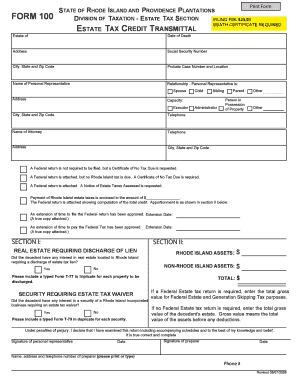

Ri Form 100

What is the Ri Form 100

The Ri Form 100 is a tax form used in the United States, specifically for reporting income and calculating tax liabilities. This form is typically utilized by individuals and businesses to ensure compliance with federal tax regulations. It captures essential financial information, including earnings, deductions, and credits, allowing the Internal Revenue Service (IRS) to assess the taxpayer's financial situation accurately. Understanding the purpose and structure of the Ri Form 100 is crucial for anyone required to file it, as it directly impacts tax obligations and potential refunds.

How to Obtain the Ri Form 100

Obtaining the Ri Form 100 is a straightforward process. Taxpayers can access the form through the official IRS website, where it is available for download in a PDF format. Additionally, physical copies can often be found at local IRS offices or through authorized tax preparers. It is essential to ensure that you are using the most current version of the form, as updates may occur annually, reflecting changes in tax laws or regulations.

Steps to Complete the Ri Form 100

Completing the Ri Form 100 involves several key steps to ensure accuracy and compliance. First, gather all necessary financial documents, including income statements, previous tax returns, and any relevant receipts for deductions. Next, fill out the form by entering your personal information, income details, and applicable deductions. It is crucial to double-check all entries for accuracy. Once completed, review the form for any errors and ensure that all required signatures are included. Finally, submit the form by the designated deadline to avoid penalties.

Legal Use of the Ri Form 100

The Ri Form 100 holds legal significance as it is a formal document submitted to the IRS. To ensure its legal validity, it must be completed accurately and submitted on time. Failure to comply with IRS regulations can result in penalties, including fines or audits. Utilizing electronic signature solutions, such as those offered by signNow, can enhance the security and legitimacy of the form, ensuring that it meets all legal requirements for electronic submission.

Filing Deadlines / Important Dates

Filing deadlines for the Ri Form 100 are critical for taxpayers to adhere to in order to avoid penalties. Typically, the form must be submitted by April fifteenth of each year for the previous tax year. However, if this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check the IRS website for any updates or changes to these deadlines, as they can vary based on specific circumstances or legislative changes.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers have several options for submitting the Ri Form 100. The form can be filed electronically through the IRS e-filing system, which is often the fastest method and allows for quicker processing of refunds. Alternatively, taxpayers may choose to mail a paper copy of the form to the appropriate IRS address, ensuring that it is postmarked by the filing deadline. Some individuals may also opt to deliver the form in person at their local IRS office, although this method may require scheduling an appointment in advance.

Quick guide on how to complete ri form 100

Effortlessly Prepare Ri Form 100 on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an excellent eco-friendly substitute to traditional printed and signed paperwork, allowing you to access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents quickly without any hold-ups. Manage Ri Form 100 on any device using the airSlate SignNow apps for Android or iOS, and simplify your document-related processes today.

The Easiest Way to Edit and eSign Ri Form 100 with Ease

- Locate Ri Form 100 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize important sections of your documents or redact sensitive information with tools that airSlate SignNow specifically offers for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Choose how you wish to send your form: via email, text message (SMS), invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or errors that require printing new document copies. airSlate SignNow addresses all your document management needs with just a few clicks from your chosen device. Edit and eSign Ri Form 100 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ri form 100

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the RI Form 100 and why is it important?

The RI Form 100 is a crucial document for taxpayers in Rhode Island. It serves as the state's corporate income tax return, and understanding how to complete it accurately is essential for compliance. Utilizing tools like airSlate SignNow can streamline the process of filling out and eSigning the RI Form 100.

-

How does airSlate SignNow assist with the RI Form 100?

AirSlate SignNow simplifies the process of preparing and submitting the RI Form 100. Our platform allows users to create, send, and eSign necessary documents efficiently. This means you can focus on your business while we handle the paperwork.

-

What pricing options are available for airSlate SignNow?

AirSlate SignNow offers flexible pricing plans suitable for businesses of all sizes. Whether you need basic features for occasional use or advanced capabilities for regular submission of RI Form 100, we have a plan for you. Check our website for the latest pricing details.

-

Can airSlate SignNow help with other tax forms apart from the RI Form 100?

Yes, airSlate SignNow is versatile and supports the eSigning of various tax forms beyond just the RI Form 100. Our platform can accommodate different business documents, making it a comprehensive solution for all your documentation needs.

-

What features does airSlate SignNow offer for eSigning documents?

AirSlate SignNow provides robust eSigning features, including customizable templates, signature tracking, and multi-user collaboration. These tools ensure a smooth experience when handling essential documents like the RI Form 100. Our intuitive interface makes it easy for anyone to use.

-

Is airSlate SignNow secure for submitting the RI Form 100?

Security is a top priority at airSlate SignNow. We use advanced encryption protocols to protect your documents and personal information when submitting the RI Form 100. You can trust that your sensitive data is safe with us.

-

Are there integrations available with airSlate SignNow for the RI Form 100?

Absolutely! AirSlate SignNow integrates with various business applications, allowing you to seamlessly manage your documents, including the RI Form 100, from your preferred tools. This connectivity enhances your workflow and boosts productivity.

Get more for Ri Form 100

Find out other Ri Form 100

- Can I Sign Missouri Doctors Last Will And Testament

- Sign New Mexico Doctors Living Will Free

- Sign New York Doctors Executive Summary Template Mobile

- Sign New York Doctors Residential Lease Agreement Safe

- Sign New York Doctors Executive Summary Template Fast

- How Can I Sign New York Doctors Residential Lease Agreement

- Sign New York Doctors Purchase Order Template Online

- Can I Sign Oklahoma Doctors LLC Operating Agreement

- Sign South Dakota Doctors LLC Operating Agreement Safe

- Sign Texas Doctors Moving Checklist Now

- Sign Texas Doctors Residential Lease Agreement Fast

- Sign Texas Doctors Emergency Contact Form Free

- Sign Utah Doctors Lease Agreement Form Mobile

- Sign Virginia Doctors Contract Safe

- Sign West Virginia Doctors Rental Lease Agreement Free

- Sign Alabama Education Quitclaim Deed Online

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later