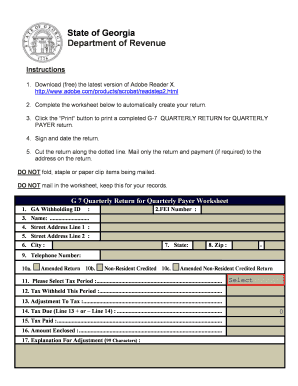

State of Georgia Department of Revenue Form

What is the State Of Georgia Department Of Revenue

The State of Georgia Department of Revenue is the governmental agency responsible for administering the state's tax laws and collecting taxes. This department oversees various tax types, including income tax, sales tax, and property tax. It ensures compliance with state tax regulations and provides resources for taxpayers to understand their obligations. The department also plays a crucial role in enforcing tax laws and conducting audits to maintain the integrity of the tax system.

How to use the State Of Georgia Department Of Revenue

Using the State of Georgia Department of Revenue involves understanding the specific forms and processes required for your tax situation. Taxpayers can access a variety of online services, including filing tax returns, checking the status of refunds, and making payments. The department's website offers guidance on how to fill out forms correctly and provides helpful resources for individuals and businesses alike. It's important to familiarize yourself with the available tools and resources to ensure compliance and efficiency in handling your tax matters.

Steps to complete the State Of Georgia Department Of Revenue

Completing forms for the State of Georgia Department of Revenue involves several key steps:

- Identify the correct form based on your tax situation, such as individual income tax or business tax.

- Gather all necessary documentation, including income statements, deductions, and credits.

- Fill out the form accurately, ensuring all information is complete and correct.

- Review the form for any errors or omissions before submission.

- Submit the form electronically through the department's online portal or via mail, depending on your preference.

Legal use of the State Of Georgia Department Of Revenue

The legal use of the State of Georgia Department of Revenue forms requires adherence to state tax laws and regulations. Electronic signatures are legally binding when specific criteria are met, ensuring that submitted forms are valid. Compliance with laws such as the Electronic Signatures in Global and National Commerce Act (ESIGN) and the Uniform Electronic Transactions Act (UETA) is essential. Taxpayers should ensure they understand their rights and responsibilities when using these forms to avoid potential legal issues.

Required Documents

When completing forms for the State of Georgia Department of Revenue, certain documents are typically required. These may include:

- W-2 forms from employers to report income.

- 1099 forms for other income sources, such as freelance work or investments.

- Documentation for deductions and credits, such as receipts for business expenses or educational expenses.

- Identification information, including Social Security numbers for individuals and Employer Identification Numbers for businesses.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit forms to the State of Georgia Department of Revenue through various methods:

- Online submission via the department's website, which is often the fastest and most efficient option.

- Mailing completed forms to the appropriate address as specified on the form.

- In-person submission at designated department offices for those who prefer direct interaction.

Quick guide on how to complete state of georgia department of revenue

Prepare State Of Georgia Department Of Revenue effortlessly on any device

Online document management has become increasingly popular among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed paperwork, allowing you to find the right form and securely keep it online. airSlate SignNow equips you with all the essential tools to create, modify, and electronically sign your documents quickly and without delays. Manage State Of Georgia Department Of Revenue on any device with airSlate SignNow Android or iOS applications and enhance any document-centered operation today.

How to alter and eSign State Of Georgia Department Of Revenue with ease

- Obtain State Of Georgia Department Of Revenue and then click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate the worry of lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device of your choosing. Edit and eSign State Of Georgia Department Of Revenue and ensure exceptional communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the state of georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow and how does it relate to the State Of Georgia Department Of Revenue?

airSlate SignNow is an electronic signature platform that allows businesses to send and eSign documents easily. For businesses interacting with the State Of Georgia Department Of Revenue, it streamlines the process of submitting forms and documents efficiently and securely.

-

How can airSlate SignNow benefit my business when dealing with the State Of Georgia Department Of Revenue?

Using airSlate SignNow, businesses can expedite document workflows associated with the State Of Georgia Department Of Revenue. This ensures that all necessary paperwork is completed and submitted promptly, reducing the risk of delays and penalties.

-

What features does airSlate SignNow offer for compliance with the State Of Georgia Department Of Revenue?

airSlate SignNow offers features such as customizable templates, advanced security protocols, and compliance with state regulations. These features help ensure that your documents meet the requirements set forth by the State Of Georgia Department Of Revenue.

-

Is airSlate SignNow cost-effective for small businesses interacting with the State Of Georgia Department Of Revenue?

Yes, airSlate SignNow is a cost-effective solution for small businesses. With flexible pricing plans, companies can choose a package that fits their budget while still accessing essential features needed to manage documents with the State Of Georgia Department Of Revenue.

-

Can I integrate airSlate SignNow with other applications for my work with the State Of Georgia Department Of Revenue?

Absolutely! airSlate SignNow offers integrations with several popular applications such as Google Drive and Salesforce. This makes it easier for businesses to manage their workflow and documents in conjunction with the State Of Georgia Department Of Revenue.

-

How secure is airSlate SignNow when handling documents for the State Of Georgia Department Of Revenue?

airSlate SignNow prioritizes security with features like data encryption and secure cloud storage. These measures ensure that your documents shared with the State Of Georgia Department Of Revenue are protected against unauthorized access.

-

What is the process for eSigning documents related to the State Of Georgia Department Of Revenue using airSlate SignNow?

The process is straightforward: upload your document, add recipient details, and send it for eSignature. Once signed via airSlate SignNow, the documents can be instantly forwarded to the State Of Georgia Department Of Revenue for processing.

Get more for State Of Georgia Department Of Revenue

- Established patient treatment form brookwood internists pc

- Jack and jill national legacy form

- Form 103 long state of indiana wellscounty

- Q small claims court courts state co form

- Audition registration forms pdf peninsula youth theatre pytnet

- Divorce forms indiana

- Prospective tenant form

- Illinois support form

Find out other State Of Georgia Department Of Revenue

- eSignature Michigan Escrow Agreement Simple

- How Do I Electronic signature Alabama Non-Compete Agreement

- How To eSignature North Carolina Sales Receipt Template

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online