Home Office Deduction Worksheet Form

What is the Home Office Deduction Worksheet

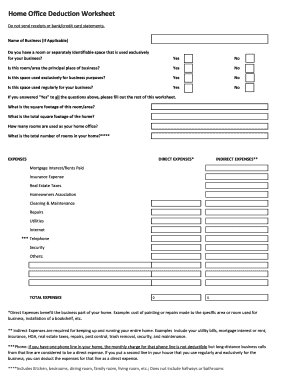

The home office deduction worksheet is a crucial tool for individuals who work from home and wish to claim deductions on their taxes. This worksheet helps taxpayers calculate the expenses associated with their home office, allowing them to determine the amount they can deduct from their taxable income. The deduction can cover various costs, including a portion of rent or mortgage interest, utilities, and home maintenance, provided that the workspace is used exclusively for business purposes.

How to use the Home Office Deduction Worksheet

Using the home office deduction worksheet involves a few straightforward steps. First, gather all relevant financial documents, such as utility bills, mortgage statements, and receipts for home office supplies. Next, identify the specific areas of your home that qualify for the deduction. This typically includes a dedicated room or a portion of a room used solely for business activities. The worksheet will guide you through entering your expenses and calculating the total deduction based on the percentage of your home used for business.

Steps to complete the Home Office Deduction Worksheet

Completing the home office deduction worksheet requires careful attention to detail. Follow these steps:

- Determine the square footage of your home office and the total square footage of your home.

- Calculate the percentage of your home that is used for business by dividing the office space by the total home space.

- List all relevant expenses, including mortgage interest, utilities, and maintenance costs.

- Multiply the total expenses by the percentage calculated earlier to find your deductible amount.

- Ensure all entries are accurate and supported by documentation.

Legal use of the Home Office Deduction Worksheet

To ensure the legal validity of the home office deduction worksheet, it is essential to follow IRS guidelines. The IRS requires that the home office be used regularly and exclusively for business purposes. Additionally, keeping detailed records of all expenses and the calculations used for the deduction is crucial. This documentation can be vital in case of an audit, as it demonstrates compliance with tax regulations.

IRS Guidelines

The IRS provides specific guidelines regarding the home office deduction. Taxpayers must meet certain criteria to qualify for the deduction, including using the space exclusively for business and regularly conducting business activities there. The IRS also outlines the types of expenses that can be deducted, emphasizing the importance of accurate record-keeping. Understanding these guidelines helps taxpayers maximize their deductions while remaining compliant with tax laws.

Eligibility Criteria

Eligibility for the home office deduction depends on several factors. Taxpayers must have a designated space in their home that is used exclusively for business activities. This can include a separate room or a specific area within a larger room. Additionally, the taxpayer must be self-employed or a qualifying employee who uses the home office for business purposes. Meeting these criteria is essential for claiming the deduction successfully.

Required Documents

To complete the home office deduction worksheet accurately, several documents are necessary. These include:

- Mortgage statements or rental agreements to verify housing costs.

- Utility bills to substantiate expenses related to electricity, water, and internet.

- Receipts for office supplies and any other relevant business expenses.

- Documentation proving the exclusive use of the space for business purposes.

Quick guide on how to complete home office deduction worksheet

Complete Home Office Deduction Worksheet effortlessly on any gadget

Digital document management has become increasingly popular among companies and individuals. It offers a perfect eco-friendly solution to conventional printed and signed papers, as you can easily locate the correct form and securely store it online. airSlate SignNow provides all the features you require to create, alter, and eSign your documents quickly without delays. Manage Home Office Deduction Worksheet on any gadget with airSlate SignNow Android or iOS applications and enhance any document-related task today.

How to modify and eSign Home Office Deduction Worksheet without any hassle

- Find Home Office Deduction Worksheet and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Verify all the details and click on the Done button to save your changes.

- Choose how you wish to deliver your form, via email, text message (SMS), or invite link, or download it to your computer.

Forget about lost or mislaid documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Edit and eSign Home Office Deduction Worksheet and ensure exceptional communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the home office deduction worksheet

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a home office deduction worksheet?

A home office deduction worksheet is a tool that helps you calculate the amount of your home business expenses that can be deducted on your taxes. By accurately filling out this worksheet, you can ensure you are claiming all eligible deductions, maximizing your tax savings while working from home.

-

How can airSlate SignNow help with my home office deduction worksheet?

AirSlate SignNow offers features that simplify the process of managing your documents, including your home office deduction worksheet. You can easily create, edit, and sign documents electronically, ensuring that your deduction paperwork is organized and accessible whenever you need it.

-

Is there a cost associated with using the home office deduction worksheet feature?

Using the home office deduction worksheet through airSlate SignNow is part of our subscription services, which are designed to be cost-effective for businesses of all sizes. We offer various pricing plans to fit your budget while providing essential tools for managing your documents electronically.

-

What features are included in the airSlate SignNow home office deduction worksheet?

The airSlate SignNow home office deduction worksheet includes essential features like eSignature capabilities, document templates, and easy sharing options. These features make it easy to manage your deduction worksheets and ensure that all your documents are securely stored and accessible.

-

Can I integrate the home office deduction worksheet with other tools?

Yes, airSlate SignNow allows for seamless integration with various applications and platforms. This means you can connect your home office deduction worksheet with accounting software and other tools to streamline your tax preparation process and maintain organized records.

-

What benefits does using airSlate SignNow provide for managing my home office deduction worksheet?

Using airSlate SignNow to manage your home office deduction worksheet provides efficiency, security, and ease of access. With our user-friendly interface, you can quickly fill out and submit your deduction worksheet, ensuring that all your financial documents are secure and in one place.

-

Is there customer support available for help with my home office deduction worksheet?

Absolutely! AirSlate SignNow offers dedicated customer support to assist you with any questions regarding your home office deduction worksheet. Whether you need help with features or troubleshooting, our team is here to provide guidance and ensure a smooth experience.

Get more for Home Office Deduction Worksheet

Find out other Home Office Deduction Worksheet

- Help Me With eSign Ohio Product Defect Notice

- eSign Mississippi Sponsorship Agreement Free

- eSign North Dakota Copyright License Agreement Free

- How Do I eSign Idaho Medical Records Release

- Can I eSign Alaska Advance Healthcare Directive

- eSign Kansas Client and Developer Agreement Easy

- eSign Montana Domain Name Registration Agreement Now

- eSign Nevada Affiliate Program Agreement Secure

- eSign Arizona Engineering Proposal Template Later

- eSign Connecticut Proforma Invoice Template Online

- eSign Florida Proforma Invoice Template Free

- Can I eSign Florida Proforma Invoice Template

- eSign New Jersey Proforma Invoice Template Online

- eSign Wisconsin Proforma Invoice Template Online

- eSign Wyoming Proforma Invoice Template Free

- eSign Wyoming Proforma Invoice Template Simple

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement