Form 5396

What is the Form 5396

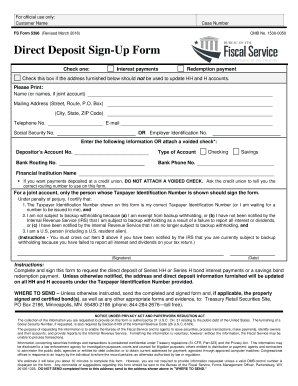

The FS Form 5396 is a document used primarily for the purpose of requesting a refund for overpaid federal taxes. This form is essential for individuals and businesses that need to rectify their tax payments with the Internal Revenue Service (IRS). By completing this form, taxpayers can ensure that they receive the correct amount of refund due to them, based on their tax filings. Understanding the purpose and requirements of the FS Form 5396 is crucial for accurate tax management and compliance.

How to use the Form 5396

Using the FS Form 5396 involves several steps to ensure proper completion and submission. Taxpayers should first gather all necessary documentation, including previous tax returns and any relevant financial records. Once the form is obtained, individuals must fill it out accurately, providing all required information such as personal details and the reason for the refund request. After completing the form, it should be reviewed for accuracy before submission to the IRS, either electronically or via mail.

Steps to complete the Form 5396

Completing the FS Form 5396 requires careful attention to detail. Follow these steps for successful completion:

- Gather all necessary documents, including prior tax returns and payment records.

- Obtain the FS Form 5396 from the IRS website or authorized sources.

- Fill in your personal information, including your name, address, and Social Security number.

- Clearly state the reason for your refund request in the designated section.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 5396

The FS Form 5396 is legally binding when completed correctly and submitted according to IRS guidelines. To ensure its legality, taxpayers must adhere to specific requirements, such as providing accurate information and maintaining compliance with relevant tax laws. Electronic submissions of the form must also meet legal standards for e-signatures and data protection to be considered valid.

Form Submission Methods

Taxpayers have several options for submitting the FS Form 5396. The form can be submitted electronically through the IRS e-file system, which is a quick and efficient method. Alternatively, individuals can print the completed form and mail it to the appropriate IRS address. In-person submissions may also be possible at designated IRS offices, depending on local regulations and availability.

Required Documents

When completing the FS Form 5396, certain documents are required to support the refund request. These may include:

- Previous tax returns for the relevant tax year.

- Documentation of overpayments, such as bank statements or payment confirmations.

- Any correspondence from the IRS regarding tax payments.

Having these documents readily available will facilitate the completion and submission process, ensuring that all necessary information is included.

Quick guide on how to complete form 5396

Complete Form 5396 effortlessly on any device

Digital document management has gained traction among both organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools required to create, alter, and eSign your documents quickly without delays. Manage Form 5396 on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign Form 5396 without hassle

- Find Form 5396 and click Get Form to begin.

- Use the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you would prefer to send your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 5396 to ensure outstanding communication at any point in the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 5396

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the fs form 5396 and how is it used?

The fs form 5396 is a document used for various official purposes, typically related to federal services. It enables users to provide necessary information for processing certain requests. Understanding how to fill out the fs form 5396 correctly is essential for ensuring timely service.

-

How can airSlate SignNow help with the fs form 5396?

airSlate SignNow offers a streamlined way to eSign the fs form 5396, simplifying the signing process for you and your clients. With intuitive features, you can easily fill out, send, and manage this form. Our platform also ensures that your documents are secure and legally binding.

-

Is airSlate SignNow affordable for signing the fs form 5396?

Yes, airSlate SignNow provides cost-effective plans tailored to various business needs, making it an affordable option for signing the fs form 5396. Our pricing model is transparent and competitive, allowing businesses of all sizes to handle their documentation efficiently without breaking the bank.

-

What features does airSlate SignNow offer for the fs form 5396?

airSlate SignNow includes features such as customizable templates, secure eSigning, and document tracking for the fs form 5396. These capabilities enable users to streamline their document workflows and improve efficiency. Additionally, our platform is user-friendly and designed to enhance your signing experience.

-

Can I integrate airSlate SignNow with other applications for managing the fs form 5396?

Absolutely! airSlate SignNow integrates seamlessly with a variety of applications, allowing you to manage the fs form 5396 alongside your other tools. Integrations with platforms like Google Drive, Dropbox, and CRM systems enhance your workflow, making document management much more efficient.

-

What are the benefits of using airSlate SignNow for the fs form 5396?

Using airSlate SignNow for the fs form 5396 offers numerous benefits, including enhanced security, quick turnaround times, and a paperless solution. Our platform ensures that you can manage your documents anytime, anywhere, which is especially beneficial for remote teams. This ultimately leads to greater productivity and satisfaction.

-

How secure is airSlate SignNow when signing the fs form 5396?

Security is a top priority at airSlate SignNow. When signing the fs form 5396, we utilize industry-standard encryption and comply with regulations to protect your data. Our platform also offers audit trails, ensuring that you can track actions and maintain the integrity of your documents at all times.

Get more for Form 5396

Find out other Form 5396

- Can I Electronic signature Minnesota Government Quitclaim Deed

- Help Me With Electronic signature Mississippi Government Confidentiality Agreement

- Electronic signature Kentucky Finance & Tax Accounting LLC Operating Agreement Myself

- Help Me With Electronic signature Missouri Government Rental Application

- Can I Electronic signature Nevada Government Stock Certificate

- Can I Electronic signature Massachusetts Education Quitclaim Deed

- Can I Electronic signature New Jersey Government LLC Operating Agreement

- Electronic signature New Jersey Government Promissory Note Template Online

- Electronic signature Michigan Education LLC Operating Agreement Myself

- How To Electronic signature Massachusetts Finance & Tax Accounting Quitclaim Deed

- Electronic signature Michigan Finance & Tax Accounting RFP Now

- Electronic signature Oklahoma Government RFP Later

- Electronic signature Nebraska Finance & Tax Accounting Business Plan Template Online

- Electronic signature Utah Government Resignation Letter Online

- Electronic signature Nebraska Finance & Tax Accounting Promissory Note Template Online

- Electronic signature Utah Government Quitclaim Deed Online

- Electronic signature Utah Government POA Online

- How To Electronic signature New Jersey Education Permission Slip

- Can I Electronic signature New York Education Medical History

- Electronic signature Oklahoma Finance & Tax Accounting Quitclaim Deed Later