Irs Form 941 for

What is the IRS Form 941 For

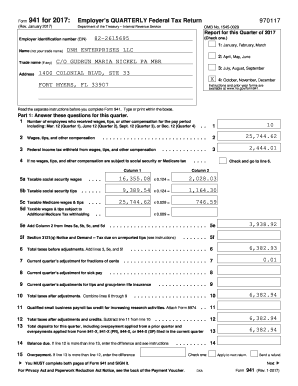

The IRS Form 941, also known as the Employer's Quarterly Federal Tax Return, is used by employers to report income taxes, Social Security tax, and Medicare tax withheld from employee wages. This form is essential for businesses that withhold these taxes from their employees' paychecks. It is filed quarterly and provides the IRS with information about the wages paid and the taxes owed. Understanding the purpose of Form 941 is crucial for compliance with federal tax regulations.

Steps to Complete the IRS Form 941

Filling out the IRS Form 941 involves several key steps to ensure accuracy and compliance. Here’s a streamlined process:

- Gather necessary information: Collect details about your business, including the Employer Identification Number (EIN), total wages paid, and taxes withheld.

- Complete the form: Fill out each section of the form, including employee count, wages, and tax amounts. Be thorough to avoid errors.

- Review for accuracy: Double-check all entries to ensure they are correct and complete. Mistakes can lead to penalties.

- Submit the form: File Form 941 electronically or by mail, adhering to the deadlines set by the IRS.

Legal Use of the IRS Form 941

The IRS Form 941 is legally binding and must be completed accurately to avoid legal repercussions. Employers are required to file this form to report their tax liabilities and ensure compliance with federal tax laws. Failure to file or inaccuracies can result in penalties, interest on unpaid taxes, and potential audits by the IRS. It is important to maintain accurate records and submit the form on time to uphold legal obligations.

Filing Deadlines / Important Dates

Employers must adhere to specific deadlines for filing Form 941 to avoid penalties. The form is due on the last day of the month following the end of each quarter. The quarterly deadlines are as follows:

- First Quarter (January - March): Due by April 30

- Second Quarter (April - June): Due by July 31

- Third Quarter (July - September): Due by October 31

- Fourth Quarter (October - December): Due by January 31 of the following year

Examples of Using the IRS Form 941

Employers across various industries utilize Form 941 to report their payroll taxes. For instance, a small business with five employees must report the wages paid and the corresponding taxes withheld each quarter. Similarly, larger corporations with hundreds of employees must accurately report their payroll tax liabilities to maintain compliance. Each example illustrates the importance of timely and accurate reporting to the IRS.

Form Submission Methods (Online / Mail / In-Person)

Employers have several options for submitting the IRS Form 941. The form can be filed electronically through the IRS e-file system, which is the fastest method and allows for immediate confirmation of receipt. Alternatively, employers can mail a paper version of the form to the appropriate IRS address based on their location. In-person submissions are generally not available for Form 941, making electronic filing the most efficient choice.

Quick guide on how to complete irs form 941 for

Effortlessly Prepare Irs Form 941 For on Any Device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed paperwork, enabling you to obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents swiftly, without any delays. Manage Irs Form 941 For on any platform with the airSlate SignNow applications for Android or iOS and streamline any document-related task today.

Seamless Editing and eSigning of Irs Form 941 For

- Obtain Irs Form 941 For and click on Obtain Form to begin.

- Utilize the tools we provide to fill out your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature using the Signature tool, which only takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Complete button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, invitation link, or download it to your PC.

Eliminate concerns about lost or mislaid files, tedious form navigation, or errors necessitating the printing of new document copies. airSlate SignNow addresses all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Irs Form 941 For to ensure effective communication at any stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs form 941 for

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an example of a 941 form filled out?

An example of a 941 form filled out typically includes the employer's identification information, total wages paid, and taxes withheld. This form is essential for employers to report income taxes, Social Security, and Medicare taxes to the IRS. airSlate SignNow can help you fill out and eSign these forms quickly, ensuring accuracy and compliance.

-

How can airSlate SignNow assist with my example of 941 form filled out?

airSlate SignNow simplifies the process of completing your example of 941 form filled out by providing customizable templates and easy eSignature options. You can collaborate with multiple signers, ensuring that all necessary information is included and verified. This streamlines the filing process and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for filling out the 941 form?

Yes, airSlate SignNow offers several pricing plans that cater to businesses of all sizes, allowing you to choose one that fits your budget. The plans include features that enhance your document management experience, including eSigning and tracking capabilities for your example of 941 form filled out. This affordability makes it a cost-effective solution for handling essential tax forms.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow offers a range of features including customizable templates, eSignature capabilities, and secure document storage. These features can be utilized when working on your example of 941 form filled out, making it easier to gather signatures and manage submissions. Enhanced tracking and notifications also keep you informed throughout the process.

-

Can I integrate airSlate SignNow with other software to manage my 941 forms?

Absolutely! airSlate SignNow supports integration with various software solutions such as accounting and CRM systems. This ensures that you can seamlessly manage your example of 941 form filled out alongside your other business processes, improving efficiency and reducing manual data entry.

-

How does airSlate SignNow enhance compliance when filling out forms?

By using airSlate SignNow, you ensure that your example of 941 form filled out adheres to IRS requirements with its compliant eSignature process. Additionally, the platform keeps an audit trail of all changes and signatures, providing documentation necessary for audits or record-keeping. This compliance feature gives businesses peace of mind while handling tax forms.

-

What are the benefits of using airSlate SignNow for my business?

Utilizing airSlate SignNow offers numerous benefits, including enhanced workflow efficiency, reduced errors in form completion, and expedited processing times. When you handle documents like the example of 941 form filled out, you can minimize delays in filing and improve your overall productivity. Plus, its intuitive interface makes it simple for all users to adopt.

Get more for Irs Form 941 For

Find out other Irs Form 941 For

- Can I eSign South Dakota Doctors Contract

- eSign Mississippi Construction Rental Application Mobile

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template