St Clair County Illinois Disabled Veteran Property Tax Exemption Form 2018

What is the St Clair County Illinois Disabled Veteran Property Tax Exemption Form

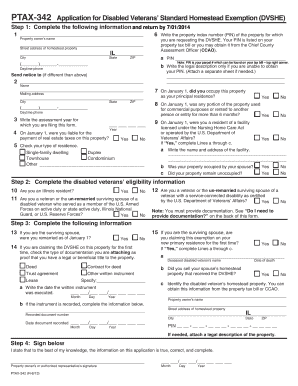

The St Clair County Illinois Disabled Veteran Property Tax Exemption Form is a legal document that allows eligible disabled veterans to apply for property tax exemptions in St Clair County. This exemption provides financial relief by reducing the property tax burden for veterans who have been honorably discharged and meet specific disability criteria. The form is essential for veterans seeking to benefit from this state-supported program, ensuring they receive the financial assistance they deserve.

Eligibility Criteria

To qualify for the St Clair County Illinois Disabled Veteran Property Tax Exemption, applicants must meet several criteria:

- Must be an honorably discharged veteran of the United States Armed Forces.

- Must have a service-connected disability as determined by the U.S. Department of Veterans Affairs.

- The property must be the primary residence of the veteran.

It is crucial for applicants to provide documentation that verifies their military service and disability status when submitting the form.

Steps to Complete the St Clair County Illinois Disabled Veteran Property Tax Exemption Form

Completing the St Clair County Illinois Disabled Veteran Property Tax Exemption Form involves several key steps:

- Download the form from the official St Clair County website or obtain a physical copy from the local assessor's office.

- Fill out the required personal information, including name, address, and military service details.

- Provide documentation of your disability status, such as a letter from the Department of Veterans Affairs.

- Review the completed form for accuracy and completeness.

- Submit the form by the specified deadline to the appropriate local government office.

Following these steps carefully can help ensure that your application is processed smoothly.

Form Submission Methods

The St Clair County Illinois Disabled Veteran Property Tax Exemption Form can be submitted through various methods:

- Online: Many counties offer electronic submission through their official websites.

- By Mail: Completed forms can be mailed to the local assessor's office.

- In-Person: Applicants may also choose to submit the form directly at the local government office.

Choosing the right submission method can help expedite the processing of your application.

Required Documents

When applying for the St Clair County Illinois Disabled Veteran Property Tax Exemption, certain documents are necessary to support your application:

- A completed property tax exemption form.

- Proof of military service, such as a DD-214 form.

- Documentation of disability from the Department of Veterans Affairs.

Ensuring that all required documents are included can prevent delays in the approval process.

Legal Use of the St Clair County Illinois Disabled Veteran Property Tax Exemption Form

The St Clair County Illinois Disabled Veteran Property Tax Exemption Form is legally binding once completed and submitted according to state regulations. It is important to ensure that all information provided is accurate and truthful. Misrepresentation or incomplete submissions can lead to penalties or denial of the exemption. Utilizing a trusted digital platform for completion and submission can enhance the legal standing of the form by ensuring compliance with eSignature regulations.

Quick guide on how to complete st clair county illinois disabled veteran property tax exemption form

Effortlessly Prepare St Clair County Illinois Disabled Veteran Property Tax Exemption Form on Any Device

Digital document management has gained popularity among businesses and individuals. It offers a perfect environmentally friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents quickly without any delays. Handle St Clair County Illinois Disabled Veteran Property Tax Exemption Form on any device using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and eSign St Clair County Illinois Disabled Veteran Property Tax Exemption Form with Ease

- Obtain St Clair County Illinois Disabled Veteran Property Tax Exemption Form and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Select important sections of the documents or redact sensitive information with tools specifically designed for this purpose by airSlate SignNow.

- Generate your electronic signature using the Sign tool, which takes only seconds and holds the same legal validity as a conventional ink signature.

- Review the details and click on the Done button to finalize your edits.

- Decide how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Leave behind lost or misplaced documents, the hassle of searching for forms, or errors that require printing new copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and eSign St Clair County Illinois Disabled Veteran Property Tax Exemption Form to ensure exceptional communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct st clair county illinois disabled veteran property tax exemption form

Create this form in 5 minutes!

How to create an eSignature for the st clair county illinois disabled veteran property tax exemption form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the St Clair County Illinois disabled veteran property tax exemption form?

The St Clair County Illinois disabled veteran property tax exemption form is a document that allows qualified veterans with disabilities to apply for a reduction in their property taxes. This exemption is designed to support veterans who have served our country and need financial relief.

-

How can I obtain the St Clair County Illinois disabled veteran property tax exemption form?

You can obtain the St Clair County Illinois disabled veteran property tax exemption form online through the St Clair County Assessor's website or in person at the local assessor's office. Ensure you have all necessary documentation ready to support your application.

-

What are the eligibility requirements for the St Clair County Illinois disabled veteran property tax exemption form?

To qualify for the St Clair County Illinois disabled veteran property tax exemption form, you must be a veteran with a service-connected disability rating of 30% or greater. Additionally, you must own the property and occupy it as your primary residence.

-

Is there a fee to file the St Clair County Illinois disabled veteran property tax exemption form?

There is no fee to file the St Clair County Illinois disabled veteran property tax exemption form. This process is designed to be accessible for veterans, ensuring that financial burdens are alleviated through tax exemptions.

-

Can I submit the St Clair County Illinois disabled veteran property tax exemption form online?

Yes, the St Clair County Illinois disabled veteran property tax exemption form can be submitted online through the official county website. This online submission makes it convenient for veterans to apply from the comfort of their homes.

-

What documents do I need to provide with the St Clair County Illinois disabled veteran property tax exemption form?

When submitting the St Clair County Illinois disabled veteran property tax exemption form, you will need to provide proof of your disability, such as a letter from the VA, as well as documents that verify your ownership of the property. Ensure all information is accurate to avoid delays.

-

How often must I renew the St Clair County Illinois disabled veteran property tax exemption form?

Veterans typically need to renew the St Clair County Illinois disabled veteran property tax exemption form annually, but it's best to check with the local assessor's office for specific requirements. Keeping your exemption up-to-date ensures you continue to receive the benefit.

Get more for St Clair County Illinois Disabled Veteran Property Tax Exemption Form

- Standard form 1113

- Marsh amp mccarthy run tmdl environmental protection agency epa form

- Meda results formpdffillercom

- Fdic legal invoice for fees and expenses form

- Flood acknowledgement form

- Oregon form deed trust

- Ag risk management conference usda farm service agency fsa usda form

- Contract data fs fed form

Find out other St Clair County Illinois Disabled Veteran Property Tax Exemption Form

- Sign South Dakota Non-Profit Business Plan Template Myself

- Sign Rhode Island Non-Profit Residential Lease Agreement Computer

- Sign South Carolina Non-Profit Promissory Note Template Mobile

- Sign South Carolina Non-Profit Lease Agreement Template Online

- Sign Oregon Life Sciences LLC Operating Agreement Online

- Sign Texas Non-Profit LLC Operating Agreement Online

- Can I Sign Colorado Orthodontists Month To Month Lease

- How Do I Sign Utah Non-Profit Warranty Deed

- Help Me With Sign Colorado Orthodontists Purchase Order Template

- Sign Virginia Non-Profit Living Will Fast

- How To Sign Virginia Non-Profit Lease Agreement Template

- How To Sign Wyoming Non-Profit Business Plan Template

- How To Sign Wyoming Non-Profit Credit Memo

- Sign Wisconsin Non-Profit Rental Lease Agreement Simple

- Sign Wisconsin Non-Profit Lease Agreement Template Safe

- Sign South Dakota Life Sciences Limited Power Of Attorney Mobile

- Sign Alaska Plumbing Moving Checklist Later

- Sign Arkansas Plumbing Business Plan Template Secure

- Sign Arizona Plumbing RFP Mobile

- Sign Arizona Plumbing Rental Application Secure