Form 8865

What is the Form 8865

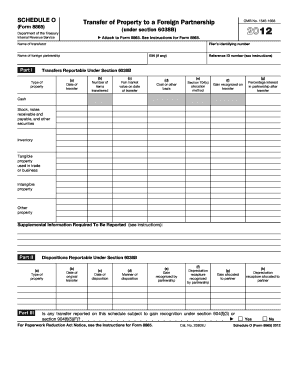

The Form 8865 is a tax form used by U.S. taxpayers to report certain information regarding foreign partnerships. It is primarily required for individuals and entities that own a stake in a foreign partnership, ensuring compliance with U.S. tax laws. The form is essential for reporting income, deductions, and credits associated with the partnership, as well as for disclosing specific transactions and financial interests. Failing to file this form can lead to significant penalties, making it crucial for eligible taxpayers to understand their obligations.

How to use the Form 8865

Using Form 8865 involves several steps to ensure accurate reporting. Taxpayers must first determine if they meet the filing requirements based on their ownership interest in a foreign partnership. Once eligibility is established, the form must be filled out with detailed information about the partnership, including its name, address, and Employer Identification Number (EIN). Taxpayers should also report their share of the partnership's income, deductions, and credits. It is advisable to consult IRS guidelines or a tax professional to ensure compliance and accuracy when completing the form.

Steps to complete the Form 8865

Completing Form 8865 requires careful attention to detail. Here are the key steps:

- Gather necessary information about the foreign partnership, including its EIN and financial data.

- Determine the correct section of the form to complete based on your ownership percentage.

- Fill in the required fields, ensuring that all information is accurate and complete.

- Attach any necessary schedules or additional documentation that supports your reporting.

- Review the completed form for accuracy before submission.

Filing Deadlines / Important Dates

Timely filing of Form 8865 is essential to avoid penalties. The deadline for submitting the form typically aligns with the taxpayer's income tax return due date, including extensions. For most taxpayers, this means the form is due on April 15 of the following year. If an extension is filed for the income tax return, the deadline for Form 8865 may also be extended. It is important to keep track of these dates to ensure compliance with IRS regulations.

Penalties for Non-Compliance

Failing to file Form 8865 or submitting it late can result in significant penalties. The IRS imposes fines that can accumulate quickly, particularly if the form is not filed within the specified time frame. Penalties may include a fixed amount per month for each month the form is late, up to a maximum limit. Additionally, if the failure to file is deemed willful, the penalties can be even more severe. Understanding these consequences underscores the importance of timely and accurate filing.

Legal use of the Form 8865

The legal use of Form 8865 is governed by U.S. tax laws, which require taxpayers to report their interests in foreign partnerships. This form serves as a key tool for the IRS to monitor compliance with international tax obligations. To ensure that the form is legally binding, it must be completed accurately and submitted on time. Taxpayers should maintain records of their filings and any correspondence with the IRS regarding the form to support their compliance efforts.

Who Issues the Form

The Form 8865 is issued by the Internal Revenue Service (IRS), the U.S. federal agency responsible for tax collection and enforcement. The IRS provides the form along with instructions that outline the requirements for completion and submission. Taxpayers can access the form and its accompanying guidelines directly from the IRS website, ensuring they have the most current information and requirements for filing.

Quick guide on how to complete form 8865 12044331

Prepare Form 8865 effortlessly on any device

Web-based document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow equips you with all the tools required to create, edit, and electronically sign your documents promptly without any hold-ups. Manage Form 8865 on any device using airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to modify and electronically sign Form 8865 with ease

- Find Form 8865 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or redact sensitive information using the tools that airSlate SignNow offers specifically for that purpose.

- Generate your electronic signature with the Sign tool, which takes just seconds and holds the same legal validity as a standard handwritten signature.

- Verify the information and click on the Done button to save your modifications.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and mistakes that necessitate reprinting document copies. airSlate SignNow simplifies your document management needs in just a few clicks from any device of your choice. Edit and electronically sign Form 8865 to ensure clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8865 12044331

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 8865 and why do I need it?

Form 8865 is a tax form required by the IRS for certain U.S. persons with interests in foreign partnerships. It's essential for reporting information about these foreign partnerships and ensuring compliance with U.S. tax regulations. airSlate SignNow simplifies the process of preparing and eSigning Form 8865, making it easier for businesses to handle their reporting obligations.

-

How does airSlate SignNow help with Form 8865?

airSlate SignNow streamlines the preparation and signing of Form 8865 by providing easy-to-use templates and eSignature features. Users can quickly fill out the form, collect the required signatures, and securely store documents. This saves time and reduces the risk of errors, ensuring that your Form 8865 is completed accurately.

-

Is there a cost associated with using airSlate SignNow for Form 8865?

Yes, airSlate SignNow offers affordable pricing plans tailored to fit different business needs. Subscriptions provide access to essential features for preparing and signing documents, including Form 8865. You can choose a plan that suits your budget while benefiting from a reliable and efficient eSigning solution.

-

Can I integrate airSlate SignNow with other software for Form 8865 management?

Absolutely! airSlate SignNow integrates seamlessly with various applications, such as CRM and accounting software, to enhance your Form 8865 management. This integration allows you to easily sync data, automate workflows, and maintain organized records without switching between platforms.

-

What are the main features of airSlate SignNow for handling Form 8865?

Key features include customizable templates, real-time collaboration, and secure eSignature capabilities. airSlate SignNow ensures that your Form 8865 can be filled out and signed efficiently while providing a secure environment for document handling. These features help to ensure a hassle-free experience when dealing with your tax forms.

-

Is airSlate SignNow user-friendly for preparing Form 8865?

Yes, airSlate SignNow is designed with user-friendliness in mind, making it easy for anyone to prepare Form 8865, regardless of their technical skills. The intuitive interface provides step-by-step guidance, ensuring you can complete your form without confusion. This can signNowly reduce the time spent on document preparation.

-

What security measures does airSlate SignNow implement for Form 8865?

airSlate SignNow prioritizes security by using advanced encryption protocols and secure data storage. This ensures that your Form 8865 and any sensitive information you share are protected against unauthorized access. Trust in airSlate SignNow to keep your documents safe throughout the signing process.

Get more for Form 8865

Find out other Form 8865

- eSign Ohio Legal Moving Checklist Simple

- How To eSign Ohio Non-Profit LLC Operating Agreement

- eSign Oklahoma Non-Profit Cease And Desist Letter Mobile

- eSign Arizona Orthodontists Business Plan Template Simple

- eSign Oklahoma Non-Profit Affidavit Of Heirship Computer

- How Do I eSign Pennsylvania Non-Profit Quitclaim Deed

- eSign Rhode Island Non-Profit Permission Slip Online

- eSign South Carolina Non-Profit Business Plan Template Simple

- How Can I eSign South Dakota Non-Profit LLC Operating Agreement

- eSign Oregon Legal Cease And Desist Letter Free

- eSign Oregon Legal Credit Memo Now

- eSign Oregon Legal Limited Power Of Attorney Now

- eSign Utah Non-Profit LLC Operating Agreement Safe

- eSign Utah Non-Profit Rental Lease Agreement Mobile

- How To eSign Rhode Island Legal Lease Agreement

- How Do I eSign Rhode Island Legal Residential Lease Agreement

- How Can I eSign Wisconsin Non-Profit Stock Certificate

- How Do I eSign Wyoming Non-Profit Quitclaim Deed

- eSign Hawaii Orthodontists Last Will And Testament Fast

- eSign South Dakota Legal Letter Of Intent Free