Usgs Tax Exempt 2006

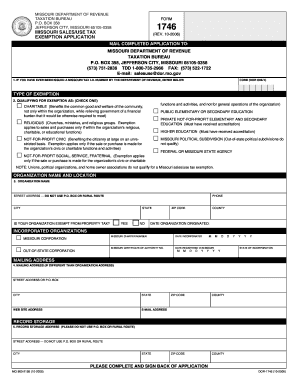

What is the USGS Tax Exempt?

The USGS tax exempt status allows certain organizations to avoid paying federal taxes on specific transactions. This status is typically granted to governmental entities, educational institutions, and non-profit organizations that meet certain criteria established by the Internal Revenue Service (IRS). The USGS, or United States Geological Survey, provides a tax exempt form that organizations can use to claim this status when applicable. Understanding the nature of this exemption is crucial for eligible entities to ensure compliance with tax regulations.

How to Obtain the USGS Tax Exempt Form

To obtain the USGS tax exempt form, organizations must first determine their eligibility based on IRS guidelines. Once eligibility is confirmed, the form can be accessed through the USGS website or by contacting the appropriate USGS office. It is essential to complete the form accurately, providing all required information to avoid delays in processing. Organizations may also need to submit additional documentation to support their request for tax exempt status.

Steps to Complete the USGS Tax Exempt Form

Completing the USGS tax exempt form involves several important steps:

- Gather necessary information, including the organization's legal name, address, and tax identification number.

- Review the eligibility criteria to ensure compliance with IRS regulations.

- Fill out the form accurately, providing detailed information where required.

- Attach any supporting documents that demonstrate the organization's tax exempt status.

- Submit the completed form through the designated method, whether online or via mail.

Legal Use of the USGS Tax Exempt

The legal use of the USGS tax exempt status is governed by federal tax laws and regulations. Organizations must use the exemption solely for qualifying purchases and activities. Misuse of the tax exempt status can lead to penalties, including the potential revocation of the exemption. It is crucial for organizations to maintain accurate records of tax exempt transactions to ensure compliance and avoid any legal issues.

Eligibility Criteria for the USGS Tax Exempt

Eligibility for the USGS tax exempt status typically includes the following criteria:

- The organization must be a governmental entity, educational institution, or a qualified non-profit.

- The organization must operate primarily for exempt purposes as defined by the IRS.

- The organization must provide documentation to support its claim for tax exempt status.

Organizations should carefully review these criteria before applying to ensure they meet all requirements.

Required Documents for the USGS Tax Exempt

When applying for the USGS tax exempt status, organizations need to prepare several key documents:

- Proof of the organization's legal status, such as incorporation papers or a charter.

- Tax identification number issued by the IRS.

- Documentation demonstrating the organization's eligibility, including financial statements or mission statements.

Having these documents ready can streamline the application process and facilitate a smoother review by the USGS.

Quick guide on how to complete usgs tax exempt

Complete Usgs Tax Exempt effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to acquire the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents rapidly without interruptions. Manage Usgs Tax Exempt on any device using airSlate SignNow’s Android or iOS applications and simplify any document-related task today.

The easiest way to edit and eSign Usgs Tax Exempt seamlessly

- Locate Usgs Tax Exempt and click on Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize relevant portions of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Decide how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or disorganized files, tedious form searches, or mistakes that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any chosen device. Alter and eSign Usgs Tax Exempt and ensure outstanding communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct usgs tax exempt

Create this form in 5 minutes!

How to create an eSignature for the usgs tax exempt

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the usgs tax exempt status and how does it apply to airSlate SignNow?

The usgs tax exempt status allows certain organizations to operate without paying federal taxes. With airSlate SignNow, businesses that qualify for this status can streamline their document signing processes while ensuring compliance with tax regulations. This feature is particularly beneficial for non-profits and government entities.

-

How can airSlate SignNow help organizations with usgs tax exempt documentation?

airSlate SignNow simplifies the management of usgs tax exempt documentation by providing a secure platform for eSigning and storing important documents. Users can easily create, send, and track tax exempt forms, ensuring that all necessary paperwork is completed efficiently. This reduces the risk of errors and enhances compliance.

-

Are there any additional costs for usgs tax exempt users when using airSlate SignNow?

No, airSlate SignNow offers competitive pricing that does not impose additional costs specifically for usgs tax exempt users. Our pricing plans are designed to be cost-effective for all organizations, including those with tax exempt status. This ensures that you can access all features without worrying about hidden fees.

-

What features does airSlate SignNow offer for usgs tax exempt organizations?

airSlate SignNow provides a range of features tailored for usgs tax exempt organizations, including customizable templates, automated workflows, and secure cloud storage. These features help streamline the signing process and ensure that all documents are compliant with tax regulations. Additionally, users can track document status in real-time.

-

Can airSlate SignNow integrate with other tools for usgs tax exempt organizations?

Yes, airSlate SignNow offers seamless integrations with various tools and platforms that usgs tax exempt organizations may already be using. This includes CRM systems, cloud storage services, and accounting software. These integrations enhance productivity and ensure that all your documents are easily accessible.

-

What are the benefits of using airSlate SignNow for usgs tax exempt entities?

Using airSlate SignNow provides numerous benefits for usgs tax exempt entities, including increased efficiency, reduced paperwork, and enhanced security. The platform allows for quick document turnaround, which is crucial for organizations that need to maintain compliance with tax regulations. Additionally, the user-friendly interface makes it easy for all team members to adopt.

-

Is airSlate SignNow compliant with usgs tax exempt regulations?

Yes, airSlate SignNow is designed to comply with usgs tax exempt regulations, ensuring that all electronic signatures and document management practices meet legal standards. This compliance helps organizations avoid potential legal issues and maintain their tax exempt status. Our platform is regularly updated to reflect any changes in regulations.

Get more for Usgs Tax Exempt

- Is the condemnation clause in your lease going faegre form

- Landlord and tenant rights and responsibilities in the case of form

- Example 2 clause dealing with fire damage form

- Damage and destruction provisions of a commercial lease form

- Leasedamages destruction and business interruption form

- Execution copy lease agreement between hudson form

- Example 2 fairer force majeure clause form

- Vxv port authority of new york and new jersey form

Find out other Usgs Tax Exempt

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU

- eSign Washington Lawers Limited Power Of Attorney Computer

- eSign Wisconsin Lawers LLC Operating Agreement Free

- eSign Alabama Legal Quitclaim Deed Online