Minnesota Additional Nontaxable Income Form

Understanding Minnesota Additional Nontaxable Income

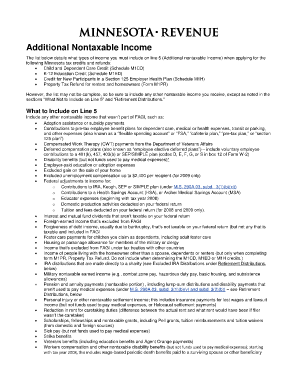

Minnesota Additional Nontaxable Income refers to specific types of income that are exempt from state taxation. This can include certain government benefits, specific types of pensions, and other allowances that the state recognizes as non-taxable. Understanding what qualifies as nontaxable income is essential for accurate tax reporting and compliance. Individuals should familiarize themselves with the guidelines to ensure they are not overpaying taxes on income that is legally exempt.

Steps to Complete the Minnesota Additional Nontaxable Income Form

Completing the Minnesota Additional Nontaxable Income form involves several key steps. First, gather all necessary documentation that supports your claim for nontaxable income. This may include pay stubs, tax documents, or official letters from government agencies. Next, accurately fill out the form, ensuring that all sections are completed with precise information. After completing the form, review it for any errors or omissions. Finally, submit the form according to the specified method, whether online, by mail, or in person.

Legal Use of the Minnesota Additional Nontaxable Income

The legal use of Minnesota Additional Nontaxable Income is crucial for taxpayers to understand. This form must be used in compliance with state tax regulations, ensuring that only eligible income is reported as nontaxable. Misreporting or claiming ineligible income can lead to penalties or audits. It is advisable to consult with a tax professional if there are uncertainties regarding what constitutes nontaxable income or how to properly complete the form.

Eligibility Criteria for Minnesota Additional Nontaxable Income

To qualify for Minnesota Additional Nontaxable Income, taxpayers must meet specific eligibility criteria set forth by the state. Generally, this includes being a resident of Minnesota and receiving income types that are explicitly listed as nontaxable. Examples may include certain social security benefits, disability payments, or specific retirement income. It is important to review the latest state guidelines to confirm eligibility before filing.

Filing Deadlines for Minnesota Additional Nontaxable Income

Filing deadlines for the Minnesota Additional Nontaxable Income form align with the general tax filing deadlines established by the state. Typically, individuals must submit their forms by April 15 of each year, unless an extension is granted. Staying aware of these deadlines is essential to avoid late fees or penalties. Taxpayers should also consider any changes in deadlines due to special circumstances or legislative updates.

Required Documents for Minnesota Additional Nontaxable Income

When completing the Minnesota Additional Nontaxable Income form, several documents are required to substantiate your claims. These may include income statements, tax returns from previous years, and any official correspondence regarding nontaxable income. Having these documents organized and readily available will facilitate a smoother filing process and help ensure compliance with state regulations.

Examples of Minnesota Additional Nontaxable Income

Examples of Minnesota Additional Nontaxable Income include various types of government assistance and benefits. Common examples are social security benefits, unemployment compensation, and certain types of pensions. Understanding these examples can help taxpayers accurately identify which portions of their income are exempt from state taxation, ensuring proper reporting and compliance.

Quick guide on how to complete minnesota additional nontaxable income

Effortlessly Prepare Minnesota Additional Nontaxable Income on Any Device

Digital document management has gained traction among companies and individuals alike. It serves as an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and without issues. Handle Minnesota Additional Nontaxable Income on any platform using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

The Easiest Way to Modify and eSign Minnesota Additional Nontaxable Income with Minimal Effort

- Locate Minnesota Additional Nontaxable Income and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing additional copies. airSlate SignNow takes care of all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Minnesota Additional Nontaxable Income and ensure exceptional communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the minnesota additional nontaxable income

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is non taxable income and how does it affect my business?

Non taxable income refers to earnings that are exempt from taxation by the IRS. Understanding non taxable income is crucial for businesses as it impacts tax planning and financial reporting. By effectively managing non taxable income, you can ensure compliance and optimize cash flow.

-

Can airSlate SignNow help me manage documents related to non taxable income?

Yes, airSlate SignNow streamlines the management of documents related to non taxable income by providing an easy-to-use platform for sending and eSigning important forms. This allows businesses to keep track of relevant paperwork efficiently, ensuring that all tax obligations are met.

-

What pricing plans does airSlate SignNow offer for businesses dealing with non taxable income?

airSlate SignNow offers flexible pricing plans tailored to different business needs, making it cost-effective for managing non taxable income documentation. Whether you are a small startup or a large enterprise, you can choose a plan that suits your budget while streamlining your document workflows.

-

Are there any integrations available to help with non taxable income tracking?

Yes, airSlate SignNow integrates seamlessly with various accounting and financial software to help you manage non taxable income efficiently. These integrations allow for real-time data synchronization, ensuring that all financial records are accurate and up to date for reporting purposes.

-

What are the benefits of using airSlate SignNow for non taxable income transactions?

Using airSlate SignNow for non taxable income transactions enhances efficiency and reduces the risk of errors in documentation. The platform ensures that your documents are securely stored and easily accessible, helping you maintain compliance while saving time and resources.

-

Can airSlate SignNow assist with compliance regarding non taxable income?

Definitely! airSlate SignNow provides features that help ensure compliance with tax regulations related to non taxable income. With eSigning and document management capabilities, businesses can confidently assert that their filings and records meet legal requirements.

-

What types of documents can I manage using airSlate SignNow related to non taxable income?

You can manage a variety of documents related to non taxable income using airSlate SignNow, including tax forms, receipts, and contracts. The platform's versatility allows you to customize documents as needed and streamline your workflow effectively.

Get more for Minnesota Additional Nontaxable Income

Find out other Minnesota Additional Nontaxable Income

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed

- Electronic signature Indiana Postnuptial Agreement Template Later