Nebraska Pay Stub Example Form

What is the Nebraska Pay Stub Example Form

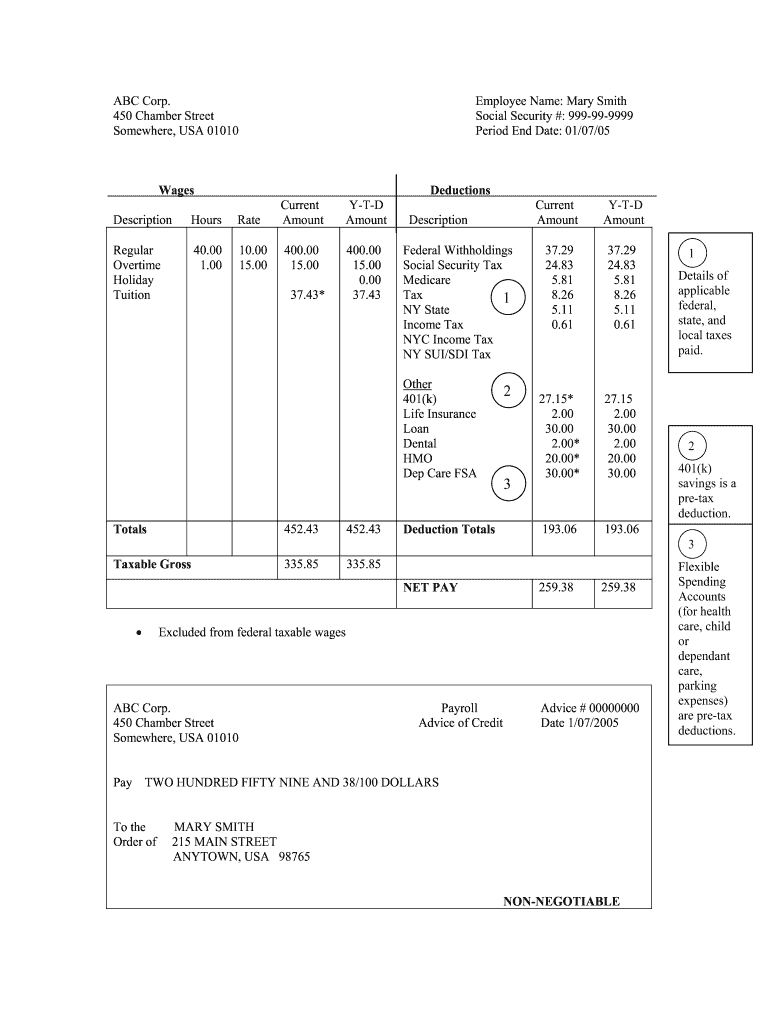

The Nebraska Pay Stub Example Form is a document that provides a detailed breakdown of an employee's earnings and deductions for a specific pay period. This form serves as a crucial tool for both employers and employees, ensuring transparency in payroll practices. It typically includes information such as gross pay, net pay, tax withholdings, and other deductions like health insurance or retirement contributions. Understanding this form is essential for employees to verify their earnings and for employers to comply with state regulations regarding payroll documentation.

How to use the Nebraska Pay Stub Example Form

Using the Nebraska Pay Stub Example Form involves several steps to ensure accurate completion and compliance. First, gather all necessary information regarding the employee's earnings and deductions for the pay period. This includes hours worked, hourly rates, and any additional bonuses or commissions. Next, fill out the form according to the structured sections, ensuring that all figures are accurate. Once completed, the form should be provided to the employee, either in printed form or electronically, to ensure they have a record of their earnings.

Key elements of the Nebraska Pay Stub Example Form

Several key elements must be included in the Nebraska Pay Stub Example Form to ensure it meets legal and practical standards. These elements typically consist of:

- Employee Information: Name, address, and identification number.

- Employer Information: Company name, address, and contact details.

- Pay Period: The specific dates for which the pay is calculated.

- Gross Pay: Total earnings before any deductions.

- Deductions: Itemized list of all deductions, including taxes and benefits.

- Net Pay: Amount the employee takes home after deductions.

Steps to complete the Nebraska Pay Stub Example Form

Completing the Nebraska Pay Stub Example Form requires careful attention to detail. Follow these steps to ensure accuracy:

- Gather all relevant payroll data, including hours worked and pay rates.

- Calculate the gross pay by multiplying the hours worked by the hourly rate.

- List all deductions, such as federal and state taxes, Social Security, and any other withholdings.

- Subtract total deductions from gross pay to determine net pay.

- Review the completed form for accuracy and clarity before distribution.

Legal use of the Nebraska Pay Stub Example Form

The Nebraska Pay Stub Example Form must adhere to specific legal requirements to be considered valid. Employers are required to provide accurate pay stubs to their employees as part of compliance with state labor laws. This form serves as proof of earnings and deductions, which can be important for tax purposes and personal financial management. Failure to provide accurate pay stubs may lead to legal repercussions for employers, including penalties and fines.

How to obtain the Nebraska Pay Stub Example Form

Obtaining the Nebraska Pay Stub Example Form can be done through various methods. Employers can create their own pay stubs using templates available online or utilize payroll software that automatically generates pay stubs for each pay period. Additionally, many accounting firms and payroll service providers offer customizable pay stub templates that comply with Nebraska regulations. It is essential to ensure that any form used meets the legal requirements specific to Nebraska.

Quick guide on how to complete nebraska pay stub example form

Finalize Nebraska Pay Stub Example Form seamlessly on any gadget

Web-based document management has become increasingly favored among enterprises and individuals. It serves as an ideal sustainable substitute for traditional printed and signed papers, as you can locate the correct form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any holdups. Handle Nebraska Pay Stub Example Form across any platform using airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

The ultimate method to modify and eSign Nebraska Pay Stub Example Form effortlessly

- Find Nebraska Pay Stub Example Form and click Get Form to begin.

- Employ the tools we provide to complete your form.

- Select important sections of the documents or obscure sensitive information using tools that airSlate SignNow supplies specifically for that function.

- Create your signature with the Sign tool, which takes moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click on the Done button to save your adjustments.

- Decide how you wish to submit your form, via email, text message (SMS), invite link, or download it to your computer.

Eliminate the hassle of lost or mislocated files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device of your choice. Modify and eSign Nebraska Pay Stub Example Form and ensure excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nebraska pay stub example form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a Nebraska Pay Stub Example Form?

A Nebraska Pay Stub Example Form is a sample document that outlines the details found on a typical pay stub in Nebraska. It includes essential information such as gross wages, deductions, and net pay. This form is useful for employers and employees for understanding pay structure and taxation.

-

How can the Nebraska Pay Stub Example Form help businesses?

The Nebraska Pay Stub Example Form assists businesses in ensuring compliance with state payroll regulations. By using this example, employers can create accurate pay stubs that meet legal requirements, reducing the risk of penalties and improving employee satisfaction. It also provides clarity in how payments are calculated.

-

Are there any costs associated with obtaining a Nebraska Pay Stub Example Form?

The Nebraska Pay Stub Example Form can be accessed for free online, but businesses may incur costs if they opt for customized templates or paid services. airSlate SignNow offers a cost-effective solution for electronically signing and managing these forms, ensuring that you always have professional, compliant documents at hand.

-

What features are included in the Nebraska Pay Stub Example Form provided by airSlate SignNow?

The Nebraska Pay Stub Example Form from airSlate SignNow comes with various features, including easy editing, eSigning capability, and sharing options. Users can customize their forms to include specific details relevant to their business. Additionally, our platform ensures that the forms are legally binding and secure.

-

How does airSlate SignNow integrate with payroll software for Nebraska Pay Stub Example Forms?

airSlate SignNow seamlessly integrates with popular payroll software to streamline the process of generating Nebraska Pay Stub Example Forms. This integration allows businesses to automate the creation of pay stubs and enhance accuracy in payroll reporting. Your payroll data syncs effortlessly, eliminating manual entry errors.

-

Can the Nebraska Pay Stub Example Form be edited once created?

Yes, the Nebraska Pay Stub Example Form can be easily edited after creation using airSlate SignNow. You can modify employee information, adjust pay rates, or update deductions as needed. This flexibility ensures that your pay stub always reflects the most accurate and up-to-date information.

-

What are the benefits of using the Nebraska Pay Stub Example Form for employees?

Using the Nebraska Pay Stub Example Form helps employees clearly understand their earnings and deductions. It empowers them to track their wages and validate that taxes are correctly withheld. By providing transparent and detailed pay stubs, employers can foster trust and improve communication with their staff.

Get more for Nebraska Pay Stub Example Form

- Njdoh facility reporting incident data and analysis yield form

- Application for health officer state of new jersey state nj form

- Kenyan death certificate sample form

- Online application form for njdot

- Form no njaps2 version 40 fillable

- Amber light permit nj form

- Ownership disclosure form state of new jersey state nj

- 2012 nj application form

Find out other Nebraska Pay Stub Example Form

- Electronic signature Kansas Plumbing Business Plan Template Secure

- Electronic signature Louisiana Plumbing Purchase Order Template Simple

- Can I Electronic signature Wyoming Legal Limited Power Of Attorney

- How Do I Electronic signature Wyoming Legal POA

- How To Electronic signature Florida Real Estate Contract

- Electronic signature Florida Real Estate NDA Secure

- Can I Electronic signature Florida Real Estate Cease And Desist Letter

- How Can I Electronic signature Hawaii Real Estate LLC Operating Agreement

- Electronic signature Georgia Real Estate Letter Of Intent Myself

- Can I Electronic signature Nevada Plumbing Agreement

- Electronic signature Illinois Real Estate Affidavit Of Heirship Easy

- How To Electronic signature Indiana Real Estate Quitclaim Deed

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure