Form 480 20 2017-2026

What is the Form 480 20

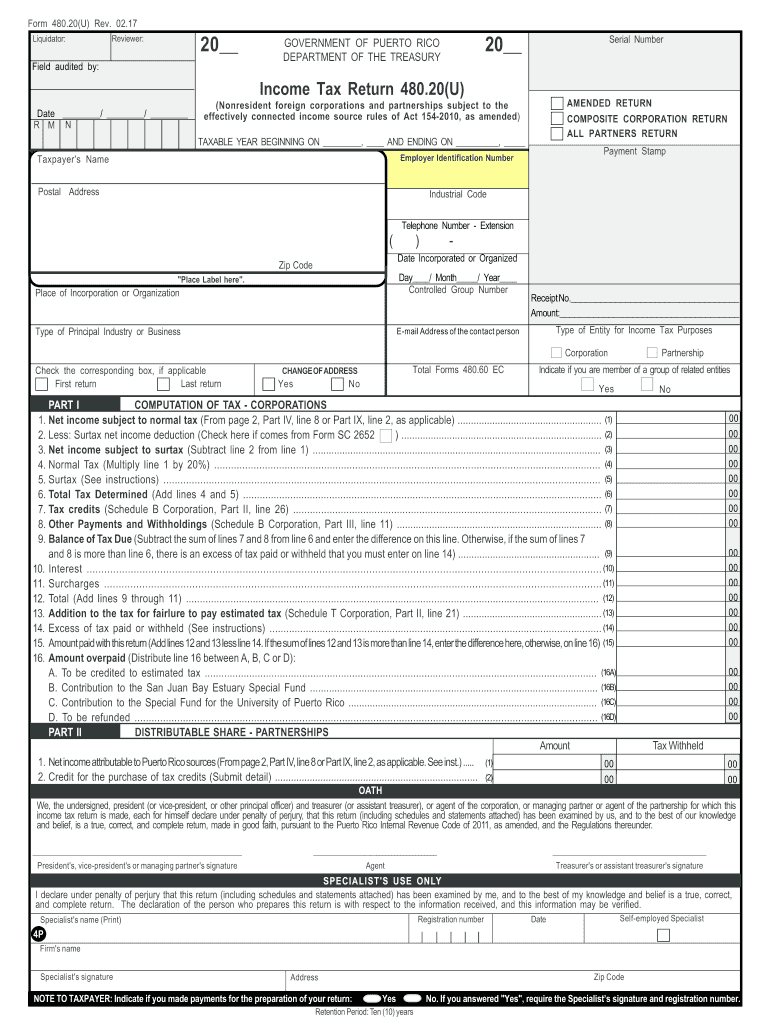

The Form 480 20 is a specific document used in the United States, primarily for tax reporting purposes. It is essential for businesses and individuals who need to report certain types of income or transactions. This form is often associated with the Puerto Rico Department of the Treasury and is vital for ensuring compliance with local tax regulations. Understanding its purpose and requirements is crucial for accurate tax reporting and avoiding potential penalties.

How to use the Form 480 20

Using the Form 480 20 involves several steps to ensure that all required information is accurately reported. First, gather all necessary documentation related to the income or transactions being reported. This may include financial statements, invoices, or other relevant records. Next, carefully fill out the form, ensuring that all sections are completed according to the instructions provided. Once the form is filled out, it must be submitted to the appropriate tax authority by the specified deadline to ensure compliance.

Steps to complete the Form 480 20

Completing the Form 480 20 requires a systematic approach to ensure accuracy and compliance. Follow these steps:

- Review the form's instructions to understand the required information.

- Gather all relevant financial documents and records.

- Fill out the form, ensuring that each section is completed accurately.

- Double-check all entries for accuracy and completeness.

- Submit the completed form to the appropriate tax authority by the deadline.

Legal use of the Form 480 20

The legal use of the Form 480 20 is governed by tax regulations in the United States, particularly in Puerto Rico. To be considered valid, the form must be completed accurately and submitted on time. Failure to comply with these regulations can result in penalties, including fines or additional taxes owed. It is important to understand the legal implications of using this form to ensure that all reporting is done correctly and in accordance with the law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 480 20 are critical for compliance. Typically, the form must be submitted by a specific date each year, which is usually aligned with the tax filing season. It is essential to keep track of these dates to avoid late submissions, which could result in penalties. Always refer to the official guidelines for the most accurate and up-to-date information regarding filing deadlines.

Key elements of the Form 480 20

The Form 480 20 includes several key elements that must be accurately reported. These elements typically include:

- Taxpayer identification information.

- Details of the income or transactions being reported.

- Any applicable deductions or credits.

- Signature and date to validate the submission.

Ensuring that each of these elements is accurately completed is essential for the form's validity and compliance with tax regulations.

Quick guide on how to complete form 480 20

Manage Form 480 20 seamlessly on any gadget

Digital document administration has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can locate the appropriate template and securely archive it online. airSlate SignNow equips you with all the necessary tools to create, edit, and electronically sign your documents swiftly without delays. Handle Form 480 20 on any device with airSlate SignNow's Android or iOS applications and streamline any document-related task today.

How to edit and electronically sign Form 480 20 effortlessly

- Obtain Form 480 20 and click on Get Form to begin.

- Utilize the features we offer to complete your document.

- Emphasize crucial sections of your files or redact sensitive information using tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to store your changes.

- Select your preferred delivery method for the document, whether by email, SMS, invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, cumbersome form navigation, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you choose. Edit and electronically sign Form 480 20 and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 480 20

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is form 480 20 and how can airSlate SignNow assist with it?

Form 480 20 is a document used for income tax reporting in Puerto Rico. airSlate SignNow simplifies the process of sending and eSigning this form, ensuring that your important tax documents are handled efficiently and securely. With features like customizable templates, it allows you to streamline the preparation of form 480 20.

-

Is airSlate SignNow a cost-effective choice for handling form 480 20?

Yes, airSlate SignNow offers a cost-effective solution for businesses looking to manage form 480 20. It provides flexible pricing plans that cater to different business needs, making it an affordable choice for eSigning and document management. You can easily evaluate its pricing to see how it fits your budget.

-

What features does airSlate SignNow offer for form 480 20?

airSlate SignNow provides various features, such as customizable templates, automated workflows, and mobile access, specifically designed to streamline the eSigning process for form 480 20. Additionally, it ensures compliance with legal standards, giving you peace of mind when handling sensitive documents. These features enhance productivity and reduce turnaround time.

-

Can I integrate airSlate SignNow with other tools for managing form 480 20?

Absolutely! airSlate SignNow offers integrations with various applications and platforms, allowing you to seamlessly manage form 480 20 alongside your existing business tools. This means you can connect it with CRM systems, cloud storage, and more, enhancing your workflow and document management capabilities.

-

How secure is airSlate SignNow when handling form 480 20?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption protocols and complies with industry standards to ensure that your form 480 20 and other sensitive documents are securely handled. You can trust that your data is protected while utilizing the eSigning features.

-

Can airSlate SignNow help with tracking the status of form 480 20?

Yes, airSlate SignNow includes tracking features that allow you to monitor the status of your form 480 20 throughout the signing process. You will receive notifications when the document is viewed, signed, or completed, enabling you to stay updated and make timely decisions regarding your document management.

-

What benefits can I expect when using airSlate SignNow for form 480 20?

Using airSlate SignNow for form 480 20 offers numerous benefits, including improved efficiency, reduced processing time, and enhanced accuracy in document handling. Additionally, the easy-to-use interface allows team members to quickly adopt the eSigning process, leading to a smoother operation and increased productivity.

Get more for Form 480 20

Find out other Form 480 20

- Electronic signature South Carolina Partnership agreements Online

- How Can I Electronic signature Florida Rental house lease agreement

- How Can I Electronic signature Texas Rental house lease agreement

- eSignature Alabama Trademark License Agreement Secure

- Electronic signature Maryland Rental agreement lease Myself

- How To Electronic signature Kentucky Rental lease agreement

- Can I Electronic signature New Hampshire Rental lease agreement forms

- Can I Electronic signature New Mexico Rental lease agreement forms

- How Can I Electronic signature Minnesota Rental lease agreement

- Electronic signature Arkansas Rental lease agreement template Computer

- Can I Electronic signature Mississippi Rental lease agreement

- Can I Electronic signature Missouri Rental lease contract

- Electronic signature New Jersey Rental lease agreement template Free

- Electronic signature New Jersey Rental lease agreement template Secure

- Electronic signature Vermont Rental lease agreement Mobile

- Electronic signature Maine Residential lease agreement Online

- Electronic signature Minnesota Residential lease agreement Easy

- Electronic signature Wyoming Rental lease agreement template Simple

- Electronic signature Rhode Island Residential lease agreement Online

- Electronic signature Florida Rental property lease agreement Free