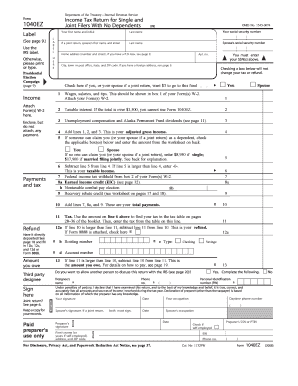

Income Tax Return for Single and Joint Filers with No Dependents Answers Form

What is the income tax return for single and joint filers with no dependents?

The income tax return for single and joint filers with no dependents is a specific form used by individuals or couples who do not have any qualifying dependents. This form is essential for reporting income, calculating tax liabilities, and determining eligibility for various tax credits and deductions. For single filers, it simplifies the filing process, allowing for a straightforward calculation of taxable income based on personal earnings without the complexities that come with dependents. Joint filers can also benefit from potential tax advantages, such as lower tax rates or increased deductions, even without dependents.

Steps to complete the income tax return for single and joint filers with no dependents

Completing the income tax return for single and joint filers with no dependents involves several key steps:

- Gather all necessary documents, including W-2 forms, 1099 forms, and any other income statements.

- Determine your filing status as either single or married filing jointly.

- Calculate your total income by adding all sources of income together.

- Identify and apply any applicable deductions or credits, such as the standard deduction.

- Complete the tax return form accurately, ensuring all information is correct.

- Review the completed form for any errors before submission.

- File the return electronically or by mail, ensuring it is submitted by the deadline.

Required documents for the income tax return for single and joint filers with no dependents

When filing the income tax return for single and joint filers with no dependents, certain documents are essential to ensure accurate reporting. These include:

- W-2 forms from employers, detailing annual earnings and taxes withheld.

- 1099 forms for any freelance or contract work, indicating non-employee compensation.

- Records of additional income sources, such as interest or dividends.

- Receipts for any deductible expenses, if applicable.

- Social Security numbers for all individuals listed on the return.

IRS guidelines for the income tax return for single and joint filers with no dependents

The IRS provides specific guidelines for completing the income tax return for single and joint filers with no dependents. Key points include:

- Understanding the difference between standard and itemized deductions, and choosing the one that maximizes tax benefits.

- Filing deadlines, which typically fall on April fifteenth unless it falls on a weekend or holiday.

- Maintaining accurate records for at least three years in case of an audit.

- Utilizing IRS resources, such as publications and online tools, to clarify any questions regarding tax laws and filing procedures.

Digital vs. paper version of the income tax return for single and joint filers with no dependents

When choosing between the digital and paper versions of the income tax return for single and joint filers with no dependents, consider the following:

- Digital submissions are generally faster, allowing for quicker processing and potential refunds.

- Electronic filing often reduces the risk of errors, as software can guide users through the process.

- Paper filing may be preferred by those who are more comfortable with traditional methods, but it can lead to longer processing times.

- Both methods require careful attention to detail to ensure compliance with IRS regulations.

Legal use of the income tax return for single and joint filers with no dependents

The legal use of the income tax return for single and joint filers with no dependents is crucial for ensuring compliance with federal tax laws. This form serves as a legal document that must be completed accurately to avoid penalties. Key legal aspects include:

- The requirement to report all income sources truthfully to avoid tax evasion allegations.

- Understanding the implications of filing jointly, as both parties are responsible for the accuracy of the return.

- Awareness of potential audits and the need to retain documentation that supports the information reported.

- Compliance with state-specific tax regulations, which may vary from federal guidelines.

Quick guide on how to complete income tax return for single and joint filers with no dependents answers

Complete Income Tax Return For Single And Joint Filers With No Dependents Answers seamlessly on any device

Web-based document management has gained popularity among companies and individuals. It offers a great eco-friendly substitute for traditional printed and signed documents, as you can easily access the right form and safely archive it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents quickly without delays. Manage Income Tax Return For Single And Joint Filers With No Dependents Answers on any device with airSlate SignNow Android or iOS applications and enhance any document-centric process today.

How to modify and eSign Income Tax Return For Single And Joint Filers With No Dependents Answers effortlessly

- Find Income Tax Return For Single And Joint Filers With No Dependents Answers and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Mark important sections of the documents or obscure sensitive details with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow meets your document management needs with just a few clicks from any device of your choice. Edit and eSign Income Tax Return For Single And Joint Filers With No Dependents Answers and ensure effective communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the income tax return for single and joint filers with no dependents answers

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What options does airSlate SignNow offer for individuals who are single with no dependents?

airSlate SignNow provides flexible pricing plans tailored for individuals, including those who are single with no dependents. These plans allow for efficient document creation and eSigning without the need for additional user fees associated with larger teams or families.

-

How does airSlate SignNow benefit someone who is single with no dependents?

For individuals who are single with no dependents, airSlate SignNow offers a streamlined way to manage personal and professional documentation. Its user-friendly interface enhances productivity, making it easy to send and sign documents quickly, ensuring that you spend less time on paperwork.

-

Are there specific features in airSlate SignNow that cater to singles with no dependents?

Yes, airSlate SignNow includes features particularly advantageous for singles with no dependents, such as customizable templates and automated reminders. These features help you efficiently track and manage your documents, meeting your specific needs without unnecessary complexity.

-

What is the pricing structure for a single user with no dependents on airSlate SignNow?

The pricing structure for airSlate SignNow is designed to be budget-friendly for individuals, including those who are single with no dependents. You can choose from monthly or annual plans, and the transparent pricing ensures there are no hidden fees, making it an economical choice for personal usage.

-

Can I integrate airSlate SignNow with other applications if I am single with no dependents?

Yes, airSlate SignNow offers integrations with various applications that are especially useful for singles with no dependents. Whether you need it for personal finance management or task organization, you can seamlessly connect your favorite tools to enhance productivity and document management.

-

Is customer support available for singles with no dependents using airSlate SignNow?

Absolutely! airSlate SignNow provides dedicated customer support for all users, including those who are single with no dependents. Whether you have questions about features or need assistance with your account, our support team is ready to help you make the most of your experience.

-

How secure is airSlate SignNow for someone who is single with no dependents?

Security is a top priority for airSlate SignNow, especially for users who are single with no dependents managing their personal information. The platform employs robust encryption methods and follows industry-standard protocols to ensure that your documents are safe and secure at all times.

Get more for Income Tax Return For Single And Joint Filers With No Dependents Answers

- Psc online application uganda form

- Navmc 10939a jrotc memo receipt for uniform issue male cadet updated to livecycle designer 8 and update reader extension

- Narcotic drug form sample

- Ohio os 32 form

- Tn dept of revrnue discharge of lien form

- Client credit card pre authorization form options pa lawpay

- Ced credit application and agreement electrical supplier ced form

- Form 1a 1

Find out other Income Tax Return For Single And Joint Filers With No Dependents Answers

- How Do I eSignature Arizona Courts Moving Checklist

- eSignature Wyoming Real Estate Quitclaim Deed Myself

- eSignature Wyoming Real Estate Lease Agreement Template Online

- How Can I eSignature Delaware Courts Stock Certificate

- How Can I eSignature Georgia Courts Quitclaim Deed

- Help Me With eSignature Florida Courts Affidavit Of Heirship

- Electronic signature Alabama Banking RFP Online

- eSignature Iowa Courts Quitclaim Deed Now

- eSignature Kentucky Courts Moving Checklist Online

- eSignature Louisiana Courts Cease And Desist Letter Online

- How Can I Electronic signature Arkansas Banking Lease Termination Letter

- eSignature Maryland Courts Rental Application Now

- eSignature Michigan Courts Affidavit Of Heirship Simple

- eSignature Courts Word Mississippi Later

- eSignature Tennessee Sports Last Will And Testament Mobile

- How Can I eSignature Nevada Courts Medical History

- eSignature Nebraska Courts Lease Agreement Online

- eSignature Nebraska Courts LLC Operating Agreement Easy

- Can I eSignature New Mexico Courts Business Letter Template

- eSignature New Mexico Courts Lease Agreement Template Mobile