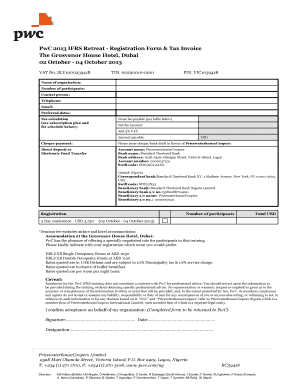

Pwc Invoice Form

What is the pwc invoice?

The pwc invoice is a formal document used for billing purposes, typically issued by PricewaterhouseCoopers (PwC) to clients for services rendered. This invoice outlines the details of the services provided, including the date, description, and amount due. It serves as a request for payment and is essential for maintaining accurate financial records.

How to use the pwc invoice

Using the pwc invoice involves a few straightforward steps. First, ensure that all necessary details are accurately filled in, including your contact information and that of the client. Next, provide a clear description of the services rendered, along with the corresponding fees. Once completed, the invoice can be sent to the client via email or traditional mail, depending on their preference. Keeping a copy for your records is also advisable.

Steps to complete the pwc invoice

Completing the pwc invoice requires careful attention to detail. Follow these steps:

- Gather all relevant information about the services provided.

- Fill in your business name, address, and contact information at the top of the invoice.

- Include the client's name, address, and contact information.

- List the services provided with a brief description and the corresponding fees.

- Calculate the total amount due, including any applicable taxes.

- Provide payment terms, such as due date and accepted payment methods.

- Review the invoice for accuracy before sending it to the client.

Legal use of the pwc invoice

The pwc invoice is legally binding once it has been issued and accepted by the client. To ensure its legal standing, it should include all necessary details and comply with relevant regulations. This includes adhering to any applicable tax laws and maintaining proper documentation for record-keeping purposes. Utilizing a reliable eSignature platform can further enhance the legitimacy of the invoice by providing a digital signature and audit trail.

Key elements of the pwc invoice

Several key elements must be present on the pwc invoice to ensure clarity and compliance:

- Invoice Number: A unique identifier for tracking purposes.

- Date of Issue: The date the invoice is created.

- Service Description: A detailed account of the services provided.

- Payment Terms: Information regarding due dates and accepted payment methods.

- Total Amount Due: The total cost, including any taxes or additional fees.

Examples of using the pwc invoice

Examples of using the pwc invoice can vary by industry and service type. For instance, a consultant may issue a pwc invoice after completing a project for a client, detailing the hours worked and the agreed-upon rate. Similarly, an accounting firm may use the invoice to bill clients for tax preparation services. Each example highlights the importance of clear communication and documentation in business transactions.

Quick guide on how to complete pwc invoice

Finish Pwc Invoice seamlessly on any gadget

Digital document management has gained traction among companies and individuals alike. It offers an ideal environmentally friendly substitute to conventional printed and signed documents, as you can obtain the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, alter, and electronically sign your documents promptly without any hold-ups. Manage Pwc Invoice on any gadget using airSlate SignNow Android or iOS applications and simplify any document-related tasks today.

The easiest method to modify and electronically sign Pwc Invoice without hassle

- Find Pwc Invoice and click on Get Form to begin.

- Utilize the tools we offer to finish your form.

- Emphasize relevant sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature using the Sign feature, which takes moments and carries the same legal validity as a regular wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to share your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiring form searches, or mistakes that necessitate printing new document copies. airSlate SignNow addresses all your document management needs in a few clicks from any device you prefer. Modify and electronically sign Pwc Invoice and ensure excellent communication at any phase of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the pwc invoice

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a pwc invoice and how can it be managed using airSlate SignNow?

A pwc invoice refers to the billing document from PwC that outlines the services rendered and associated costs. With airSlate SignNow, businesses can easily manage their pwc invoices by sending them for eSignature, ensuring a streamlined approval process while maintaining compliance and security.

-

How does airSlate SignNow enhance the processing of pwc invoices?

airSlate SignNow enhances the processing of pwc invoices by offering an intuitive interface for eSignatures, which accelerates the signing process. This means that once a pwc invoice is created, it can be sent out for signature quickly, reducing waiting times and improving cash flow.

-

Are there any costs associated with using airSlate SignNow for pwc invoices?

Yes, airSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you're a small business or a large enterprise handling multiple pwc invoices, you can choose a plan that fits your budget and ensures efficient document management.

-

What integrations does airSlate SignNow offer for pwc invoice processing?

airSlate SignNow integrates seamlessly with a range of business applications, including popular accounting and CRM software. This allows you to manage pwc invoices alongside your other business processes, ensuring that all data is centralized and easily accessible.

-

Can multiple users collaborate on a pwc invoice within airSlate SignNow?

Yes, airSlate SignNow allows multiple users to collaborate on a pwc invoice, making it easy for team members to review, comment, and approve documents in real-time. This collaborative feature helps ensure that everyone involved in the approval process is on the same page.

-

What security measures does airSlate SignNow implement for pwc invoices?

Security is a top priority at airSlate SignNow, especially for sensitive documents like pwc invoices. The platform employs encryption, secure cloud storage, and compliance with industry standards to ensure that all your invoices are protected from unauthorized access.

-

How can airSlate SignNow help automate pwc invoice workflows?

airSlate SignNow supports automation of pwc invoice workflows by allowing you to set up templates and automated reminders. This not only speeds up the process of handling invoices but also reduces the risk of human error, ensuring a smoother operation.

Get more for Pwc Invoice

- Faa weight and balance form

- How to fill the complete airman file form

- Recruiting form 2010docx quothochschulen in der entwicklungspolitikquot

- Bfs rp p 51 real property assessment division form

- Online jsa template form

- Snow load design criteria request klamath county klamathcounty form

- Appendix e pesticide use proposal form fs 2100 2

- Nc temporary tag form

Find out other Pwc Invoice

- eSignature Georgia Mobile App Design Proposal Template Myself

- eSignature Indiana Mobile App Design Proposal Template Now

- eSignature Utah Mobile App Design Proposal Template Now

- eSignature Kentucky Intellectual Property Sale Agreement Online

- How Do I eSignature Arkansas IT Consulting Agreement

- eSignature Arkansas IT Consulting Agreement Safe

- eSignature Delaware IT Consulting Agreement Online

- eSignature New Jersey IT Consulting Agreement Online

- How Can I eSignature Nevada Software Distribution Agreement

- eSignature Hawaii Web Hosting Agreement Online

- How Do I eSignature Hawaii Web Hosting Agreement

- eSignature Massachusetts Web Hosting Agreement Secure

- eSignature Montana Web Hosting Agreement Myself

- eSignature New Jersey Web Hosting Agreement Online

- eSignature New York Web Hosting Agreement Mobile

- eSignature North Carolina Web Hosting Agreement Secure

- How Do I eSignature Utah Web Hosting Agreement

- eSignature Connecticut Joint Venture Agreement Template Myself

- eSignature Georgia Joint Venture Agreement Template Simple

- eSignature Alaska Debt Settlement Agreement Template Safe