Ret 001 Form

What is the Ret 001

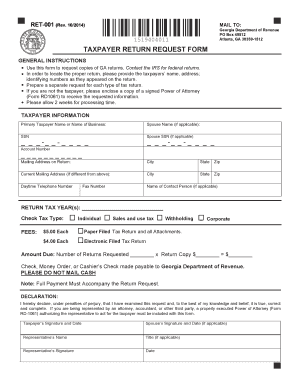

The Ret 001 form is a specific document used for reporting certain financial information to the Internal Revenue Service (IRS). It is primarily utilized by businesses and individuals to ensure compliance with federal tax regulations. Understanding the purpose of the Ret 001 is crucial for accurate reporting and maintaining good standing with tax authorities.

How to use the Ret 001

Using the Ret 001 involves several key steps. First, gather all necessary financial documents and information required for the form. This may include income statements, expense records, and any relevant tax identification numbers. Next, fill out the form accurately, ensuring that all information is complete and correct. Finally, submit the completed Ret 001 to the appropriate IRS office by the specified deadline to avoid penalties.

Steps to complete the Ret 001

Completing the Ret 001 requires careful attention to detail. Start by downloading the form from the IRS website or obtaining a physical copy. Follow these steps:

- Enter your personal and business information, including name, address, and taxpayer identification number.

- Report your income and any deductions accurately, ensuring that all figures match your financial records.

- Review the form for any errors or omissions before signing and dating it.

- Submit the form either electronically or by mail, depending on your preference and the IRS guidelines.

Legal use of the Ret 001

The Ret 001 must be used in accordance with IRS regulations to ensure its legal validity. This means that all information reported must be truthful and accurate. Falsifying information on the form can lead to severe penalties, including fines and potential legal action. It is essential to understand the legal implications of submitting the Ret 001 and to consult with a tax professional if there are any uncertainties.

Filing Deadlines / Important Dates

Filing deadlines for the Ret 001 are critical to avoid penalties. Typically, the form must be submitted by a specific date each year, which aligns with the annual tax filing season. It is important to stay informed about any changes to these deadlines, as they can vary based on individual circumstances or changes in tax law. Marking these dates on your calendar can help ensure timely submission.

Required Documents

To complete the Ret 001, certain documents are required. These may include:

- Income statements, such as W-2s or 1099s.

- Expense documentation, including receipts and invoices.

- Previous tax returns for reference.

- Any additional forms that may be relevant to your specific tax situation.

Having these documents ready can streamline the process of filling out the Ret 001 and help ensure accuracy.

Quick guide on how to complete ret 001

Complete Ret 001 effortlessly on any gadget

Web-based document management has become increasingly sought after by businesses and individuals alike. It serves as an ideal environmentally friendly substitute for conventional printed and signed paperwork, as you can access the appropriate format and securely keep it online. airSlate SignNow equips you with all the resources necessary to create, modify, and eSign your documents quickly without delays. Manage Ret 001 on any gadget using the airSlate SignNow Android or iOS applications and enhance any document-related procedure today.

The easiest way to modify and eSign Ret 001 with ease

- Find Ret 001 and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for this purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to finalize your changes.

- Select how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your preference. Modify and eSign Ret 001 and guarantee outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ret 001

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is ret 001 in airSlate SignNow?

Ret 001 refers to our streamlined document signing process in airSlate SignNow. It allows users to easily send and eSign documents, ensuring that transactions are completed quickly and securely. The ret 001 feature is designed to enhance user productivity and save time.

-

How much does airSlate SignNow cost for using ret 001?

The pricing for airSlate SignNow, including the ret 001 feature, is competitive and designed to fit various business needs. We offer various subscription plans that cater to individual users, small teams, and large enterprises. You can choose the plan that best suits your organization's requirements.

-

What are the key features of ret 001?

The ret 001 feature includes a user-friendly interface, support for multiple document formats, and secure eSigning capabilities. Additionally, it integrates with popular tools like Google Drive and Salesforce, making it easier for businesses to manage their documents. This ensures a seamless experience for users across different platforms.

-

How can ret 001 benefit my business?

Implementing ret 001 in your business can signNowly enhance efficiency by reducing the time spent on document management. It allows for faster approvals and reduces the likelihood of errors, ultimately leading to better customer satisfaction. With ret 001, you can ensure that your document signing processes are both quick and secure.

-

Can ret 001 integrate with other software?

Yes, ret 001 can seamlessly integrate with a variety of third-party applications, such as CRMs and cloud storage services. This integration capability allows for a more streamlined workflow, reducing the need for manual data entry. Users can easily connect their existing tools with airSlate SignNow to enhance business processes.

-

Is there a trial period available for ret 001?

Yes, airSlate SignNow offers a free trial period that allows users to experience the benefits of ret 001 firsthand. During the trial, you can explore all the features available and see how it fits your business needs. Sign up today to start using ret 001 without any commitments.

-

What security features does ret 001 offer?

Ret 001 adheres to industry-leading security protocols to ensure the safety of your documents. This includes encryption, secure storage, and compliance with regulations such as GDPR and eIDAS. You can trust that your sensitive information is protected every step of the way when using ret 001.

Get more for Ret 001

- Application certificate deposit 2015 2019 form

- Oregon form small claim 2014 2019

- Application cism 2015 2019 form

- Va form 22 5490 2014 2019

- Form hud 52517

- Imrf form 2013 2019

- Bluewater district school board offence declaration form

- Petition for reinstatement intramural sports program recreational sports form

Find out other Ret 001

- How To Electronic signature Alabama Business Operations Form

- Help Me With Electronic signature Alabama Car Dealer Presentation

- How Can I Electronic signature California Car Dealer PDF

- How Can I Electronic signature California Car Dealer Document

- How Can I Electronic signature Colorado Car Dealer Form

- How To Electronic signature Florida Car Dealer Word

- How Do I Electronic signature Florida Car Dealer Document

- Help Me With Electronic signature Florida Car Dealer Presentation

- Can I Electronic signature Georgia Car Dealer PDF

- How Do I Electronic signature Georgia Car Dealer Document

- Can I Electronic signature Georgia Car Dealer Form

- Can I Electronic signature Idaho Car Dealer Document

- How Can I Electronic signature Illinois Car Dealer Document

- How Can I Electronic signature North Carolina Banking PPT

- Can I Electronic signature Kentucky Car Dealer Document

- Can I Electronic signature Louisiana Car Dealer Form

- How Do I Electronic signature Oklahoma Banking Document

- How To Electronic signature Oklahoma Banking Word

- How Can I Electronic signature Massachusetts Car Dealer PDF

- How Can I Electronic signature Michigan Car Dealer Document