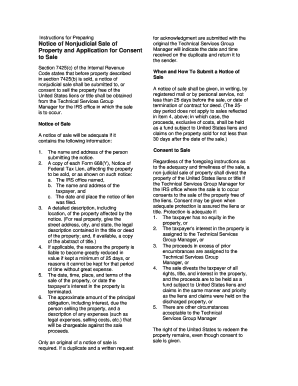

Irs Form 14497

What is the IRS Form 14497

The IRS Form 14497, also known as the "Notice of Intent to Levy," is a document used by the Internal Revenue Service to inform taxpayers of its intention to seize property or rights to property to satisfy a tax debt. This form is typically issued after the IRS has made attempts to collect unpaid taxes and is a critical step in the collection process. Understanding this form is essential for taxpayers facing potential levies, as it outlines their rights and the actions they can take to address the situation.

How to use the IRS Form 14497

Using the IRS Form 14497 involves understanding its purpose and the actions required from the taxpayer. When a taxpayer receives this form, it indicates that the IRS intends to levy their assets. Taxpayers should carefully review the form for details about the tax owed and the property that may be levied. It is important to respond promptly, as failure to address the notice can lead to further collection actions. Taxpayers may need to consult a tax professional for guidance on how to proceed, including options for appealing the levy or negotiating a payment plan.

Steps to complete the IRS Form 14497

Completing the IRS Form 14497 requires careful attention to detail. Here are the essential steps:

- Review the form thoroughly to understand the tax debt and the proposed levy.

- Gather any relevant documentation that supports your case, such as proof of payment or financial hardship.

- Complete any required sections of the form, ensuring all information is accurate and up-to-date.

- Submit the form to the IRS by the specified deadline to avoid further penalties.

- Keep a copy of the completed form and any correspondence with the IRS for your records.

Legal use of the IRS Form 14497

The legal use of the IRS Form 14497 is governed by federal tax laws. This form serves as a formal notice to taxpayers about the IRS's intent to levy. It is crucial for taxpayers to understand their rights under the law, including the right to contest the levy and the procedures for doing so. Taxpayers may also seek legal counsel to ensure compliance with all legal requirements and to explore options for resolving their tax issues.

Filing Deadlines / Important Dates

Timely filing is critical when dealing with the IRS Form 14497. Taxpayers should be aware of the deadlines associated with this form, as failure to respond within the specified timeframe can result in the IRS proceeding with the levy. Typically, taxpayers have a limited period to contest the levy or arrange for payment before the IRS takes further action. It is advisable to mark these dates on a calendar and set reminders to ensure compliance.

Penalties for Non-Compliance

Non-compliance with the IRS Form 14497 can lead to significant penalties. If a taxpayer fails to respond to the notice or does not take appropriate action, the IRS may proceed with the levy, which can result in the seizure of assets. Additionally, further penalties may accrue on the unpaid tax debt. Understanding the consequences of non-compliance underscores the importance of addressing the form promptly and seeking assistance if needed.

Quick guide on how to complete form 14497 irs

Process form 14497 irs effortlessly on any device

Digital document management has gained traction among companies and individuals. It offers an excellent eco-friendly alternative to conventional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, modify, and eSign your documents swiftly without complications. Manage irs form 14497 across any platform with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The simplest way to modify and eSign form 14497 effortlessly

- Find irs 14497 and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which only takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), or invitation link, or download it to your computer.

Purge worries about lost or misplaced files, tedious form searches, or mistakes that necessitate printing new document versions. airSlate SignNow fulfills all your document management needs in just a few clicks from your preferred device. Alter and eSign irs form 14498 and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 14497 irs

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask form 14497

-

What is IRS Form 14497, and why is it important?

IRS Form 14497 is a critical document used for reporting certain tax matters to the IRS. It ensures compliance with tax regulations and helps businesses accurately represent their financial standing. Understanding how to effectively manage IRS Form 14497 can save you time and reduce potential penalties.

-

How can airSlate SignNow help with IRS Form 14497?

airSlate SignNow provides an efficient platform for electronically signing and sending IRS Form 14497. Our intuitive interface streamlines the documentation process, making it easy for businesses to manage their tax papers. With airSlate SignNow, you can ensure that your IRS 14497 form is handled securely and promptly.

-

Is there a cost associated with using airSlate SignNow for IRS Form 14497?

Yes, airSlate SignNow offers several pricing plans tailored to meet your business needs when managing IRS Form 14497. Our cost-effective solutions are designed to provide value while ensuring you have access to all the essential features. You can choose a plan that suits your requirements and budget.

-

What features does airSlate SignNow offer for managing IRS Form 14497?

With airSlate SignNow, you get features like customizable templates, document sharing, secure eSignatures, and real-time tracking for IRS Form 14497. These tools help ensure accuracy and compliance while enhancing collaboration within your team. Our platform is user-friendly, making it easy to integrate into your existing workflow.

-

Can I integrate airSlate SignNow with other software to manage IRS Form 14497?

Absolutely! airSlate SignNow offers seamless integrations with various applications, enabling you to manage IRS Form 14497 effortlessly. Whether you use CRM software, cloud storage, or accounting platforms, our integrations enhance your workflow and improve productivity. You can easily sync your documents and data for a more streamlined process.

-

How does airSlate SignNow ensure the security of IRS Form 14497?

Security is a top priority at airSlate SignNow when handling IRS Form 14497. We use advanced encryption and comply with industry standards to protect your sensitive information. Our platform also includes features like user authentication and audit trails to give you peace of mind while managing your documents.

-

What are the benefits of using airSlate SignNow for IRS Form 14497 compared to traditional methods?

Using airSlate SignNow for IRS Form 14497 offers numerous benefits over traditional methods, including speed, efficiency, and enhanced security. Traditional paper forms can be time-consuming and prone to errors, while our digital solution simplifies the process and ensures accuracy. Additionally, you can track progress in real-time, which is invaluable for timely submissions.

Get more for irs 14497

Find out other irs form 14498

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word

- How To Electronic signature Tennessee Real Estate Document

- How Do I Electronic signature Utah Real Estate Form

- How To Electronic signature Utah Real Estate PPT

- How Can I Electronic signature Virginia Real Estate PPT

- How Can I Electronic signature Massachusetts Sports Presentation

- How To Electronic signature Colorado Courts PDF

- How To Electronic signature Nebraska Sports Form