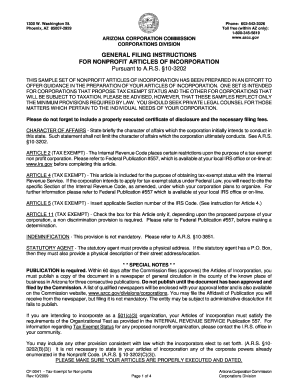

Tax Exempt Cf0041 Form

What is the Tax Exempt Cf0041 Form

The Tax Exempt Cf0041 Form is a document used in the United States to establish tax-exempt status for certain organizations. This form is typically utilized by non-profit entities, educational institutions, and other qualifying organizations seeking exemption from federal income tax. By completing this form, organizations can formally request recognition of their tax-exempt status, allowing them to operate without the burden of federal taxes.

How to use the Tax Exempt Cf0041 Form

Using the Tax Exempt Cf0041 Form involves several key steps. First, ensure that your organization meets the eligibility criteria for tax exemption. Next, gather all necessary information and documentation required for the form. This includes details about your organization’s structure, purpose, and financial information. Once the form is completed, it should be submitted to the appropriate tax authority for review. Proper usage of this form can lead to significant financial benefits for qualifying organizations.

Steps to complete the Tax Exempt Cf0041 Form

Completing the Tax Exempt Cf0041 Form requires careful attention to detail. Follow these steps for successful completion:

- Gather necessary documentation, including your organization’s bylaws and financial statements.

- Fill out the form accurately, providing all required information about your organization.

- Review the completed form to ensure all sections are filled out correctly.

- Submit the form to the appropriate tax authority, either online or via mail.

Taking these steps helps ensure that your application for tax-exempt status is processed smoothly.

Legal use of the Tax Exempt Cf0041 Form

The Tax Exempt Cf0041 Form holds legal significance as it serves as an official request for tax exemption. When properly completed and submitted, it can protect organizations from federal income taxes. It is essential that the information provided is accurate and truthful, as any discrepancies can result in legal consequences or denial of tax-exempt status. Organizations must adhere to all relevant laws and regulations to maintain their tax-exempt status.

Key elements of the Tax Exempt Cf0041 Form

Several key elements are crucial to the Tax Exempt Cf0041 Form:

- Organization Information: This section requires basic details about the organization, including its name, address, and purpose.

- Financial Information: Organizations must provide financial data, including income and expenses, to demonstrate their non-profit status.

- Governing Documents: Bylaws and articles of incorporation must be included to support the application.

- Signature: The form must be signed by an authorized representative of the organization to validate the submission.

Filing Deadlines / Important Dates

Filing deadlines for the Tax Exempt Cf0041 Form can vary based on the organization’s fiscal year and the specific requirements set by the IRS. It is important to be aware of these deadlines to avoid penalties or delays in processing. Generally, organizations should submit their application as early as possible to ensure compliance with tax regulations and to secure their tax-exempt status in a timely manner.

Quick guide on how to complete tax exempt cf0041 form 10990360

Complete Tax Exempt Cf0041 Form effortlessly on any gadget

Online document management has become increasingly favored by companies and individuals alike. It offers an exceptional environmentally-friendly substitute for traditional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Manage Tax Exempt Cf0041 Form on any gadget with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest way to modify and eSign Tax Exempt Cf0041 Form with ease

- Locate Tax Exempt Cf0041 Form and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive data with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you would like to share your form, via email, SMS, or an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management requirements in just a few clicks from your preferred device. Alter and eSign Tax Exempt Cf0041 Form and ensure exceptional communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax exempt cf0041 form 10990360

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Tax Exempt Cf0041 Form?

The Tax Exempt Cf0041 Form is a document used to signNow that an entity is exempt from paying sales tax. This form is essential for businesses and organizations that qualify for tax-exempt status under specific regulations, allowing them to make tax-free purchases. Understanding the Tax Exempt Cf0041 Form can greatly benefit eligible entities by reducing operational costs.

-

How can airSlate SignNow help with the Tax Exempt Cf0041 Form?

airSlate SignNow offers a seamless way to electronically sign and send the Tax Exempt Cf0041 Form, making the process faster and more efficient. Users can easily fill out the form, eSign it, and share it securely with relevant parties. This digital solution simplifies document handling, ensuring all transactions related to the Tax Exempt Cf0041 Form are organized and accessible.

-

Are there any costs associated with using airSlate SignNow for the Tax Exempt Cf0041 Form?

airSlate SignNow provides a cost-effective solution for processing documents like the Tax Exempt Cf0041 Form. They offer different pricing plans tailored to various business needs, ensuring you only pay for the features you require. This flexibility makes it affordable for small businesses and large organizations alike.

-

What features does airSlate SignNow offer for managing the Tax Exempt Cf0041 Form?

airSlate SignNow includes robust features like customizable templates, eSignature capabilities, and secure document storage, specifically beneficial for managing the Tax Exempt Cf0041 Form. These features help streamline the completion and submission process. Additionally, real-time tracking and notifications keep users updated on the status of their documents.

-

Can I integrate airSlate SignNow with other software for handling the Tax Exempt Cf0041 Form?

Yes, airSlate SignNow supports integration with various software tools like CRMs, accounting software, and cloud storage services for efficient management of the Tax Exempt Cf0041 Form. These integrations allow for automated workflows and better document organization. This interoperability enhances your overall workflow and saves time when handling tax-exempt documentation.

-

What are the benefits of using airSlate SignNow for the Tax Exempt Cf0041 Form?

Using airSlate SignNow to process the Tax Exempt Cf0041 Form provides numerous benefits, such as saving time and improving accuracy. The user-friendly interface allows quick completion, which minimizes errors commonly associated with paper forms. Additionally, the security features ensure that sensitive information remains protected during the eSigning process.

-

Is it legal to eSign the Tax Exempt Cf0041 Form using airSlate SignNow?

Yes, electronically signing the Tax Exempt Cf0041 Form using airSlate SignNow is legally valid and compliant with eSignature laws, such as the ESIGN Act and UETA. This means that eSignatures have the same legal weight as handwritten ones, making airSlate SignNow a reliable option for managing tax-exempt documentation. Users can confidently use this solution to meet their compliance needs.

Get more for Tax Exempt Cf0041 Form

- Health information quality authority 456685553

- Pssap beneficiary form

- F1002a financial statement the law courts of newfoundland form

- 2020 uk passport application form

- City of bozeman montana development review application form a 1

- Fillable personnel action form

- Form affirmation as to applicants good moral character

- Consent form frontiers

Find out other Tax Exempt Cf0041 Form

- Electronic signature Utah New hire forms Now

- Electronic signature Texas Tenant contract Now

- How Do I Electronic signature Florida Home rental application

- Electronic signature Illinois Rental application Myself

- How Can I Electronic signature Georgia Rental lease form

- Electronic signature New York Rental lease form Safe

- Electronic signature Kentucky Standard rental application Fast

- Electronic signature Arkansas Real estate document Online

- Electronic signature Oklahoma Real estate document Mobile

- Electronic signature Louisiana Real estate forms Secure

- Electronic signature Louisiana Real estate investment proposal template Fast

- Electronic signature Maine Real estate investment proposal template Myself

- eSignature Alabama Pet Addendum to Lease Agreement Simple

- eSignature Louisiana Pet Addendum to Lease Agreement Safe

- eSignature Minnesota Pet Addendum to Lease Agreement Fast

- Electronic signature South Carolina Real estate proposal template Fast

- Electronic signature Rhode Island Real estate investment proposal template Computer

- How To Electronic signature Virginia Real estate investment proposal template

- How To Electronic signature Tennessee Franchise Contract

- Help Me With Electronic signature California Consulting Agreement Template