Form 8949

What is the Form 8949

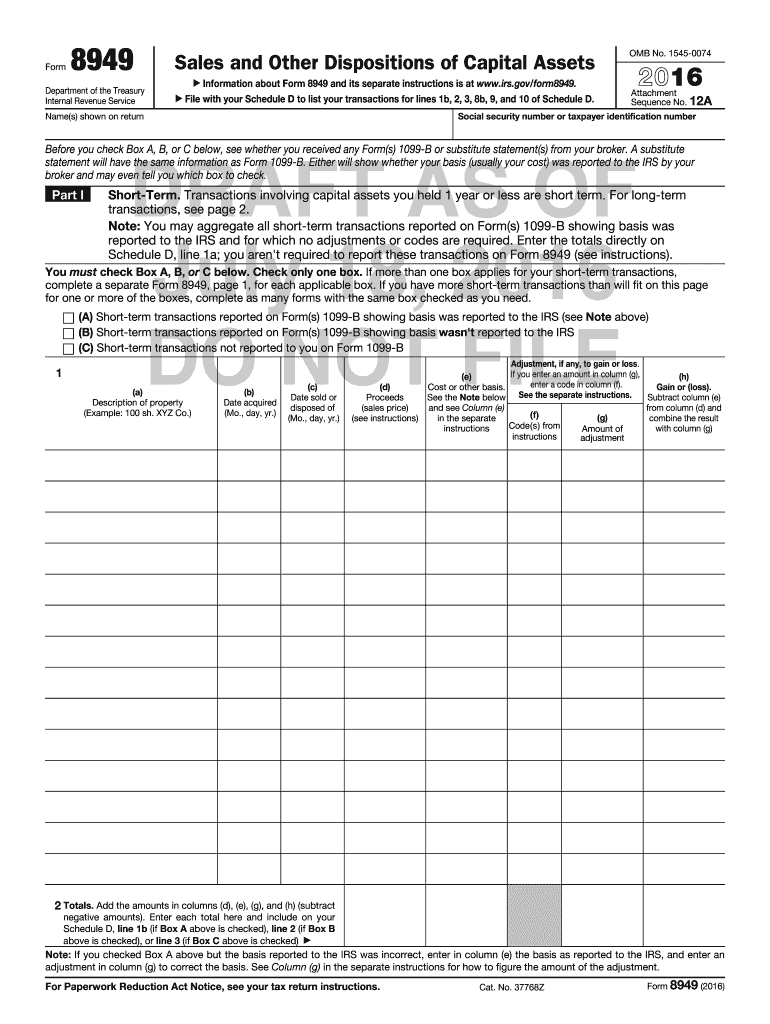

The 8949 form for 2016 is a crucial tax document utilized by U.S. taxpayers to report capital gains and losses from the sale of investments. This form is essential for accurately calculating the amount of tax owed on these transactions. It requires detailed information about each transaction, including the date of acquisition, date of sale, proceeds, cost basis, and the resulting gain or loss. Taxpayers must file this form alongside their annual tax return to ensure compliance with IRS regulations.

How to use the Form 8949

Using the 2016 form 8949 involves several steps to ensure accurate reporting of capital gains and losses. Taxpayers should first gather all necessary documentation regarding their investment transactions. This includes brokerage statements and records of any purchases or sales. Next, taxpayers will categorize their transactions into short-term and long-term sections of the form, depending on the holding period of each asset. Finally, the totals from the 8949 must be transferred to Schedule D of the tax return, which summarizes overall capital gains and losses.

Steps to complete the Form 8949

Completing the form 8949 for 2016 requires careful attention to detail. Here are the steps to follow:

- Gather all relevant transaction records, including purchase and sale dates, amounts, and costs.

- Separate transactions into short-term (held for one year or less) and long-term (held for more than one year).

- Fill out the appropriate sections of the form, entering details for each transaction.

- Calculate the total gain or loss for each section.

- Transfer the totals to Schedule D of your tax return.

Legal use of the Form 8949

The legal use of the 8949 form for 2016 is governed by IRS regulations, which mandate that taxpayers report all capital gains and losses accurately. Failure to do so can result in penalties or audits. The form must be completed truthfully, and all information provided should be verifiable through supporting documents. Compliance with these legal requirements ensures that taxpayers fulfill their obligations and avoid potential legal issues with the IRS.

Filing Deadlines / Important Dates

For the 2016 tax year, the deadline for filing the 8949 form coincides with the standard tax return deadline, which is typically April fifteenth of the following year. However, if this date falls on a weekend or holiday, the deadline may shift to the next business day. Taxpayers should be aware of these dates to avoid late penalties and ensure timely submission of their tax returns.

IRS Guidelines

The IRS provides specific guidelines for completing the form 8949, which include instructions on how to report different types of transactions, how to calculate gains and losses, and how to handle various scenarios such as wash sales. Taxpayers should refer to the IRS instructions for the 8949 to ensure compliance and accuracy in their reporting. These guidelines are essential for understanding the nuances of capital gains taxation and ensuring that all transactions are reported correctly.

Quick guide on how to complete form 8949

Effortlessly prepare Form 8949 on any device

Online document management has gained traction among organizations and individuals. It offers an ideal environmentally-friendly solution to traditional printed and signed documents, as you can easily locate the necessary form and securely save it online. airSlate SignNow provides all the tools needed to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8949 on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to edit and electronically sign Form 8949 with ease

- Find Form 8949 and click on Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of your documents or obscure sensitive information with tools specifically offered by airSlate SignNow for that purpose.

- Create your electronic signature with the Sign feature, which takes just seconds and has the same legal validity as a conventional ink signature.

- Review all the details and then click on the Done button to save your changes.

- Select your preferred method to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new document versions. airSlate SignNow addresses your document management needs in just a few clicks from any device you choose. Modify and electronically sign Form 8949 and ensure effective communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8949

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the 8949 form 2016 and why is it important?

The 8949 form 2016 is used to report capital gains and losses from the sale of securities and other assets. It's essential for accurate tax reporting to ensure compliance with IRS regulations. Properly completing this form can help you avoid penalties and maximize your tax returns.

-

How can airSlate SignNow help me with the 8949 form 2016?

airSlate SignNow simplifies the process of filling and electronically signing the 8949 form 2016. With our platform, you can easily upload, fill out, and eSign your documents securely, ensuring all necessary information is included for submission to the IRS.

-

What features does airSlate SignNow offer for the 8949 form 2016?

We provide a user-friendly interface for creating and editing the 8949 form 2016, along with secure eSignature capabilities. Our platform also allows you to store documents, track changes, and collaborate with others, making the process seamless and efficient.

-

Is there a cost associated with using airSlate SignNow for the 8949 form 2016?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Our plans are designed to be cost-effective, providing all the necessary features to handle the 8949 form 2016 efficiently, ensuring you get value for your investment.

-

Can I integrate airSlate SignNow with other tools for filling out the 8949 form 2016?

Absolutely! airSlate SignNow supports integrations with various applications and tools, enhancing your experience while working on the 8949 form 2016. Integrating with tools like Google Drive and Dropbox allows for easier document management and access.

-

How secure is airSlate SignNow when handling the 8949 form 2016?

Security is our top priority at airSlate SignNow. We use advanced encryption and secure servers to protect your data while you work on the 8949 form 2016, ensuring that your personal and financial information is kept confidential.

-

What support does airSlate SignNow offer for users of the 8949 form 2016?

We offer comprehensive support for all our users, including those filling out the 8949 form 2016. Our knowledgeable support team is available to assist you with any questions or technical issues you may encounter while using our platform.

Get more for Form 8949

- Dd form 1616

- Punjab medical council registration renewal form 34148322

- Application for appointment or re appointment to macomb county form

- Whole foods online job application form

- Form 341 english san diego county office of education sdcoe

- Calstrs retirement system election form sdcoe

- Standard affirmation and disclosure form

- Virtual school form george jenkins high school

Find out other Form 8949

- How To Sign Georgia Non-Profit Presentation

- Can I Sign Nevada Life Sciences PPT

- Help Me With Sign New Hampshire Non-Profit Presentation

- How To Sign Alaska Orthodontists Presentation

- Can I Sign South Dakota Non-Profit Word

- Can I Sign South Dakota Non-Profit Form

- How To Sign Delaware Orthodontists PPT

- How Can I Sign Massachusetts Plumbing Document

- How To Sign New Hampshire Plumbing PPT

- Can I Sign New Mexico Plumbing PDF

- How To Sign New Mexico Plumbing Document

- How To Sign New Mexico Plumbing Form

- Can I Sign New Mexico Plumbing Presentation

- How To Sign Wyoming Plumbing Form

- Help Me With Sign Idaho Real Estate PDF

- Help Me With Sign Idaho Real Estate PDF

- Can I Sign Idaho Real Estate PDF

- How To Sign Idaho Real Estate PDF

- How Do I Sign Hawaii Sports Presentation

- How Do I Sign Kentucky Sports Presentation