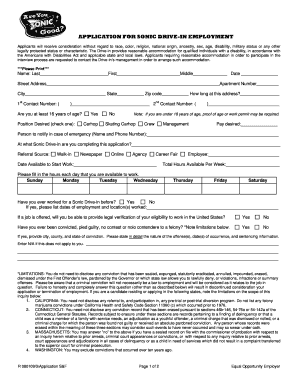

APPLICATION for SONIC DRIVE in EMPLOYMENT Form

What is the sonic w2 form?

The sonic w2 form, also known as the Sonic Drive-In W-2, is a tax document provided by Sonic Drive-In to its employees. This form reports the annual wages earned and the taxes withheld from an employee's paycheck. It is essential for employees to accurately complete their tax returns, as it summarizes their earnings and tax contributions for the year. Understanding the sonic w2 form is vital for both current and former employees to ensure compliance with IRS regulations.

How to obtain the sonic w2 form

Employees can obtain their sonic w2 form through the Sonic employee portal. Accessing the portal requires a secure login, which typically includes a username and password. Once logged in, employees can navigate to the tax documents section to view and download their W-2 forms. For former employees, the process remains similar, but they may need to follow specific instructions for accessing their records if they no longer have an active account.

Steps to complete the sonic w2 form

Completing the sonic w2 form involves several straightforward steps:

- Access the form through the Sonic employee portal or download it from your email if provided.

- Fill in your personal information, including your name, address, and Social Security number.

- Review the earnings and tax withholding information to ensure accuracy.

- Sign and date the form, confirming that the information provided is correct.

- Submit the completed form to the appropriate tax authority or include it with your tax return.

Legal use of the sonic w2 form

The sonic w2 form is legally binding and must be filled out accurately to comply with IRS regulations. It serves as proof of income and tax payments, which is essential during tax filing. Employees should ensure that all information is correct and that they retain a copy for their records. Misreporting or failing to submit the form can lead to penalties, so understanding its legal implications is crucial.

IRS guidelines for the sonic w2 form

The IRS has specific guidelines regarding the sonic w2 form that employees must follow. The form must be issued by January 31 of each year, allowing employees sufficient time to file their taxes. The IRS requires that all income and withholding amounts be accurately reported to avoid discrepancies. Employees should also be aware of the deadlines for filing their tax returns to ensure compliance and avoid penalties.

Filing deadlines for the sonic w2 form

Filing deadlines for the sonic w2 form align with general tax filing deadlines set by the IRS. Employees must receive their W-2 forms by January 31, and they should file their tax returns by April 15. If April 15 falls on a weekend or holiday, the deadline may be extended. Staying informed about these deadlines is essential for timely tax filing and to avoid any potential penalties.

Quick guide on how to complete application for sonic drive in employment

Effortlessly Prepare APPLICATION FOR SONIC DRIVE IN EMPLOYMENT on Any Device

Digital document management has gained traction among businesses and individuals. It offers an ideal eco-friendly substitute to conventional printed and signed paperwork, allowing you to acquire the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents swiftly without delays. Manage APPLICATION FOR SONIC DRIVE IN EMPLOYMENT across any platform using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to Modify and eSign APPLICATION FOR SONIC DRIVE IN EMPLOYMENT with Ease

- Find APPLICATION FOR SONIC DRIVE IN EMPLOYMENT and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of the documents or obscure sensitive data with tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign tool, which takes seconds and holds the same legal authority as a traditional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Adjust and eSign APPLICATION FOR SONIC DRIVE IN EMPLOYMENT and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the application for sonic drive in employment

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the process for obtaining my sonic w2 as a former employee?

As a sonic w2 former employee, you can access your W-2 forms through the official employee portal or contact your HR department directly. Additionally, airSlate SignNow allows for easy electronic signing and management of documents, streamlining the process of retrieving your W-2 forms.

-

Are there any fees associated with obtaining my sonic w2 as a former employee?

Generally, there are no fees for accessing your sonic w2 former employee documents through the official channels. However, if you opt to use services like airSlate SignNow for e-signing or document management, it offers flexible pricing plans to cater to individual needs without hidden costs.

-

Can airSlate SignNow help with other employment-related documents for sonic w2 former employees?

Yes, airSlate SignNow provides a comprehensive platform for managing various employment-related documents, including tax forms and contracts. This makes it easier for sonic w2 former employees to securely sign and share their documents electronically.

-

What features does airSlate SignNow offer for former employees needing their sonic w2?

airSlate SignNow offers several features beneficial for sonic w2 former employees, such as document tracking, templates for quick document creation, and secure e-signing capabilities. This ensures that retrieving and signing necessary documents is both efficient and safe.

-

How secure is the airSlate SignNow platform for handling sensitive documents like sonic w2 forms?

Security is a top priority at airSlate SignNow. The platform uses advanced encryption and security measures to protect all documents, including sonic w2 former employee forms, ensuring that your sensitive information remains safe and confidential.

-

Can I integrate airSlate SignNow with other tools to manage my sonic w2 as a former employee?

Absolutely! airSlate SignNow offers integrations with various tools and platforms, enhancing your workflow. This flexibility allows sonic w2 former employees to seamlessly manage their documents in conjunction with other applications they may already use.

-

What are the benefits of using airSlate SignNow for handling my sonic w2 as a former employee?

Using airSlate SignNow grants sonic w2 former employees the benefit of convenience, as you can easily access, sign, and share your documents online. The platform is designed to be user-friendly, cost-effective, and helps to speed up the entire document management process.

Get more for APPLICATION FOR SONIC DRIVE IN EMPLOYMENT

Find out other APPLICATION FOR SONIC DRIVE IN EMPLOYMENT

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free

- eSign Louisiana Insurance Promissory Note Template Simple

- eSign Texas Lawers Contract Fast

- eSign Texas Lawers Lease Agreement Free

- eSign Maine Insurance Rental Application Free

- How Can I eSign Maryland Insurance IOU