Estimated Vouchers Form

What is the Estimated Vouchers Form

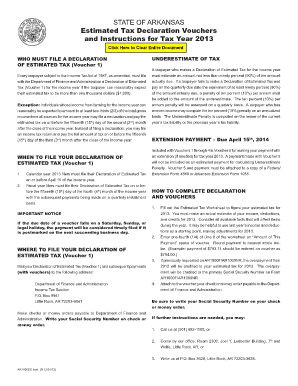

The Estimated Vouchers Form is a crucial document used primarily for tax purposes in the United States. It allows individuals and businesses to report and pay estimated taxes on income that is not subject to withholding. This form is essential for taxpayers who expect to owe tax of one thousand dollars or more when they file their tax return. By submitting this form, taxpayers can avoid penalties and interest that may arise from underpayment of taxes throughout the year.

How to use the Estimated Vouchers Form

Using the Estimated Vouchers Form involves several straightforward steps. First, gather your financial information, including expected income and deductions. Next, calculate your estimated tax liability based on your income projections. Once you have this information, fill out the form accurately, ensuring all required fields are completed. After completing the form, you can submit it online, by mail, or in person, depending on your preference and the guidelines provided by the IRS.

Steps to complete the Estimated Vouchers Form

Completing the Estimated Vouchers Form requires careful attention to detail. Follow these steps for a smooth process:

- Gather necessary documents, including previous tax returns and income statements.

- Calculate your estimated income for the year, considering all sources of revenue.

- Determine your deductions and credits to arrive at your estimated tax liability.

- Fill out the form, ensuring accuracy in all calculations and personal information.

- Review the completed form for any errors or omissions.

- Submit the form according to the preferred method, ensuring it is sent by the deadline.

Legal use of the Estimated Vouchers Form

The Estimated Vouchers Form is legally binding when filled out and submitted correctly. To ensure its legal standing, it must comply with IRS regulations regarding estimated tax payments. This includes accurate calculations and timely submissions. Failure to adhere to these guidelines can result in penalties or interest charges. Therefore, understanding the legal implications of using this form is essential for all taxpayers.

Filing Deadlines / Important Dates

Filing deadlines for the Estimated Vouchers Form are critical to avoid penalties. Generally, estimated tax payments are due quarterly, with specific deadlines falling on the fifteenth day of April, June, September, and January of the following year. Taxpayers should mark these dates on their calendars to ensure timely submissions and avoid any potential late fees.

Required Documents

To complete the Estimated Vouchers Form accurately, certain documents are required. These include:

- Previous year’s tax return for reference.

- Income statements, such as W-2s or 1099s.

- Documentation of any deductions or credits you plan to claim.

- Any relevant financial statements that reflect your current income situation.

Examples of using the Estimated Vouchers Form

There are various scenarios in which the Estimated Vouchers Form is utilized. For instance, self-employed individuals often use this form to report their income and pay estimated taxes throughout the year. Similarly, investors who earn dividends or capital gains may need to submit this form to account for taxes owed on their earnings. Understanding these examples can help taxpayers recognize the importance of timely and accurate submissions.

Quick guide on how to complete estimated vouchers form

Easily Prepare Estimated Vouchers Form on Any Device

Digital document organization has gained traction among businesses and individuals alike. It offers an ideal environmentally-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow equips you with all the features required to produce, modify, and eSign your documents quickly without any delays. Manage Estimated Vouchers Form from any device using airSlate SignNow's Android or iOS applications and streamline your document-related processes today.

The Optimal Method to Modify and eSign Estimated Vouchers Form Effortlessly

- Obtain Estimated Vouchers Form and click on Get Form to commence.

- Utilize the tools provided to complete your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with the tools that airSlate SignNow offers specifically for this purpose.

- Create your eSignature using the Sign tool, which takes merely seconds and carries the same legal significance as a conventional pen-and-ink signature.

- Review the details and click on the Done button to finalize your changes.

- Select your preferred method of delivering your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document copies. airSlate SignNow fulfills your document management needs in just a few clicks from your chosen device. Modify and eSign Estimated Vouchers Form to ensure effective communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the estimated vouchers form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Estimated Vouchers Form in airSlate SignNow?

The Estimated Vouchers Form in airSlate SignNow is a customizable document that allows businesses to efficiently collect, validate, and store voucher information. This form simplifies the process of managing estimated vouchers, ensuring accuracy and compliance with company standards.

-

How can I create an Estimated Vouchers Form using airSlate SignNow?

Creating an Estimated Vouchers Form is simple with airSlate SignNow. You can use our user-friendly drag-and-drop editor to customize fields, add your branding, and incorporate eSignature options to streamline your workflow. Once designed, you can share the form directly with recipients via email or link.

-

What are the benefits of using the Estimated Vouchers Form?

Using the Estimated Vouchers Form helps to enhance efficiency by reducing manual errors and speeding up the data collection process. The form's integration with eSigning allows for quicker approval times, which can lead to better financial planning and cash flow management for businesses.

-

Is the Estimated Vouchers Form secure?

Yes, airSlate SignNow prioritizes your data security. The Estimated Vouchers Form is protected with advanced encryption methods and complies with industry standards, ensuring your information remains confidential and safe from unauthorized access.

-

What integrations are available with the Estimated Vouchers Form?

airSlate SignNow offers various integrations that enhance the functionality of the Estimated Vouchers Form. You can seamlessly connect with popular apps like Google Drive, Salesforce, and Microsoft Office, allowing for streamlined workflows and easy access to your documents.

-

Can I track the status of my Estimated Vouchers Form submissions?

Absolutely! airSlate SignNow provides real-time tracking for your Estimated Vouchers Form submissions. You can easily monitor who has opened, filled out, and signed the form, ensuring you stay informed throughout the entire process.

-

What is the pricing structure for using the Estimated Vouchers Form?

airSlate SignNow offers a flexible pricing structure designed to accommodate various business needs. Pricing for using the Estimated Vouchers Form depends on the chosen plan, with options for small businesses to larger enterprises, ensuring you find the right fit for your budget.

Get more for Estimated Vouchers Form

- Travel state govcontenttraveldna relationship testing procedures travel form

- Application for enrollment mille lacs mlbo dev form

- Thinking report examples form

- Standard handyman contract template form

- Standard loan contract template form

- Standard for service contract template form

- Standard occupation contract template form

- Standard model contract template form

Find out other Estimated Vouchers Form

- Electronic signature Massachusetts Legal Quitclaim Deed Easy

- Electronic signature Minnesota Legal LLC Operating Agreement Free

- Electronic signature Minnesota Legal LLC Operating Agreement Secure

- Electronic signature Louisiana Life Sciences LLC Operating Agreement Now

- Electronic signature Oregon Non-Profit POA Free

- Electronic signature South Dakota Non-Profit Business Plan Template Now

- Electronic signature South Dakota Non-Profit Lease Agreement Template Online

- Electronic signature Legal Document Missouri Online

- Electronic signature Missouri Legal Claim Online

- Can I Electronic signature Texas Non-Profit Permission Slip

- Electronic signature Missouri Legal Rental Lease Agreement Simple

- Electronic signature Utah Non-Profit Cease And Desist Letter Fast

- Electronic signature Missouri Legal Lease Agreement Template Free

- Electronic signature Non-Profit PDF Vermont Online

- Electronic signature Non-Profit PDF Vermont Computer

- Electronic signature Missouri Legal Medical History Mobile

- Help Me With Electronic signature West Virginia Non-Profit Business Plan Template

- Electronic signature Nebraska Legal Living Will Simple

- Electronic signature Nevada Legal Contract Safe

- How Can I Electronic signature Nevada Legal Operating Agreement