FORM NO 15 H SEE RULE 29 C 1A the Karur Vysya Bank

What is the Form 15H KVB?

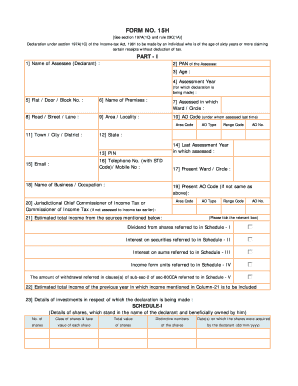

The Form 15H, also known as the KVB 15H form, is a declaration form used by individuals in the United States to ensure that no tax is deducted at source on interest income. This form is particularly relevant for senior citizens or individuals whose total taxable income is below the taxable limit. By submitting the Form 15H, taxpayers can avoid unnecessary tax deductions, allowing them to receive their full interest earnings without withholding.

How to Obtain the Form 15H KVB

The Form 15H can be easily obtained through various channels. It is available for download from the official website of the Karur Vysya Bank. Additionally, individuals can request a physical copy from their nearest bank branch. It is advisable to ensure that the latest version of the form is being used to comply with current regulations.

Steps to Complete the Form 15H KVB

Completing the Form 15H involves several straightforward steps:

- Download the form from the Karur Vysya Bank website or obtain a physical copy.

- Fill in your personal details, including your name, address, and PAN (Permanent Account Number).

- Provide details of your income sources and ensure that your total income is below the taxable limit.

- Sign and date the form to confirm the accuracy of the information provided.

- Submit the completed form to your bank branch or through the designated online portal.

Legal Use of the Form 15H KVB

The Form 15H is legally binding when completed accurately and submitted to the relevant financial institution. It serves as a formal declaration that the individual meets the eligibility criteria for non-deduction of tax at source. Compliance with the requirements outlined in the form is essential to ensure that the declaration is accepted by the bank and that tax deductions are avoided.

Eligibility Criteria for the Form 15H KVB

To be eligible to submit the Form 15H, individuals must meet specific criteria, including:

- Being a resident individual in the United States.

- Having a total income that does not exceed the taxable limit set by the IRS.

- Being at least sixty years old, or if younger, having a total income below the taxable threshold.

Form Submission Methods for the Form 15H KVB

The Form 15H can be submitted through various methods to ensure convenience for taxpayers. These methods include:

- In-person submission at the nearest Karur Vysya Bank branch.

- Online submission through the bank's official digital platform.

- Mailing the completed form to the designated address provided by the bank.

Quick guide on how to complete form no 15 h see rule 29 c 1a the karur vysya bank

Complete FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank effortlessly on any device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly solution to traditional printed and signed materials, as you can obtain the necessary form and securely keep it online. airSlate SignNow provides you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Handle FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank with ease

- Locate FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank and click Get Form to begin.

- Utilize the features we provide to complete your form.

- Highlight important parts of the documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select your preferred method of delivering the form, whether by email, SMS, invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank and ensure clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form no 15 h see rule 29 c 1a the karur vysya bank

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 15h kvb download and why is it important?

The form 15h kvb download is a document used for tax exemption purposes. It allows individuals to request a reduction in tax withholding on their income, making it essential for efficient financial management. With airSlate SignNow, you can create and send this form easily, ensuring compliance and accuracy.

-

How can I download the form 15h kvb using airSlate SignNow?

To download the form 15h kvb, simply log into your airSlate SignNow account, navigate to the templates, and select the form 15h kvb from the available documents. You can then download it directly in your preferred format for easy access and distribution.

-

Is there a cost associated with the form 15h kvb download on airSlate SignNow?

airSlate SignNow offers various pricing plans, which include access to the form 15h kvb download. Depending on your subscription, you can leverage additional features for eSignature and document management without any hidden costs.

-

What features does airSlate SignNow provide for managing the form 15h kvb?

airSlate SignNow includes features that allow you to customize your form 15h kvb, set signature fields, and track its status in real-time. The platform also ensures the security of your documents with advanced encryption methods, making it safe for sensitive information.

-

Can I integrate airSlate SignNow with other software for the form 15h kvb download?

Yes, airSlate SignNow offers integrations with various software solutions, such as CRM and accounting tools. This allows for seamless workflow, enabling you to manage your form 15h kvb download efficiently alongside other business processes.

-

What are the benefits of using airSlate SignNow for the form 15h kvb download?

Using airSlate SignNow for the form 15h kvb download simplifies the document signing process, saving you time and effort. The platform also provides easy access to templates, ensuring that you can manage your forms while maintaining compliance with tax regulations.

-

Is it possible to send the form 15h kvb for eSignature through airSlate SignNow?

Absolutely! airSlate SignNow allows you to send the form 15h kvb for eSignature quickly and securely. Recipients can sign the document electronically, enabling faster processing while ensuring legal compliance.

Get more for FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank

Find out other FORM NO 15 H SEE RULE 29 C 1A THE Karur Vysya Bank

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple

- eSign Idaho Healthcare / Medical Arbitration Agreement Later

- How To eSign Colorado High Tech Forbearance Agreement