Freddie Mac Form 1106

What is the Freddie Mac Form 1106

The Freddie Mac Form 1106 is a crucial document used primarily in the context of mortgage applications and refinancing. This form is essential for borrowers seeking to provide detailed information about their financial status, including income, assets, and liabilities. It plays a significant role in the underwriting process, helping lenders assess the risk associated with a mortgage loan. Understanding the purpose and requirements of this form is vital for any applicant navigating the mortgage landscape.

How to use the Freddie Mac Form 1106

Using the Freddie Mac Form 1106 involves several key steps that ensure accurate and efficient completion. First, gather all necessary financial documents, including pay stubs, bank statements, and tax returns. Next, fill out the form with precise information regarding your income and expenses. It is important to double-check all entries for accuracy, as any discrepancies can delay the approval process. Once completed, the form can be submitted electronically, which streamlines the application process and enhances security.

Steps to complete the Freddie Mac Form 1106

Completing the Freddie Mac Form 1106 can be broken down into a series of manageable steps:

- Gather required financial documents, such as income statements and tax returns.

- Fill in personal information, including your name, address, and Social Security number.

- Detail your income sources, including salary, bonuses, and any additional income.

- List your assets, such as bank accounts, investments, and real estate.

- Document your liabilities, including existing loans and credit card debts.

- Review the completed form for accuracy and completeness.

- Submit the form electronically or via the preferred method outlined by your lender.

Legal use of the Freddie Mac Form 1106

The Freddie Mac Form 1106 is legally binding when completed and submitted according to established guidelines. To ensure its validity, it must be filled out truthfully and accurately. Electronic signatures are accepted, provided they comply with the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA). Adhering to these legal frameworks enhances the form's enforceability in any potential disputes.

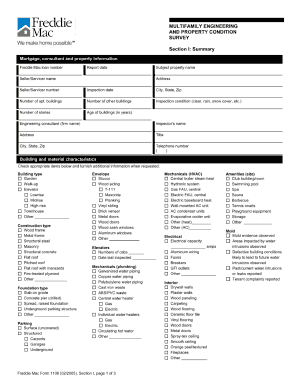

Key elements of the Freddie Mac Form 1106

Several key elements are essential to the Freddie Mac Form 1106, which include:

- Personal Information: This includes the borrower's name, contact details, and Social Security number.

- Income Details: A comprehensive breakdown of all income sources, including employment and other earnings.

- Asset Information: A list of all assets that contribute to the borrower's financial stability.

- Liabilities: Disclosure of all existing debts and financial obligations.

- Certification: A declaration that the information provided is accurate and complete.

How to obtain the Freddie Mac Form 1106

The Freddie Mac Form 1106 can be obtained through various channels. Most commonly, it is available directly from lenders, who provide the form as part of the mortgage application package. Additionally, it can be accessed through Freddie Mac's official website or by contacting a mortgage broker. Ensuring you have the latest version of the form is important, as updates may occur that reflect changes in regulations or requirements.

Quick guide on how to complete freddie mac form 1106

Easily prepare Freddie Mac Form 1106 on any device

Managing documents online has gained traction among organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to find the appropriate form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents promptly without delays. Handle Freddie Mac Form 1106 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The simplest way to edit and eSign Freddie Mac Form 1106 effortlessly

- Find Freddie Mac Form 1106 and then click Get Form to initiate.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive data with tools specifically designed by airSlate SignNow for that purpose.

- Create your eSignature using the Sign feature, which only takes a few seconds and carries the same legal significance as a standard wet ink signature.

- Review the details and then click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you select. Modify and eSign Freddie Mac Form 1106 while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the freddie mac form 1106

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is Freddie Mac Form 1106?

Freddie Mac Form 1106 is a necessary document used in the mortgage industry for loan applications. This form helps lenders assess the borrower's financial status and eligibility for loan programs. Understanding this form is essential for anyone navigating the mortgage process.

-

How can airSlate SignNow help with Freddie Mac Form 1106?

airSlate SignNow simplifies the process of completing and eSigning the Freddie Mac Form 1106. Our platform provides easy-to-use templates and tools that facilitate the signing process, making it faster and more efficient. This ensures that your documentation is handled with accuracy and speed.

-

What are the features of airSlate SignNow for managing Freddie Mac Form 1106?

AirSlate SignNow offers a range of features to support the management of Freddie Mac Form 1106, including customizable templates, automated workflows, and secure cloud storage. These features streamline the document management process, allowing for easy access and collaboration. You can track the signing status in real-time to ensure nothing is missed.

-

Is airSlate SignNow affordable for users needing to complete Freddie Mac Form 1106?

Yes, airSlate SignNow is a cost-effective solution for businesses and individuals needing to complete the Freddie Mac Form 1106. Our pricing plans are designed to fit different budgets, offering flexibility and scalability. By using our platform, you can save on printing and courier costs as well.

-

Can I integrate airSlate SignNow with other tools for handling Freddie Mac Form 1106?

Absolutely! AirSlate SignNow seamlessly integrates with various applications such as CRM systems, document management tools, and cloud storage services. This integration capability enhances the overall workflow when dealing with the Freddie Mac Form 1106, ensuring a more streamlined user experience.

-

What are the benefits of using airSlate SignNow for Freddie Mac Form 1106?

Using airSlate SignNow for the Freddie Mac Form 1106 introduces numerous benefits, including increased efficiency, reduced turnaround time, and enhanced accuracy. Our eSigning solution eliminates the hassles of manual paperwork, allowing for faster processing of loan applications. Moreover, it provides a secure environment for handling sensitive information.

-

How secure is airSlate SignNow for signing Freddie Mac Form 1106?

AirSlate SignNow prioritizes the security of your data, employing advanced encryption and secure servers to protect all documents, including the Freddie Mac Form 1106. Our platform complies with industry standards to ensure that all eSignatures are legally binding and your information remains confidential. You can feel confident when using our service.

Get more for Freddie Mac Form 1106

Find out other Freddie Mac Form 1106

- How Can I Electronic signature Maine Lawers PPT

- How To Electronic signature Maine Lawers PPT

- Help Me With Electronic signature Minnesota Lawers PDF

- How To Electronic signature Ohio High Tech Presentation

- How Can I Electronic signature Alabama Legal PDF

- How To Electronic signature Alaska Legal Document

- Help Me With Electronic signature Arkansas Legal PDF

- How Can I Electronic signature Arkansas Legal Document

- How Can I Electronic signature California Legal PDF

- Can I Electronic signature Utah High Tech PDF

- How Do I Electronic signature Connecticut Legal Document

- How To Electronic signature Delaware Legal Document

- How Can I Electronic signature Georgia Legal Word

- How Do I Electronic signature Alaska Life Sciences Word

- How Can I Electronic signature Alabama Life Sciences Document

- How Do I Electronic signature Idaho Legal Form

- Help Me With Electronic signature Arizona Life Sciences PDF

- Can I Electronic signature Colorado Non-Profit Form

- How To Electronic signature Indiana Legal Form

- How To Electronic signature Illinois Non-Profit Document