Columbia Bank Personal Financial Statement Form

What is the Columbia Bank Personal Financial Statement

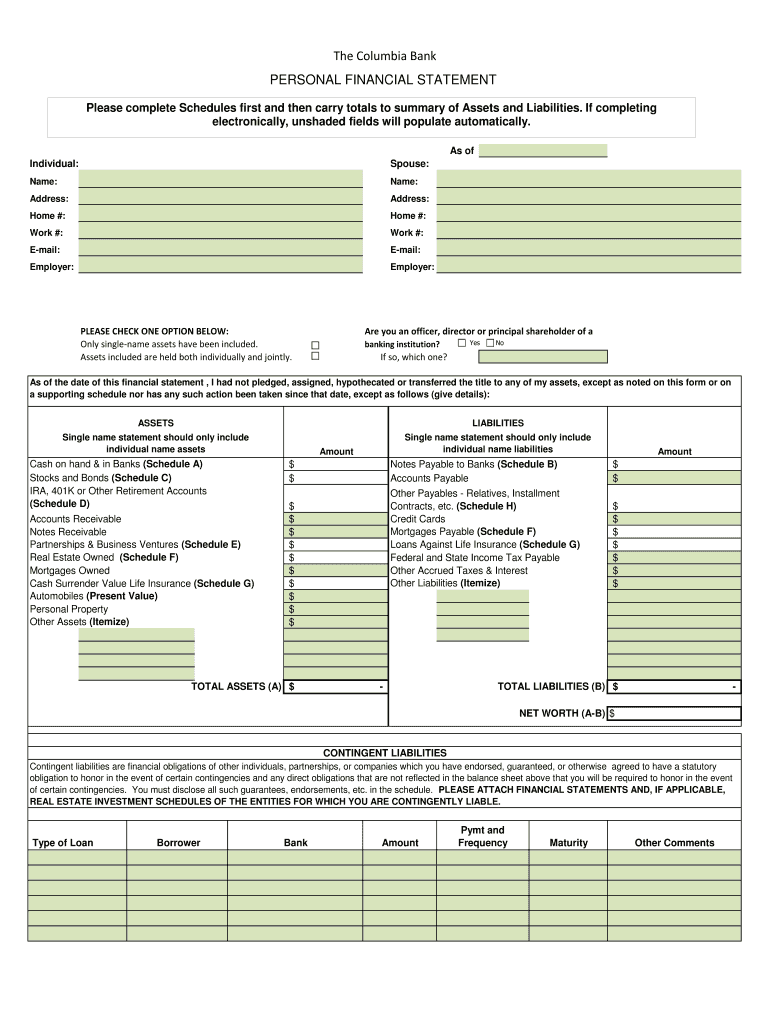

The Columbia Bank Personal Financial Statement is a comprehensive document that outlines an individual's financial status. This form is essential for various financial transactions, including loan applications and credit assessments. It typically includes details about assets, liabilities, income, and expenses, providing a clear picture of one's financial health. By completing this statement, individuals can present their financial information in a structured format, which is often required by lenders and financial institutions.

How to use the Columbia Bank Personal Financial Statement

Using the Columbia Bank Personal Financial Statement involves filling out the required sections accurately. Start by gathering all necessary financial documents, such as bank statements, tax returns, and proof of income. Next, complete the form by entering your assets, including cash, investments, and property. Then, list your liabilities, such as loans and credit card debts. Finally, ensure that all information is up-to-date and reflects your current financial situation. This completed statement can be submitted to banks or lenders as part of your financial application process.

Steps to complete the Columbia Bank Personal Financial Statement

Completing the Columbia Bank Personal Financial Statement involves several key steps:

- Gather necessary financial documents, including income statements and asset valuations.

- Fill in your personal information, such as name, address, and contact details.

- Detail your assets, including cash, real estate, and investments.

- List your liabilities, including mortgages, loans, and credit card debts.

- Calculate your net worth by subtracting total liabilities from total assets.

- Review the information for accuracy and completeness.

- Sign and date the statement to validate it.

Key elements of the Columbia Bank Personal Financial Statement

The Columbia Bank Personal Financial Statement comprises several key elements that are crucial for a complete assessment:

- Personal Information: Includes your name, address, and contact details.

- Assets: A detailed list of all financial assets, such as cash, stocks, bonds, and real estate.

- Liabilities: A comprehensive list of all debts, including loans and credit card balances.

- Income: Information on all sources of income, including salary, rental income, and dividends.

- Expenses: A breakdown of monthly expenses to provide insight into financial obligations.

Legal use of the Columbia Bank Personal Financial Statement

The Columbia Bank Personal Financial Statement is legally recognized when completed accurately and signed by the individual. It serves as a formal declaration of one's financial status and can be used in various legal and financial contexts, such as loan applications or financial disclosures. Ensuring compliance with relevant laws and regulations is essential, as inaccuracies can lead to legal repercussions or denial of financial requests. Using a reliable platform for electronic signatures can enhance the legal standing of the completed document.

How to obtain the Columbia Bank Personal Financial Statement

Obtaining the Columbia Bank Personal Financial Statement can be done through several methods. Individuals can visit the Columbia Bank website to download a printable version of the form. Alternatively, the form may be available at local Columbia Bank branches. It is advisable to check for the most current version to ensure all information is accurate and up-to-date. If assistance is needed, contacting a representative at Columbia Bank can provide guidance on obtaining the form.

Quick guide on how to complete pdf personal financial form

The optimal approach to locate and endorse Columbia Bank Personal Financial Statement

At the magnitude of an entire organization, ineffective procedures regarding document endorsement can consume a signNow amount of working hours. Signing documents such as Columbia Bank Personal Financial Statement is an essential aspect of operations in any enterprise, which is why the efficiency of each contract's lifecycle signNowly impacts the overall performance of the organization. With airSlate SignNow, endorsing your Columbia Bank Personal Financial Statement is as straightforward and quick as possible. You will discover on this platform the latest version of nearly any form. Even better, you can sign it instantly without the necessity of downloading external applications on your computer or printing out hard copies.

Steps to acquire and endorse your Columbia Bank Personal Financial Statement

- Explore our collection by category or utilize the search bar to find the form you require.

- Examine the form preview by clicking Learn more to confirm it is the correct one.

- Select Get form to commence editing immediately.

- Fill in your form and insert any required information using the toolbar.

- Once completed, click the Sign tool to endorse your Columbia Bank Personal Financial Statement.

- Choose the signature method that is most suitable for you: Draw, Create initials, or upload an image of your handwritten signature.

- Click Done to conclude editing and move on to document-sharing options as needed.

With airSlate SignNow, you have everything necessary to handle your documents efficiently. You can locate, fill out, modify, and even dispatch your Columbia Bank Personal Financial Statement in a single tab without any hassle. Simplify your procedures by utilizing a unified, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

I am a layman. What is Form 16, Income Tax return and the fuss about it?

The filing of Income Tax returns is a mandatory duty along with the payment of Income Tax to the Government of India . As the season closes by (last date of filing return - 5th August for 2014), many new tax-payers are in qualms as to how to go with the procedure as well as do away with the seemingly complicated mechanism behind it .Following are some of the pointers , which I acquired through self-learning (all are written considering the tax procedures for an Individual, and not Companies or other organizations). Here goes :1) Firstly , it is important to understand that Income Tax return is a document which is filed by you stating your Total Income in a Financial Year through various sources of income i.e Salary , business, house property, etc . (Financial Year is the year of your income , and Assessment Year is the year next to it in which the tax is due . Eg - Financial Year 2013-14, Assessment Year 2014-15)It also states the Taxable income on that salary and the Total tax payable with surcharges and Education Cess . The Taxable income has an exemption of upto 2 lakh rupees(For an individual, and not a senior citizen) for this assessment year , and 2.5 lakhs for the next (As per the new budget) . You also get tax exemptions on various other investments/allowances such as HRA , Fixed Deposits , Insurance Policies , Provident Funds , Children's Education , etc under various clauses of Section 80.People should know that return is filed to intimate the Government of your tax statements and it should not be confused with the Tax-refund one gets if there is a surplus tax paid by you to the Government . Return is not Refund .2) Government of India collects Income Tax through three modes :a) TDS - Tax Deduction at Source . TDS is the system in which any corporation/business as an Employer is supposed to deduct the Income tax of an Employee from his/her salary at source and submit it to the GOI before the end of Financial Year . The tax is deducted regularly from the employee's salary in certain percentage so as to overcome the liability of Total Tax to be paid by the employer for the Financial Year.The Employer issues a TDS Certificate in the form of Form 16 or Form 16A to the Employee which would be used to claim the TDS by the employee while filing his/her return . Form 16 is the certificate issued for the tax deducted under the head Salaries . Form 16A is issued for tax deducted for income through other sources such as interests on securities,dividends,winnings,etc.If the employee has some extra income through other sources , he/she should intimate the Employer about it before so as to include it for TDS . The total tax paid by you through TDS is also available online on the TRACES portal which is linked to your Bank Account and PAN No. for your convenience . You can also generate and validate your Form 16 / 16A from the website to file your return online .b) Advance Tax and Self Assessment Tax .Advance Tax may also be called 'Pay as you earn' Tax . In India one has to estimate his income during the financial year.If your projected tax liability of the current Financial year is more than Rs 10000, you are supposed to pay Advance tax !This has to be paid in three instalments. 30 % by 15th Sept,60% minus first instalment by 15th Dec and 100% minus 2nd instalment by 15th March.For individuals who are earning only through salaries , the Advance Tax is taken care of through TDS by the employers and there is hardly any Advance Tax to be paid . But for individuals who have other sources of income , they have to pay Advance Tax .If one forgets to pay he is liable to pay interest @ 1% p.m.Self-Assessment Tax - While filing your Return of Income, one does a computation of income and taxes to be filled in the Return. On computation, sometimes it is noted that the Taxes paid either as Advance Tax or by way of TDS fall short of the Actual Tax Payable . The shortfall so determined is called the Self Assessment Tax which is payable before filing the Return of Income. c) TCS - Tax Collection at Source .Tax Collected at Source (TCS) is income tax collected by a Seller from a Payer on sale of certain items. The seller has to collect tax at specified rates from the payer who has purchased these items : Alcoholic liquor for human consumption Tendu leaves Timber obtained under a forest lease Timber obtained by any mode other than under a forest lease Any other forest produce not being timber or tendu leaves Scrap Minerals being coal or lignite or iron ore Scrap BatteriesSalaried Individuals are not concerned with TCS .3) Online Procedure for Filing your Return , Payment of Tax , and viewing/generating your TDS certificate . a) Filing Income Tax Return :The procedure is as simple as it gets . You have to go to the E-filing homepage of the GOI , i.e https://incometaxindiaefiling.go... and login to your account . If you don't have an account yet , you can create it through the 'Register Yourself' link above it . All you need is a PAN No. (obviously) . After logging in , you have to go to the E-file tab and select the 'Prepare and Submit online ITR' option . Alternatively , you can select the 'Upload Return' option to upload your return through an XML file downloaded from the 'Downloads' tab and filled offline by you .You have to enter your PAN No, select ITR Form name 'ITR1' (Form ITR1 is for salaried individuals, income from house property and other income) , select Assessment year and submit .Now all you have to do is fill the form with the tabs Personal Information , Income Details , Tax Details , Tax Paid and Verification and 80G to complete your Return and submit it to the Income Tax Department .The 'Income Details' tab asks for your Total Income through various sources , and Tax exemptions claimed by you under various clauses of Section 80 . It also computes the Income tax liability of yours for that Financial Year . The 'Tax details' tab asks for the TAN (Tax Deduction Account Number) and Details of Form 16/16A issued by the employer/generated by you for TDS . It also asks for Advance Tax / Self Assessment Tax, if paid and the Challan no. of the payment receipt .The 'Tax Paid and Verification' Tab asks for your Bank Account Number and IFSC code . If there is a surplus tax paid by you in the form of TDS/Advance Tax , you will get its refund with interest in a 4 months period by the Income Tax Department . After submitting the Return , you get a link on your registered E-mail id . This link provides you the ITR-V document (an acknowledgement slip) which you have to download , print , put your signature , and send it to the Bangalore division of the Income Tax Department for completion of your Return Filing . The address is mentioned in the document . Alternatively , you can evade the ITR-V process and opt to digitally sign in the beginning of E-filing , but the process requires you to spend money and is to be renewed every year .b) Payment of Tax - You can pay the TDS (Not required for an individual, it is to be paid by the employer) , Advance Tax or Self Assessment Tax through the portal of Tax Information Network , i.e e-TAX Payment System After filling the required form (ITNS 280 for Income Tax) , you pay the tax through your Bank Account , and get a Challan receipt which will be used during filing your return .c) View/ Generate TDS Certificate online .You can do it by logging on to the TRACES portal of the Tax Deduction System , i.e , Page on tdscpc.gov.in You will have to register yourself before logging in through your PAN no.You can view the details of your TDS deducted by the Employer via From 26AS on the portal .Also , you can generate your TDS Certificate in the form of Form 16/16A by entering the TAN No. of your Employer .

-

How do I fill a form which is PDF?

You can try out Fill which had a free forever plan and requires no download. You simply upload your PDF and then fill it in within the browser:UploadFillDownloadIf the fields are live, as in the example above, simply fill them in. If the fields are not live you can drag on the fields to complete it quickly. Once you have completed the form click the download icon in the toolbar to download a copy of the finished PDF. Or send it for signing.Open a free account on Fill here

-

How can I electronically fill out a PDF form?

You’ll need a PDF editor to fill out forms. I recommend you PDF Expert, it’s a great solution for Mac.What forms it supports:Acro forms created in signNow or similar programs.Static XFA forms created in signNow LiveCycle.PDF Expert supports checkboxes and text fields. Just click them and type what you need.If your form is non-interactive, you can type on it using the ‘Text’ tool (go to the ‘Annotate’ tab > ‘Text’).For a non-interactive checkbox, you can use the ‘Stamp’ tool or just type ‘x’ on it.For a more detailed tutorial, check the article “How to fill out a PDF form on Mac”. And here are the guides on how to fill out different tax forms.Hopefully, this helps!

-

How do you fill out a form scanned as a PDF?

If you have Acrobat Reader or Foxit Phantom, you can add form to the PDF file you want to fill in. Refer to the screenshot here (Phantom). First click on Form, then you can pick option you want for your form (Text Field, Check box…) and draw it where you want to input your data. You can also change font and size of it to fit the existing text. When you are done adding the fields, you can just click on the hand icon, and you can now fill in your form and then save it as.

-

What is the best way to fill out a PDF form?

If you are a user of Mac, iPhone or iPad, your tasks will be quickly and easily solved with the help of PDF Expert. Thanks to a simple and intuitive design, you don't have to dig into settings and endless options. PDF Expert also allows you to view, edit, reduce, merge, extract, annotate important parts of documents in a click. You have a special opportunity to try it on your Mac for free!

-

Is it possible to display a PDF form on mobile web to fill out and get e-signed?

Of course, you can try a web called eSign+. This site let you upload PDF documents and do some edition eg. drag signature fields, add date and some informations. Then you can send to those, from whom you wanna get signatures.

-

Is there a service that will allow me to create a fillable form on a webpage, and then email a PDF copy of each form filled out?

You can use Fill which is has a free forever plan.You can use Fill to turn your PDF document into an online document which can be completed, signed and saved as a PDF, online.You will end up with a online fillable PDF like this:w9 || FillWhich can be embedded in your website should you wish.InstructionsStep 1: Open an account at Fill and clickStep 2: Check that all the form fields are mapped correctly, if not drag on the text fields.Step 3: Save it as a templateStep 4: Goto your templates and find the correct form. Then click on the embed settings to grab your form URL.

-

When is it mandatory to fill out a personal financial statement for one's bank? The form states no deadline about when it must be returned.

The only time I know that financial statements are asked for is when one applies for a business or personal loan, or applying for a mortgage. Each bank or credit union can have their own document requirements, however for each transaction. It really is at their discretion.

Create this form in 5 minutes!

How to create an eSignature for the pdf personal financial form

How to make an electronic signature for the Pdf Personal Financial Form online

How to create an electronic signature for the Pdf Personal Financial Form in Chrome

How to make an electronic signature for putting it on the Pdf Personal Financial Form in Gmail

How to make an electronic signature for the Pdf Personal Financial Form from your mobile device

How to create an eSignature for the Pdf Personal Financial Form on iOS devices

How to generate an eSignature for the Pdf Personal Financial Form on Android devices

People also ask

-

What is a Columbia Bank Personal Financial Statement?

The Columbia Bank Personal Financial Statement is a comprehensive document that outlines your financial situation, including assets, liabilities, income, and expenses. This statement is essential for applying for loans or credit, providing lenders with a clear picture of your financial health.

-

How can I complete a Columbia Bank Personal Financial Statement using airSlate SignNow?

You can easily complete a Columbia Bank Personal Financial Statement using airSlate SignNow by uploading your financial data into our secure platform. Our user-friendly interface allows you to fill out the necessary fields, and you can eSign the document quickly and securely.

-

What are the benefits of using airSlate SignNow for my Columbia Bank Personal Financial Statement?

Using airSlate SignNow for your Columbia Bank Personal Financial Statement offers several benefits, including a streamlined signing process, enhanced security features, and the ability to send documents directly to your lender. Additionally, our cost-effective solution saves you time and ensures your information is handled with care.

-

Is there a cost associated with using airSlate SignNow for Columbia Bank Personal Financial Statements?

Yes, while airSlate SignNow offers various pricing plans, the cost is generally very competitive compared to traditional methods of signing documents. We provide a range of options to suit different business needs, ensuring you can manage your Columbia Bank Personal Financial Statement efficiently and affordably.

-

Can I integrate airSlate SignNow with other tools for managing my Columbia Bank Personal Financial Statement?

Absolutely! airSlate SignNow offers seamless integrations with a variety of third-party applications, allowing you to manage your Columbia Bank Personal Financial Statement alongside your existing tools. This integration enhances productivity and keeps all your financial documents organized in one place.

-

How secure is my data when using airSlate SignNow for Columbia Bank Personal Financial Statements?

Your data is highly secure with airSlate SignNow, as we employ advanced encryption methods and other security protocols to protect your Columbia Bank Personal Financial Statement. We prioritize the confidentiality and integrity of your information, ensuring that only authorized users have access.

-

Can I track the status of my Columbia Bank Personal Financial Statement sent via airSlate SignNow?

Yes, airSlate SignNow allows you to track the status of your Columbia Bank Personal Financial Statement in real-time. You will receive notifications when your document is viewed, signed, or completed, providing you with full visibility throughout the signing process.

Get more for Columbia Bank Personal Financial Statement

- Sapperton terrace housing co operative form

- Www lifeindenmark dk atp form

- Modulo di contestazione addebitoclaim form

- Metlife absolute assignment form

- Educational enhancement opportunity definition fcps form

- Fai aba form

- Teacher certification and renewal kentucky department of form

- Service line and meter set application form

Find out other Columbia Bank Personal Financial Statement

- How To eSign California Home Loan Application

- How To eSign Florida Home Loan Application

- eSign Hawaii Home Loan Application Free

- How To eSign Hawaii Home Loan Application

- How To eSign New York Home Loan Application

- How To eSign Texas Home Loan Application

- eSignature Indiana Prenuptial Agreement Template Now

- eSignature Indiana Prenuptial Agreement Template Simple

- eSignature Ohio Prenuptial Agreement Template Safe

- eSignature Oklahoma Prenuptial Agreement Template Safe

- eSignature Kentucky Child Custody Agreement Template Free

- eSignature Wyoming Child Custody Agreement Template Free

- eSign Florida Mortgage Quote Request Online

- eSign Mississippi Mortgage Quote Request Online

- How To eSign Colorado Freelance Contract

- eSign Ohio Mortgage Quote Request Mobile

- eSign Utah Mortgage Quote Request Online

- eSign Wisconsin Mortgage Quote Request Online

- eSign Hawaii Temporary Employment Contract Template Later

- eSign Georgia Recruitment Proposal Template Free