E213 Forma

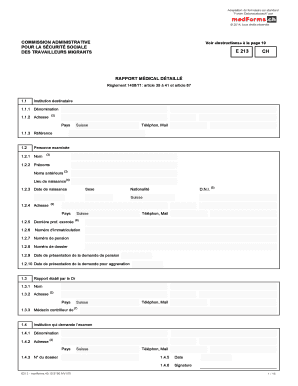

What is the E213 Forma

The E213 forma is a specific document used primarily for tax purposes in the United States. It serves as a means for individuals or businesses to report certain financial information to the relevant tax authorities. Understanding the purpose and requirements of the E213 forma is essential for compliance and accurate reporting.

How to use the E213 Forma

Using the E213 forma involves several key steps. First, gather all necessary financial documents and information required to complete the form accurately. Next, fill out the form carefully, ensuring that all fields are completed as per the instructions. Once completed, review the form for any errors before submission. It is important to follow any specific guidelines provided by the IRS or relevant tax authority to ensure proper use of the form.

Steps to complete the E213 Forma

Completing the E213 forma requires a systematic approach:

- Collect necessary financial records, including income statements and expense receipts.

- Obtain the latest version of the E213 forma, ensuring it is the correct one for the current tax year.

- Fill in personal or business information as required, including name, address, and tax identification number.

- Provide detailed financial information, ensuring accuracy in reporting income and expenses.

- Double-check all entries for completeness and correctness before finalizing the form.

Legal use of the E213 Forma

The E213 forma is legally binding when completed and submitted according to federal and state regulations. It must adhere to the guidelines set forth by the IRS, including accurate reporting and timely submission. Failure to comply with these regulations can result in penalties or legal repercussions. Therefore, understanding the legal implications of using the E213 forma is crucial for all users.

Key elements of the E213 Forma

Several key elements are essential when filling out the E213 forma:

- Identification Information: This includes the taxpayer's name, address, and identification number.

- Financial Reporting: Accurate reporting of income, deductions, and credits is vital for compliance.

- Signature: The form must be signed by the individual or authorized representative to validate its contents.

Form Submission Methods

The E213 forma can be submitted through various methods, ensuring flexibility for users. Common submission methods include:

- Online Submission: Many users opt to file electronically through the IRS e-file system.

- Mail: The form can also be printed and mailed to the appropriate tax authority.

- In-Person: Some individuals may choose to submit the form in person at designated tax offices.

Quick guide on how to complete e213 forma

Complete E213 Forma effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed paperwork, as you can access the necessary form and securely store it online. airSlate SignNow provides you with all the tools required to create, modify, and eSign your documents swiftly without delays. Handle E213 Forma on any device with airSlate SignNow's Android or iOS applications and enhance any document-based workflow today.

The easiest method to modify and eSign E213 Forma with ease

- Find E213 Forma and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select your preferred method of delivering your form, whether by email, SMS, or invite link, or download it to your computer.

Eliminate the worry of lost or misplaced files, tedious document searches, or mistakes that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you choose. Alter and eSign E213 Forma and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the e213 forma

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the e213 forma and how does it work?

The e213 forma is a digital document designed for efficient processing and signing. It facilitates the electronic signing of important documents, enabling users to complete paperwork online quickly and securely.

-

How can airSlate SignNow help with the e213 forma?

airSlate SignNow provides an intuitive platform for managing the e213 forma, ensuring that all signatures and approvals can be completed seamlessly. This enhances productivity by allowing users to handle the e213 forma without the need for physical paperwork.

-

Is there a cost associated with using the e213 forma on airSlate SignNow?

Yes, using the e213 forma with airSlate SignNow may incur a subscription fee, but it remains an affordable option for businesses. The pricing plans are designed to fit various organizational needs and budgets.

-

What features does airSlate SignNow offer for the e213 forma?

airSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage for the e213 forma. These tools help streamline the signing process and keep documents organized.

-

Can I integrate the e213 forma with other software?

Absolutely! airSlate SignNow supports integrations with various applications, allowing you to link the e213 forma with your existing tools and systems. This creates a more cohesive workflow within your organization.

-

What benefits does the e213 forma provide for businesses?

Utilizing the e213 forma allows businesses to expedite document handling, reduce costs associated with paper use, and improve compliance. With e-signatures, approvals become faster and more secure, adding signNow value.

-

Is the e213 forma legally binding?

Yes, documents signed using the e213 forma through airSlate SignNow are legally binding in many jurisdictions. The platform adheres to industry standards and regulations, ensuring that your e-signatures hold up in court.

Get more for E213 Forma

Find out other E213 Forma

- eSign Car Dealer Form Georgia Simple

- eSign Florida Car Dealer Profit And Loss Statement Myself

- eSign Georgia Car Dealer POA Mobile

- Sign Nebraska Courts Warranty Deed Online

- Sign Nebraska Courts Limited Power Of Attorney Now

- eSign Car Dealer Form Idaho Online

- How To eSign Hawaii Car Dealer Contract

- How To eSign Hawaii Car Dealer Living Will

- How Do I eSign Hawaii Car Dealer Living Will

- eSign Hawaii Business Operations Contract Online

- eSign Hawaii Business Operations LLC Operating Agreement Mobile

- How Do I eSign Idaho Car Dealer Lease Termination Letter

- eSign Indiana Car Dealer Separation Agreement Simple

- eSign Iowa Car Dealer Agreement Free

- eSign Iowa Car Dealer Limited Power Of Attorney Free

- eSign Iowa Car Dealer Limited Power Of Attorney Fast

- eSign Iowa Car Dealer Limited Power Of Attorney Safe

- How Can I eSign Iowa Car Dealer Limited Power Of Attorney

- How To eSign Illinois Business Operations Stock Certificate

- Can I eSign Louisiana Car Dealer Quitclaim Deed