Vat52 Form

What is the Vat52

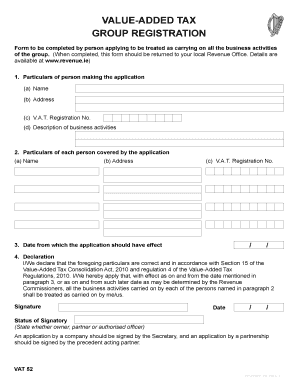

The Vat52 form is a specific document used primarily for tax purposes in the United States. It serves as a formal declaration for certain transactions, often related to value-added tax (VAT) claims. Understanding the Vat52 is crucial for businesses and individuals who engage in activities that may require VAT reporting or refunds. The form ensures compliance with tax regulations and helps facilitate proper accounting practices.

How to use the Vat52

Using the Vat52 form involves several steps to ensure accurate completion and submission. First, gather all necessary information, including transaction details and any relevant supporting documents. Next, fill out the form with precise data, ensuring that all fields are completed as required. Once completed, the form can be submitted electronically or via mail, depending on your preference and the guidelines provided by the tax authority.

Steps to complete the Vat52

Completing the Vat52 form requires careful attention to detail. Follow these steps:

- Gather necessary documentation related to the transactions for which you are claiming VAT.

- Fill in your personal or business information in the designated sections of the form.

- Provide details of the transactions, including dates, amounts, and descriptions.

- Review the completed form for accuracy and completeness.

- Submit the form according to the specified submission methods, either online or by mail.

Legal use of the Vat52

The Vat52 form must be used in accordance with U.S. tax laws to ensure its legal validity. This includes adhering to guidelines set forth by the Internal Revenue Service (IRS) and other relevant tax authorities. Proper use of the form can protect individuals and businesses from potential penalties or legal issues related to tax compliance. It is essential to keep records of submitted forms and any correspondence with tax authorities for future reference.

Key elements of the Vat52

Several key elements define the Vat52 form and its purpose:

- Identification Information: Personal or business details that identify the filer.

- Transaction Details: Specifics about the transactions related to VAT claims.

- Signature: A signature is required to validate the form and confirm accuracy.

- Submission Method: Instructions on how to submit the form, either electronically or via mail.

Examples of using the Vat52

The Vat52 form can be utilized in various scenarios. For instance, a business that exported goods may use the form to claim back VAT paid on purchases related to those goods. Additionally, individuals who have incurred VAT on eligible expenses while traveling for business may also submit the Vat52 to reclaim those costs. Understanding these examples can help clarify when and how to effectively use the form.

Quick guide on how to complete vat52

Complete Vat52 effortlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to locate the right form and securely store it on the web. airSlate SignNow equips you with all the tools required to create, modify, and eSign your documents quickly without delays. Handle Vat52 on any device using airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

How to alter and eSign Vat52 with ease

- Find Vat52 and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize relevant parts of the documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal standing as a conventional handwritten signature.

- Verify the details and click on the Done button to secure your changes.

- Select how you would like to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate the worries of lost or misplaced files, tedious document searching, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you prefer. Modify and eSign Vat52 and ensure outstanding communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the vat52

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is vat52 and how does it relate to airSlate SignNow?

Vat52 is a crucial tax form used for VAT transactions in certain jurisdictions. With airSlate SignNow, users can easily eSign the vat52 form and manage VAT-related documents seamlessly. This ensures compliance and efficiency when handling necessary tax documents.

-

How much does it cost to use airSlate SignNow for vat52 transactions?

airSlate SignNow offers flexible pricing plans to accommodate various business needs. While specific costs may vary, using airSlate SignNow for vat52 transactions is cost-effective, allowing businesses to manage signing and document workflows without incurring additional expenses for traditional methods.

-

What features does airSlate SignNow provide for vat52 document management?

airSlate SignNow provides a variety of features for vat52 document management, including customizable templates, automated workflows, and secure cloud storage. These functionalities make it easy to create, send, and collect eSignatures on vat52 forms, streamlining the process for all users.

-

Are there any integrations available for vat52 eSigning with airSlate SignNow?

Yes, airSlate SignNow integrates seamlessly with multiple applications and services, enhancing the management of vat52 documents. Whether you use CRM software or cloud storage solutions, these integrations simplify the process of sending and signing vat52 forms and other important documents.

-

What benefits does airSlate SignNow offer for businesses handling vat52 documents?

Using airSlate SignNow for vat52 documents offers several key benefits, including improved efficiency, reduced paper usage, and enhanced security. Businesses can streamline their signing processes and ensure that all vat52 forms are signed quickly and securely, leading to smoother operations.

-

Can I track the status of my vat52 documents in airSlate SignNow?

Absolutely! airSlate SignNow allows you to track the status of all your vat52 documents in real-time. This feature ensures that you are aware of who has signed and who still needs to complete the process, providing transparency and control over your document management.

-

Is airSlate SignNow legally compliant for vat52 eSigning?

Yes, airSlate SignNow complies with eSignature laws like the ESIGN Act and UETA, making it legally valid for vat52 eSigning. This compliance ensures that your electronically signed vat52 forms hold the same legal weight as traditional handwritten signatures, offering peace of mind to businesses.

Get more for Vat52

Find out other Vat52

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form