lease Agreement Online

- How Do I eSign West Virginia Police Quitclaim Deed