Otc 924 Form

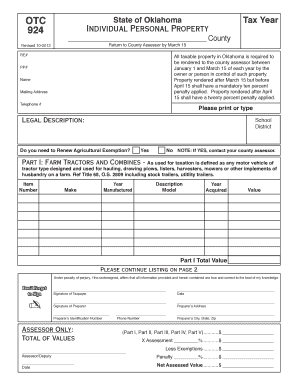

What is the OTC 924?

The OTC 924 is a specific form used in various administrative processes, often related to tax or regulatory compliance. It serves as a standardized document that individuals or businesses must complete to provide necessary information to government agencies. Understanding the purpose and requirements of the OTC 924 is essential for ensuring compliance and avoiding potential penalties.

How to Obtain the OTC 924

Obtaining the OTC 924 is a straightforward process. Typically, the form can be accessed through official government websites or authorized agencies. Individuals may also request a physical copy by contacting the relevant office directly. It is important to ensure that you are using the most current version of the form to avoid complications during submission.

Steps to Complete the OTC 924

Completing the OTC 924 requires careful attention to detail. Follow these steps to ensure accuracy:

- Review the instructions provided with the form.

- Gather all required information and documentation.

- Fill out the form completely, ensuring all fields are accurately completed.

- Double-check for any errors or omissions.

- Sign and date the form as required.

Legal Use of the OTC 924

The OTC 924 holds legal significance when completed correctly. To ensure its validity, it must adhere to relevant laws and regulations governing electronic signatures and document submissions. Utilizing a reliable eSignature solution can enhance the legal standing of the completed form, as it provides necessary authentication and compliance with standards such as ESIGN and UETA.

Key Elements of the OTC 924

Understanding the key elements of the OTC 924 is crucial for proper completion. Key components typically include:

- Identification information of the individual or entity submitting the form.

- Details regarding the purpose of the form and any relevant dates.

- Signature lines for the authorized signatory.

- Any necessary attachments or supporting documentation.

Examples of Using the OTC 924

The OTC 924 can be utilized in various scenarios, such as:

- Tax filings for individuals or businesses.

- Regulatory compliance submissions to state or federal agencies.

- Documentation for financial transactions or audits.

Form Submission Methods

Submitting the OTC 924 can be done through multiple methods, including:

- Online submission via designated government portals.

- Mailing the completed form to the appropriate agency.

- In-person delivery to local offices, if applicable.

Quick guide on how to complete otc 924

Prepare Otc 924 easily on any device

Digital document management has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute to conventional printed and signed documents, as you can access the necessary form and securely save it online. airSlate SignNow equips you with all the tools you need to create, edit, and eSign your documents swiftly without delays. Handle Otc 924 on any platform with airSlate SignNow Android or iOS applications and enhance any document-driven workflow today.

How to modify and eSign Otc 924 effortlessly

- Find Otc 924 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize relevant sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature with the Sign tool, which takes seconds and carries the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Select how you would like to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misfiled documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choice. Modify and eSign Otc 924 and ensure excellent communication at every phase of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the otc 924

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is OTC 924?

OTC 924 is a powerful electronic signature solution provided by airSlate SignNow that offers businesses a seamless way to send, sign, and manage documents online. With its user-friendly interface, OTC 924 streamlines your signing process, making it easier for you to handle paperwork efficiently.

-

How much does OTC 924 cost?

The pricing for OTC 924 is competitive and designed to fit the budget of various businesses. airSlate SignNow offers flexible plans that cater to different needs, ensuring you get the best value for your investment in electronic signing solutions.

-

What features does OTC 924 offer?

OTC 924 comes equipped with a range of features including document templates, mobile signing, and audit trails. These features enhance your document workflow, making OTC 924 an ideal choice for businesses looking to simplify their eSigning process.

-

What are the benefits of using OTC 924 for my business?

Using OTC 924 allows businesses to save time and reduce paperwork-related costs. Its electronic signature capabilities lead to faster transactions and improved customer satisfaction, making it a valuable asset for any organization.

-

Can OTC 924 integrate with other tools I already use?

Yes, OTC 924 supports integration with various popular applications, enhancing its functionality. This compatibility allows you to incorporate OTC 924 into your existing workflows seamlessly, ensuring a smoother transition to electronic signing.

-

Is OTC 924 secure for sensitive documents?

Absolutely! OTC 924 prioritizes security, employing advanced encryption methods to protect your documents. You can trust that your sensitive information is safe when you choose airSlate SignNow's OTC 924 for your eSigning needs.

-

How easy is it to get started with OTC 924?

Getting started with OTC 924 is straightforward. Users can sign up quickly, and the intuitive design makes it simple to create and send documents for signature, ensuring you can hit the ground running with minimal learning curve.

Get more for Otc 924

Find out other Otc 924

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter

- eSign Alaska High Tech Warranty Deed Computer

- eSign Alaska High Tech Lease Template Myself

- eSign Colorado High Tech Claim Computer

- eSign Idaho Healthcare / Medical Residential Lease Agreement Simple