Form 1040r

What is the Form 1040r

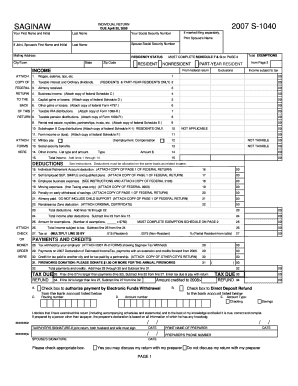

The Form 1040r is a specific tax document used by individuals in the United States to report income and calculate their tax liability. This form is particularly relevant for taxpayers who are required to report distributions from retirement accounts or pensions. Understanding the purpose of the 1040r is essential for ensuring compliance with IRS regulations and accurately reporting financial information.

How to use the Form 1040r

Using the Form 1040r involves several key steps. First, gather all necessary financial documents, including W-2s, 1099s, and any records of retirement account distributions. Next, fill out the form by entering your personal information, income details, and any applicable deductions or credits. After completing the form, review it for accuracy before submitting it to the IRS. It is important to retain a copy for your records.

Steps to complete the Form 1040r

Completing the Form 1040r requires careful attention to detail. Follow these steps for a smooth process:

- Gather all relevant financial documents, such as income statements and retirement account information.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your total income, including any distributions from retirement accounts.

- Calculate your tax liability based on the provided instructions and applicable tax rates.

- Include any deductions or credits that apply to your situation.

- Review the completed form for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Form 1040r

The legal use of the Form 1040r is governed by IRS regulations. To ensure that the form is considered valid, it must be completed accurately and submitted by the appropriate deadlines. Additionally, electronic signatures are legally binding if they comply with the ESIGN Act and UETA. Using a trusted eSignature solution can enhance the security and legality of your submission.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1040r typically align with the annual tax filing season. Generally, taxpayers must submit their forms by April 15 of each year, unless that date falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day. It is crucial to stay informed about any changes to these dates to avoid penalties.

Required Documents

When completing the Form 1040r, certain documents are necessary to provide accurate information. Key required documents include:

- W-2 forms from employers

- 1099 forms for other income sources

- Records of retirement account distributions

- Documentation for any deductions or credits claimed

Having these documents ready will streamline the completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete form 1040r

Prepare Form 1040r effortlessly on any device

Digital document management has gained popularity among both companies and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily access the necessary form and securely save it online. airSlate SignNow provides all the tools required to create, modify, and eSign your documents quickly without any holdups. Manage Form 1040r on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and eSign Form 1040r with ease

- Find Form 1040r and click Get Form to begin.

- Utilize the tools we offer to fill in your document.

- Emphasize relevant sections of your documents or mask sensitive information with tools that airSlate SignNow specifically provides for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and has the same legal validity as a traditional wet ink signature.

- Review all details and then click the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that require printing new document versions. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Modify and eSign Form 1040r and guarantee effective communication at every step of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1040r

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 1040r form and who needs it?

The 1040r form is a tax return form specifically for individuals who are required to report their income and calculate their tax liability. This form is crucial for those who may be claiming specific deductions or credits. If you're filing taxes in the U.S., understanding the 1040r form is essential for accurate submissions.

-

How can airSlate SignNow assist with submitting the 1040r form?

airSlate SignNow simplifies the process of sending and eSigning the 1040r form. With our platform, you can easily upload your documents, get them signed, and keep everything organized in one place. This streamlines the submission process and ensures that you can meet your tax deadlines effortlessly.

-

Is there a cost associated with using airSlate SignNow for eSigning the 1040r form?

Yes, airSlate SignNow offers subscription plans starting at a competitive price designed to fit various business needs. Our platform provides a cost-effective solution for eSigning documents, including the 1040r form. By choosing SignNow, you can ensure efficient processing without breaking your budget.

-

What features does airSlate SignNow offer for the 1040r form?

airSlate SignNow provides several features to enhance your experience with the 1040r form. Users benefit from customizable templates, seamless document tracking, and secure cloud storage for all signed documents. These features help you manage your tax filings more efficiently.

-

Can I integrate airSlate SignNow with other software for handling the 1040r form?

Absolutely! airSlate SignNow integrates with a variety of third-party applications, making it easier to manage your documents associated with the 1040r form. Popular integrations include CRM systems and cloud storage services, providing a streamlined workflow for your tax-related tasks.

-

How does airSlate SignNow ensure the security of my 1040r form?

AirSlate SignNow prioritizes the security of your documents, including the 1040r form, by employing industry-standard encryption protocols. Your data is stored securely in the cloud with access controls to ensure that only authorized users can view or sign documents. We take your privacy seriously.

-

Is there customer support available for using airSlate SignNow with the 1040r form?

Yes, airSlate SignNow offers dedicated customer support to assist you with any questions regarding the 1040r form. Our team is available through multiple channels, including chat and email, to ensure you have the help you need during your eSigning process.

Get more for Form 1040r

- Community support quarterly submittal form city of bastrop cityofbastrop

- Dallas county clerk form

- Printable dallas county divorce papers form

- County of dallas offer and purchase agreement dallascounty form

- Blank move out inspection forms

- Job application johnson county texas johnsoncountytx form

- Security alarm permit el paso tx form

- Find birth certificate no g b c 021500408653 form

Find out other Form 1040r

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document