05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx

What is the 05 163 Texas Franchise Tax Annual No Tax Due Information Report?

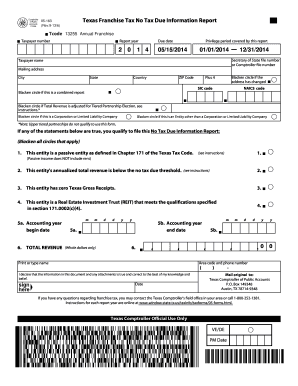

The 05 163 Texas Franchise Tax Annual No Tax Due Information Report is a form used by certain businesses in Texas to report their franchise tax status. This form is specifically designed for entities that do not owe any franchise tax for the reporting year. It serves as a declaration to the state that the business meets the criteria for not being liable for franchise taxes, thus ensuring compliance with state regulations.

Steps to Complete the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

Completing the 05 163 form involves several steps to ensure accuracy and compliance. Start by gathering necessary information about your business, including your Texas taxpayer number and details on your business structure. Next, fill out the form by providing accurate information in each required field. After completing the form, review it for any errors or omissions. Finally, submit the form electronically or by mail, depending on your preference and compliance requirements.

How to Obtain the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

The 05 163 form can be obtained directly from the Texas Comptroller's website or through authorized state offices. It is available in a digital format, making it easy to download and fill out. Ensure that you have the most current version of the form to avoid any issues during submission. If you prefer a paper version, you can also request it from local government offices or print it directly from the website.

Legal Use of the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

The legal use of the 05 163 form is crucial for businesses seeking to maintain compliance with Texas tax laws. When submitted correctly, it serves as a formal declaration of a business's tax status. This form must be filed annually, and failure to do so can result in penalties or fines. It is important to ensure that all information provided is accurate and truthful to avoid legal repercussions.

Key Elements of the 05 163 Texas Franchise Tax Annual No Tax Due Information Report

Key elements of the 05 163 form include the business name, taxpayer number, and confirmation that no franchise tax is due. Additionally, the form requires the signature of an authorized representative, affirming that the information provided is correct. Understanding these key components is essential for ensuring that the form is filled out correctly and submitted on time.

Filing Deadlines / Important Dates

Filing deadlines for the 05 163 Texas Franchise Tax Annual No Tax Due Information Report typically fall on May 15 of each year. It is important for businesses to be aware of this date to avoid late fees or penalties. Keeping track of important dates related to tax filings can help ensure compliance and maintain good standing with the state.

Form Submission Methods (Online / Mail / In-Person)

The 05 163 form can be submitted through various methods, including online submission via the Texas Comptroller's website, mailing a paper copy, or delivering it in person to a local office. Online submission is often the most efficient method, allowing for immediate processing and confirmation of receipt. Businesses should choose the submission method that best fits their needs and capabilities.

Quick guide on how to complete 05 163 texas franchise tax annual no tax due information report window state tx

Effortlessly prepare 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx on any device

The management of documents online has become increasingly popular among both companies and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed paperwork, allowing you to find the correct form and securely keep it online. airSlate SignNow equips you with all the necessary tools to quickly create, amend, and eSign your documents without any holdups. Handle 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx on any device using airSlate SignNow's Android or iOS applications and simplify any document-related operation today.

How to modify and eSign 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx with ease

- Obtain 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or redact sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Edit and eSign 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx and ensure exceptional communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 05 163 texas franchise tax annual no tax due information report window state tx

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Texas form 05 163 used for?

The Texas form 05 163 is a crucial document required for specific business transactions in Texas. It serves to ensure compliance with state regulations and is often needed in various business processes. Using airSlate SignNow to eSign this document ensures a seamless and efficient workflow.

-

How can I fill out the Texas form 05 163 online?

Filling out the Texas form 05 163 online is simple with airSlate SignNow. Our platform allows you to upload the form, fill in the necessary details, and eSign it in just a few clicks. Streamlining this process saves you time and reduces the risk of errors.

-

Is there a cost associated with using airSlate SignNow for the Texas form 05 163?

airSlate SignNow offers flexible pricing options that cater to different business needs. While there are costs associated with the service, the investment pays off by enhancing document management efficiency, especially for critical documents like the Texas form 05 163.

-

What are the main features of airSlate SignNow for processing the Texas form 05 163?

AirSlate SignNow provides several features tailored for processing the Texas form 05 163, including customizable templates, secure eSigning, and real-time tracking. Additionally, the user-friendly interface ensures ease of use, making it ideal for individuals and businesses alike.

-

How does airSlate SignNow ensure the security of the Texas form 05 163?

AirSlate SignNow prioritizes the security of all documents, including the Texas form 05 163, with advanced encryption protocols and secure cloud storage. We adhere to industry standards to protect sensitive information, ensuring that your documents remain safe throughout the signing process.

-

Can I integrate airSlate SignNow with other applications for the Texas form 05 163?

Yes, airSlate SignNow is designed to seamlessly integrate with various applications, enhancing the management of the Texas form 05 163. This integration capability allows users to streamline workflows across platforms, providing a comprehensive solution for document handling.

-

What are the benefits of using airSlate SignNow for the Texas form 05 163?

Using airSlate SignNow for the Texas form 05 163 comes with numerous benefits, including increased efficiency, reduced paperwork, and enhanced compliance with state requirements. The platform simplifies the signing process, allowing for quicker transactions and improved collaboration.

Get more for 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx

Find out other 05 163 Texas Franchise Tax Annual No Tax Due Information Report Window State Tx

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed

- Electronic signature Arkansas Sports LLC Operating Agreement Myself

- How Do I Electronic signature Nevada Real Estate Quitclaim Deed

- How Can I Electronic signature New Jersey Real Estate Stock Certificate

- Electronic signature Colorado Sports RFP Safe

- Can I Electronic signature Connecticut Sports LLC Operating Agreement