8283 Supplemental Statement Form

What is the 8283 Supplemental Statement

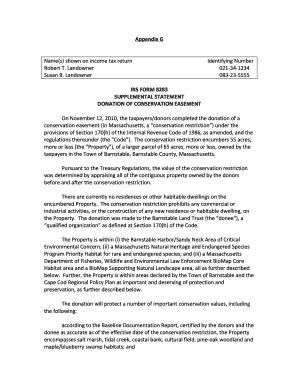

The IRS Form 8283 Supplemental Statement is a crucial document for taxpayers who are claiming deductions for non-cash charitable contributions. This form provides detailed information about the donated property, including its description, fair market value, and the method used to determine that value. It is essential for ensuring compliance with IRS regulations when reporting these deductions on your tax return. The supplemental statement is typically used in conjunction with the main Form 8283, which outlines the overall contributions made during the tax year.

Steps to complete the 8283 Supplemental Statement

Completing the IRS Form 8283 Supplemental Statement involves several important steps to ensure accuracy and compliance. Here is a simplified process:

- Gather information about the donated property, including its description and fair market value.

- Determine the method used to assess the fair market value, such as appraisal or comparable sales.

- Fill out the required sections of the supplemental statement, ensuring all details are accurate.

- Sign and date the form, as your signature verifies the information provided.

- Attach the completed supplemental statement to your main Form 8283 when filing your tax return.

Legal use of the 8283 Supplemental Statement

The legal use of the IRS Form 8283 Supplemental Statement is governed by specific IRS guidelines. To be valid, the form must be completed accurately and submitted with your tax return. Failure to provide the supplemental statement when required can result in disallowed deductions and potential penalties. It is important to ensure that all information is truthful and substantiated, as the IRS may request additional documentation to verify the claimed deductions.

Key elements of the 8283 Supplemental Statement

Several key elements must be included in the IRS Form 8283 Supplemental Statement to ensure it meets IRS requirements. These elements include:

- Description of the property: A clear and detailed description of the donated item or items.

- Fair market value: The value of the property at the time of donation, which must be substantiated.

- Method of valuation: An explanation of how the fair market value was determined, including any appraisals.

- Donor's signature: A signature from the donor affirming the accuracy of the information provided.

How to obtain the 8283 Supplemental Statement

Taxpayers can obtain the IRS Form 8283 Supplemental Statement directly from the IRS website or through tax preparation software that includes IRS forms. It is essential to ensure that you are using the most current version of the form to comply with any changes in IRS regulations. Additionally, tax professionals can provide assistance in acquiring and completing the form accurately.

Filing Deadlines / Important Dates

The filing deadlines for the IRS Form 8283 Supplemental Statement align with the overall tax return deadlines. Generally, individual taxpayers must file their tax returns by April 15th of each year. If you require an extension, it is important to note that the supplemental statement must still be submitted by the extended deadline. Keeping track of these dates is crucial for ensuring compliance and avoiding penalties.

Quick guide on how to complete 8283 supplemental statement

Complete 8283 Supplemental Statement effortlessly on any device

Digital document management has gained traction among companies and individuals alike. It offers an ideal eco-friendly substitute to conventional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without hassles. Manage 8283 Supplemental Statement on any device using the airSlate SignNow Android or iOS applications and enhance any document-based task today.

How to modify and eSign 8283 Supplemental Statement easily

- Locate 8283 Supplemental Statement and click on Get Form to begin.

- Use the tools we provide to finalize your document.

- Highlight pertinent sections of your documents or obscure sensitive data with tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes just seconds and bears the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Choose your preferred method for sending your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious searches for forms, or mistakes that require printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device of your choice. Modify and eSign 8283 Supplemental Statement and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8283 supplemental statement

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the purpose of the IRS Form 8283 Supplemental Statement?

The IRS Form 8283 Supplemental Statement is used to provide additional information about noncash charitable contributions. This form ensures that taxpayers can adequately report their donations on their tax returns, particularly when the value exceeds $500. Utilizing airSlate SignNow can simplify the process of completing this form and securing necessary signatures.

-

How can airSlate SignNow help with IRS Form 8283 Supplemental Statement submissions?

airSlate SignNow allows you to easily create, send, and eSign documents, including the IRS Form 8283 Supplemental Statement. Our platform streamlines the documentation process, making it straightforward for businesses and individuals to get the necessary signatures. This efficiency helps ensure timely and accurate submissions to the IRS.

-

Is there a cost associated with using airSlate SignNow for the IRS Form 8283 Supplemental Statement?

Yes, airSlate SignNow offers a range of pricing plans that cater to various business needs. The cost is competitive, providing a cost-effective solution for managing documents like the IRS Form 8283 Supplemental Statement. Each plan includes features that enhance efficiency and ease of use.

-

What features does airSlate SignNow offer for tax forms like the IRS Form 8283 Supplemental Statement?

airSlate SignNow boasts features such as customizable templates, secure eSignatures, and automated workflows. These features make it easier to prepare and finalize important forms, including the IRS Form 8283 Supplemental Statement. Our user-friendly interface ensures that the process is seamless and efficient.

-

Can I integrate airSlate SignNow with other software for IRS Form 8283 Supplemental Statement management?

Absolutely! airSlate SignNow integrates with multiple applications, including CRMs and cloud storage solutions. This integration capability allows for a smoother workflow when managing documents like the IRS Form 8283 Supplemental Statement, enhancing overall productivity.

-

What benefits does eSigning offer for IRS Form 8283 Supplemental Statement?

eSigning the IRS Form 8283 Supplemental Statement provides reassurance that all parties have reviewed and accepted the document. It also speeds up the process compared to traditional signatures, reducing delays in tax reporting. With airSlate SignNow, you can ensure that this form is signed quickly and securely.

-

How secure is my information when using airSlate SignNow for IRS Form 8283 Supplemental Statement?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and security measures to safeguard your information while completing forms like the IRS Form 8283 Supplemental Statement. Trust our solution to keep your sensitive data protected throughout the signing process.

Get more for 8283 Supplemental Statement

- 24 h on claim form

- Homeschool declaration of intent sultan school district form

- Continuing education credit hours clock hours proteach www test ospi k12 wa form

- Www eisd orgcmslibcountywide polling place voting area address city and zip form

- Www governmentjobs comcareerselpasojob opportunitiescity of el paso careers governmentjobs form

- Nonprofitlight comakbethelassociation of village council presidentsnon profit data form

- Health care administration cpc based comp exam summary form

- Instructions for completing a tfi universal walkthrough pre form

Find out other 8283 Supplemental Statement

- How To Electronic signature Missouri Insurance Form

- How Can I Electronic signature New Jersey Insurance Document

- How To Electronic signature Indiana High Tech Document

- How Do I Electronic signature Indiana High Tech Document

- How Can I Electronic signature Ohio Insurance Document

- Can I Electronic signature South Dakota Insurance PPT

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word