Wyoming Property Tax Report Adt25 Form

What is the Wyoming Property Tax Report Adt25

The Wyoming Property Tax Report Adt25 is a specific form used by property owners in Wyoming to report property tax information to the state. This form is essential for ensuring that property taxes are assessed accurately and fairly. It collects data on property ownership, property value, and any applicable exemptions. Understanding this form is crucial for compliance with state tax regulations and for taking advantage of any tax benefits available to property owners.

How to use the Wyoming Property Tax Report Adt25

Using the Wyoming Property Tax Report Adt25 involves several steps to ensure accurate completion. First, gather all necessary information about your property, including its location, assessed value, and any exemptions you may qualify for. Next, fill out the form with the required details, ensuring that all entries are accurate and complete. Once completed, the form can be submitted electronically or via mail to the appropriate state office. Utilizing a digital platform can streamline this process, making it easier to fill out and sign the document securely.

Steps to complete the Wyoming Property Tax Report Adt25

Completing the Wyoming Property Tax Report Adt25 requires careful attention to detail. Follow these steps for a successful submission:

- Gather necessary documents, including property deeds and previous tax statements.

- Access the Adt25 form online or obtain a physical copy from your local tax office.

- Fill out the form, providing accurate information about your property and any exemptions.

- Review the form for completeness and accuracy.

- Submit the form electronically or mail it to the designated state office by the deadline.

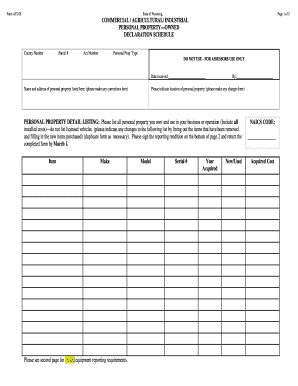

Key elements of the Wyoming Property Tax Report Adt25

The Wyoming Property Tax Report Adt25 includes several key elements that must be accurately reported. These elements typically consist of:

- Property identification information, including the parcel number.

- Owner's name and contact information.

- Details regarding property use, such as residential or commercial classification.

- Assessed value of the property and any claimed exemptions.

Providing accurate information in these sections is critical for proper tax assessment and compliance with state laws.

Filing Deadlines / Important Dates

Filing deadlines for the Wyoming Property Tax Report Adt25 are crucial for property owners to keep in mind. Typically, the form must be submitted by a specific date each year to ensure that property taxes are assessed correctly. Missing the deadline can result in penalties or loss of exemptions. It is advisable to check the Wyoming Department of Revenue's website or contact local tax authorities for the most current deadlines and important dates related to property tax reporting.

Form Submission Methods (Online / Mail / In-Person)

The Wyoming Property Tax Report Adt25 can be submitted through various methods, offering flexibility to property owners. Options typically include:

- Online submission via a secure digital platform, which allows for easy completion and signing.

- Mailing a physical copy of the completed form to the appropriate state office.

- In-person submission at local tax offices, where assistance may be available for completing the form.

Choosing the right submission method can help ensure that the form is processed efficiently and securely.

Quick guide on how to complete wyoming property tax report adt25

Complete Wyoming Property Tax Report Adt25 seamlessly on any device

Managing documents online has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, as you can locate the necessary form and securely save it online. airSlate SignNow provides all the resources you require to create, edit, and eSign your documents swiftly without delays. Handle Wyoming Property Tax Report Adt25 on any device with airSlate SignNow Android or iOS applications and enhance any document-based workflow today.

How to edit and eSign Wyoming Property Tax Report Adt25 effortlessly

- Obtain Wyoming Property Tax Report Adt25 and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize essential sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Generate your eSignature using the Sign feature, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to save your adjustments.

- Select how you wish to send your form, whether by email, SMS, or invite link, or download it to your computer.

Put an end to lost or misplaced documents, tedious form hunting, or errors that necessitate printing new document copies. airSlate SignNow manages all your needs in document administration in just a few clicks from any device you prefer. Modify and eSign Wyoming Property Tax Report Adt25 and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wyoming property tax report adt25

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the importance of understanding Wyoming property tax for business owners?

Understanding Wyoming property tax is crucial for business owners as it directly impacts their financial planning and budgeting. Familiarity with these taxes helps in making informed decisions regarding asset acquisitions and company growth. Additionally, properly accounting for Wyoming property tax can aid in ensuring compliance with state regulations.

-

How can airSlate SignNow help with managing Wyoming property tax documents?

airSlate SignNow streamlines the process of managing Wyoming property tax documents by providing a user-friendly platform for sending and signing essential paperwork. This cloud-based solution ensures that all documents are securely stored and easily accessible, making it simpler for businesses to handle tax-related tasks. Additionally, it helps in reducing the time spent on administrative tasks associated with Wyoming property tax.

-

What are the features of airSlate SignNow that support Wyoming property tax management?

Key features of airSlate SignNow that specifically support Wyoming property tax management include electronic signatures, customizable templates, and document tracking. These tools ensure that all necessary tax forms can be quickly completed and signed, while also providing users with real-time updates on their document's status. By utilizing these features, businesses can efficiently manage their Wyoming property tax responsibilities.

-

What pricing options are available for airSlate SignNow for users dealing with Wyoming property tax?

airSlate SignNow offers a variety of pricing plans to cater to different business needs, including those focused on Wyoming property tax. These plans range from basic individual use to more extensive options suitable for larger teams. This flexibility allows users to choose a plan that fits their budget while ensuring they have the necessary tools to manage Wyoming property tax seamlessly.

-

Can I integrate airSlate SignNow with other tools for managing Wyoming property tax?

Yes, airSlate SignNow can be seamlessly integrated with various accounting and document management software that businesses may already be using to handle Wyoming property tax. Integrations with tools like QuickBooks or Dropbox can streamline workflows and enhance productivity. This compatibility ensures that your Wyoming property tax documentation process is both efficient and effective.

-

What are the benefits of using airSlate SignNow for Wyoming property tax documentation?

Using airSlate SignNow for Wyoming property tax documentation offers several benefits, including improved efficiency, reduced paperwork, and enhanced security. The ability to quickly send and receive signed documents reduces the time otherwise spent on traditional methods. Furthermore, all transactions are secure and legally binding, providing peace of mind when managing Wyoming property tax documents.

-

Is airSlate SignNow user-friendly for those unfamiliar with Wyoming property tax processes?

Absolutely! airSlate SignNow is designed with user-friendliness in mind, making it accessible even for those unfamiliar with Wyoming property tax processes. The platform provides easy-to-follow instructions, helpful templates, and customer support to assist users along the way. This ensures a smooth experience for anyone dealing with Wyoming property tax documents.

Get more for Wyoming Property Tax Report Adt25

- Lincoln request distribution form

- Medco 13 2009 form

- Twb 2 transitional work offer and acceptance form

- Medco 31 request for prior authorization of medication form

- The mt charitable foundation online application form

- Enrollment form for automatic payments mampt bank

- Foreclosure prevention package mampt bank form

- Chipotle menu template form

Find out other Wyoming Property Tax Report Adt25

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online

- Can I Sign California Car Insurance Quotation Form

- Sign Illinois Car Insurance Quotation Form Fast

- Can I Sign Maryland Car Insurance Quotation Form