Form 709

What is the Form 709

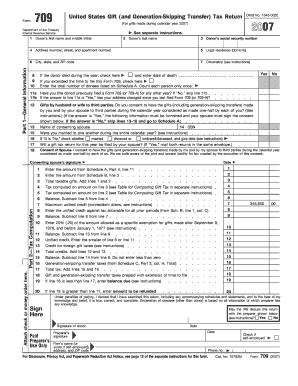

The Form 709, also known as the United States Gift (and Generation-Skipping Transfer) Tax Return, is a tax document required by the Internal Revenue Service (IRS) for reporting gifts made during the tax year. This form is essential for individuals who exceed the annual exclusion limit for gifts, which is set by the IRS. The form helps track the lifetime gift tax exemption and ensures compliance with federal tax regulations. It is particularly relevant for individuals who wish to transfer wealth to others while understanding the tax implications associated with such transfers.

How to use the Form 709

Using the Form 709 involves several steps to ensure accurate reporting of gifts. First, gather all necessary information about the gifts made, including the recipient's details and the value of each gift. Next, complete the form by providing details such as the donor's information, the total value of gifts, and any applicable deductions. It is important to review the instructions provided by the IRS carefully to ensure all sections are filled out correctly. Once completed, the form must be filed with the IRS by the due date, typically April 15 of the year following the gift.

Steps to complete the Form 709

Completing the Form 709 requires attention to detail and adherence to IRS guidelines. Follow these steps:

- Gather Information: Collect all relevant data regarding the gifts made, including dates, values, and recipient information.

- Fill Out the Form: Begin by entering your personal information as the donor. Then, list each gift and its value in the appropriate sections.

- Calculate Deductions: Identify any deductions for gifts that qualify under IRS rules, such as gifts to spouses or charitable donations.

- Review and Verify: Double-check all entries for accuracy. Ensure that all required fields are completed and that calculations are correct.

- Submit the Form: File the completed Form 709 with the IRS by the deadline, either electronically or via mail.

Legal use of the Form 709

The legal use of Form 709 is crucial for compliance with U.S. tax laws. Filing this form is mandatory for individuals who exceed the annual gift tax exclusion amount. Failure to file can result in penalties, including interest on unpaid taxes. The form serves as a record of the gifts made and helps establish the donor's lifetime gift tax exemption. It is important to use the form correctly to avoid legal issues and ensure that all gifts are reported accurately to the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing and filing Form 709. These guidelines include information on eligibility, the types of gifts that must be reported, and the deadlines for submission. It is essential to refer to the latest IRS publications and instructions to stay updated on any changes in tax laws or filing requirements. Understanding these guidelines helps ensure that the form is completed correctly and submitted on time, minimizing the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for Form 709 are critical for compliance. Generally, the form must be filed by April 15 of the year following the year in which the gifts were made. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. It is advisable to keep track of these important dates to avoid late filing penalties. Additionally, if an extension is needed, Form 4868 can be filed to request additional time, although this does not extend the payment deadline for any taxes owed.

Quick guide on how to complete form 709 1655241

Effortlessly Prepare Form 709 on Any Device

Managing documents online has become increasingly favored by both businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the correct form and securely keep it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your paperwork quickly without delays. Handle Form 709 on any platform using airSlate SignNow's Android or iOS apps and enhance any document-based workflow today.

How to Modify and eSign Form 709 with Ease

- Locate Form 709 and click on Get Form to begin.

- Utilize the features we provide to fill out your document.

- Emphasize key sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature with the Sign tool, which takes mere seconds and carries the same legal authority as a conventional wet ink signature.

- Review the details and click the Done button to save your modifications.

- Choose your preferred method to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Forget about lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Edit and eSign Form 709 and ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 1655241

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Form 709 and when do I need to file it?

Form 709 is the United States Gift (and Generation-Skipping Transfer) Tax Return, used to report gifts exceeding the annual exclusion limit. You need to file Form 709 if you've given gifts above this limit to any individual during the tax year. It’s crucial to ensure compliance and avoid potential penalties, especially if you plan to use eSignature solutions like airSlate SignNow.

-

How can airSlate SignNow help me with Form 709?

airSlate SignNow simplifies the process of completing and sending Form 709 by offering user-friendly tools for electronic signatures. It ensures that your Form 709 is securely signed and easily shared with relevant parties without the hassle of physical paperwork. This streamlines the management of tax documents and keeps them organized.

-

Is airSlate SignNow compliant with IRS regulations for Form 709?

Yes, airSlate SignNow is compliant with IRS regulations for electronic signatures on tax documents, including Form 709. This means you can confidently use our platform to get your Form 709 signed, knowing that it's legally recognized and secure. Our commitment to compliance ensures that your sensitive information remains protected.

-

What features does airSlate SignNow offer for managing Form 709?

airSlate SignNow offers a range of features for managing Form 709, including customizable templates, real-time tracking, and secure storage. You can easily edit your Form 709, add signers, and send reminders to ensure timely submission. These tools help streamline the process of filing your gift tax return.

-

What are the pricing options for using airSlate SignNow for Form 709?

airSlate SignNow offers various pricing options depending on your business needs, including a free trial for new users. Plans are competitively priced to provide value for both individuals and businesses needing to manage Form 709 and other documents. Check our website for detailed pricing information and subscription plans.

-

Can I integrate airSlate SignNow with other software for handling Form 709?

Yes, airSlate SignNow offers seamless integrations with various software platforms that can assist in handling Form 709, including CRM and accounting tools. This connectivity enhances your workflow by allowing easy data transfers and management. Integrating airSlate SignNow ensures a more efficient process from gift tracking to filing.

-

What are the benefits of using airSlate SignNow for my Form 709 submissions?

Using airSlate SignNow for your Form 709 submissions offers several benefits, such as improved efficiency, reduced paperwork, and enhanced security for sensitive tax information. The platform's easy-to-use interface allows you to complete your signed forms quickly. Additionally, airSlate SignNow's tracking features keep you informed about the status of your submissions.

Get more for Form 709

Find out other Form 709

- Electronic signature Insurance Document Kentucky Myself

- Electronic signature Delaware High Tech Quitclaim Deed Online

- Electronic signature Maine Insurance Quitclaim Deed Later

- Electronic signature Louisiana Insurance LLC Operating Agreement Easy

- Electronic signature West Virginia Education Contract Safe

- Help Me With Electronic signature West Virginia Education Business Letter Template

- Electronic signature West Virginia Education Cease And Desist Letter Easy

- Electronic signature Missouri Insurance Stock Certificate Free

- Electronic signature Idaho High Tech Profit And Loss Statement Computer

- How Do I Electronic signature Nevada Insurance Executive Summary Template

- Electronic signature Wisconsin Education POA Free

- Electronic signature Wyoming Education Moving Checklist Secure

- Electronic signature North Carolina Insurance Profit And Loss Statement Secure

- Help Me With Electronic signature Oklahoma Insurance Contract

- Electronic signature Pennsylvania Insurance Letter Of Intent Later

- Electronic signature Pennsylvania Insurance Quitclaim Deed Now

- Electronic signature Maine High Tech Living Will Later

- Electronic signature Maine High Tech Quitclaim Deed Online

- Can I Electronic signature Maryland High Tech RFP

- Electronic signature Vermont Insurance Arbitration Agreement Safe