5227 Form

What is the 5227 Form

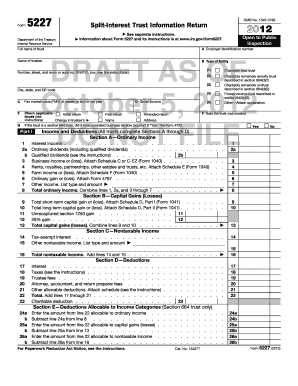

The 5227 Form is a crucial document used primarily for reporting specific financial information to the IRS. It is often associated with various tax-related obligations, particularly for individuals and businesses that need to disclose certain transactions or financial details. Understanding the purpose of this form is essential for compliance with federal regulations.

How to use the 5227 Form

Using the 5227 Form involves a series of steps to ensure that all required information is accurately reported. First, gather all necessary financial documents and data relevant to the transactions you need to report. Next, carefully fill out each section of the form, ensuring that all figures are correct and that you adhere to the specific instructions provided by the IRS. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines set by the IRS.

Steps to complete the 5227 Form

Completing the 5227 Form requires attention to detail. Here are the steps to follow:

- Review the form for any specific instructions related to your situation.

- Gather all necessary financial information, including income, expenses, and any relevant documentation.

- Fill in your personal information, including your name, address, and taxpayer identification number.

- Complete the sections related to your financial transactions, ensuring accuracy in all figures.

- Double-check the form for any errors or omissions before submission.

Legal use of the 5227 Form

The 5227 Form must be used in compliance with IRS regulations to ensure its legal validity. This means that all information provided must be truthful and accurate, as any discrepancies can lead to penalties or legal repercussions. It is important to understand the legal implications of submitting this form, including the potential for audits or reviews by the IRS.

Filing Deadlines / Important Dates

Timely filing of the 5227 Form is essential to avoid penalties. The IRS typically sets specific deadlines for submission, which can vary based on the type of taxpayer and the nature of the transactions being reported. It is important to stay informed about these deadlines and to mark your calendar accordingly to ensure compliance.

Form Submission Methods (Online / Mail / In-Person)

The 5227 Form can be submitted through various methods, providing flexibility for taxpayers. You can choose to file the form online through the IRS e-filing system, which offers a quick and efficient way to submit your information. Alternatively, you may opt to mail the form to the appropriate IRS address or submit it in person at a local IRS office. Each method has its own guidelines, so it is important to follow the instructions carefully to ensure proper submission.

Quick guide on how to complete 5227 form 1373041

Effortlessly prepare 5227 Form on any device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly alternative to conventional printed and physically signed documents, allowing you to find the right template and securely keep it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents promptly and without delays. Manage 5227 Form on any gadget using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to modify and eSign 5227 Form effortlessly

- Find 5227 Form and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of the documents or hide sensitive information with the tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method to submit your form, whether via email, text message (SMS), invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form searching, or mistakes that require reprinting new copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your preference. Edit and eSign 5227 Form while ensuring seamless communication at every step of the document preparation phase with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 5227 form 1373041

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 5227 Form and why is it important?

The 5227 Form is a crucial document used for various administrative processes. Understanding its purpose ensures that businesses comply with regulations and streamline their workflows. Using airSlate SignNow to manage the 5227 Form can simplify the signing process and enhance efficiency.

-

How can airSlate SignNow help with the 5227 Form?

airSlate SignNow allows users to create, send, and eSign the 5227 Form effortlessly. Its intuitive platform features templates that save time and reduce errors. Additionally, automated reminders ensure that all necessary parties complete the signing process promptly.

-

Is there a cost associated with using airSlate SignNow for the 5227 Form?

Yes, airSlate SignNow offers a variety of pricing plans tailored to fit different business needs. These plans provide comprehensive features, including support for the 5227 Form. You can choose a plan based on the volume of documents your business handles.

-

Can I integrate airSlate SignNow with other software for handling the 5227 Form?

Absolutely! airSlate SignNow seamlessly integrates with many popular applications, making it easy to manage the 5227 Form alongside other tools you already use. This integration capability enhances productivity and ensures that all your processes work smoothly.

-

What are the benefits of using airSlate SignNow for the 5227 Form?

Using airSlate SignNow for the 5227 Form provides numerous benefits, including increased efficiency, reduced paper usage, and improved security for sensitive information. The platform's electronic signature feature expedites document turnaround times, making it a valuable tool for businesses.

-

Is airSlate SignNow compliant with regulations for the 5227 Form?

Yes, airSlate SignNow complies with major eSignature regulations, making it a trusted choice for managing the 5227 Form. The platform ensures that all signatures are legally binding and that your documents are securely stored and accessible.

-

How secure is my data when using airSlate SignNow for the 5227 Form?

airSlate SignNow prioritizes data security and employs advanced encryption standards to protect your documents, including the 5227 Form. Regular security audits and compliance with industry regulations further ensure that your sensitive information remains safe.

Get more for 5227 Form

- Where do i get a civil appeal bond in denton county tx form

- Need to print out marrage license applications 2014 2019 form

- Passport republic application form

- Prepass online application form

- Usa basketball letter of clearance 2010 form

- Boiler inspection form state of michigan

- Hud 903 pdf 193 1993 form

- Pump it up permission slip form

Find out other 5227 Form

- How To Electronic signature Idaho Police Last Will And Testament

- How Do I Electronic signature North Dakota Real Estate Quitclaim Deed

- Can I Electronic signature Ohio Real Estate Agreement

- Electronic signature Ohio Real Estate Quitclaim Deed Later

- How To Electronic signature Oklahoma Real Estate Business Plan Template

- How Can I Electronic signature Georgia Sports Medical History

- Electronic signature Oregon Real Estate Quitclaim Deed Free

- Electronic signature Kansas Police Arbitration Agreement Now

- Electronic signature Hawaii Sports LLC Operating Agreement Free

- Electronic signature Pennsylvania Real Estate Quitclaim Deed Fast

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe