SALES and USE TAX REPORT Form

What is the SALES AND USE TAX REPORT

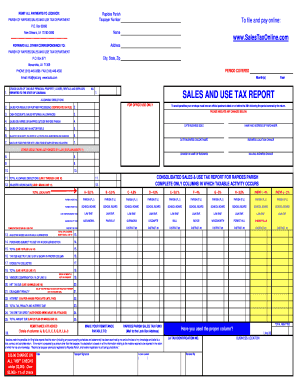

The SALES AND USE TAX REPORT is a crucial document used by businesses to report and remit sales tax collected from customers and use tax owed on purchases made without sales tax. This report helps ensure compliance with state tax laws and provides a clear record of tax obligations. It is essential for maintaining accurate financial records and avoiding potential penalties for non-compliance.

How to use the SALES AND USE TAX REPORT

Using the SALES AND USE TAX REPORT involves several steps. First, gather all relevant sales data, including total sales, tax collected, and any exempt sales. Next, calculate the total use tax owed on items purchased without sales tax. Fill out the report accurately, ensuring all figures are correct. Finally, submit the report to the appropriate state tax authority by the specified deadline.

Steps to complete the SALES AND USE TAX REPORT

Completing the SALES AND USE TAX REPORT requires careful attention to detail. Follow these steps:

- Collect sales records and receipts for the reporting period.

- Calculate total sales and sales tax collected.

- Determine any purchases subject to use tax.

- Fill out the report, ensuring all sections are completed accurately.

- Review the report for errors or omissions.

- Submit the completed report to your state tax authority.

Legal use of the SALES AND USE TAX REPORT

The SALES AND USE TAX REPORT is legally binding when filled out and submitted correctly. To ensure its legal standing, the report must comply with state regulations and be signed by an authorized individual. Utilizing electronic signatures can enhance the document's validity, provided that the eSignature solution meets legal standards such as ESIGN and UETA.

Filing Deadlines / Important Dates

Filing deadlines for the SALES AND USE TAX REPORT vary by state and can depend on the frequency of reporting (monthly, quarterly, or annually). It is important to be aware of these deadlines to avoid penalties. Typically, reports are due on the last day of the month following the reporting period. Check with your state tax authority for specific dates.

Required Documents

To complete the SALES AND USE TAX REPORT, certain documents are typically required. These may include:

- Sales records and invoices.

- Receipts for purchases subject to use tax.

- Previous tax returns for reference.

- Any exemption certificates for tax-exempt sales.

Penalties for Non-Compliance

Failing to submit the SALES AND USE TAX REPORT on time or providing inaccurate information can result in significant penalties. These may include fines, interest on unpaid taxes, and potential legal action. It is crucial for businesses to stay informed about their tax obligations and ensure timely and accurate reporting to avoid these consequences.

Quick guide on how to complete sales and use tax report

Manage SALES AND USE TAX REPORT effortlessly on any device

Digital document management has become common among businesses and individuals. It offers an ideal sustainable alternative to traditional printed and signed documents, as you can locate the needed form and securely store it online. airSlate SignNow equips you with all the features required to create, modify, and eSign your documents swiftly without delays. Handle SALES AND USE TAX REPORT on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven process today.

How to modify and eSign SALES AND USE TAX REPORT with ease

- Find SALES AND USE TAX REPORT and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant parts of the documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature with the Sign feature, which takes moments and holds the same legal validity as a traditional wet ink signature.

- Verify all the information and click the Done button to save your changes.

- Select how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Forget about missing or misplaced documents, tedious form navigation, or errors that necessitate printing new copies. airSlate SignNow addresses all your needs in document management in just a few clicks from any device you prefer. Adapt and eSign SALES AND USE TAX REPORT and ensure effective communication at any point of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sales and use tax report

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a SALES AND USE TAX REPORT?

A SALES AND USE TAX REPORT is a document used by businesses to report and remit sales tax liabilities to the government. It details the amount of sales tax collected from customers and the purchases subject to use tax. Understanding how to generate and manage your SALES AND USE TAX REPORT is crucial for compliance and avoiding penalties.

-

How can airSlate SignNow help with generating SALES AND USE TAX REPORTS?

airSlate SignNow offers seamless document management that simplifies the process of generating SALES AND USE TAX REPORTS. With easy e-signatures and document tracking features, users can efficiently collect necessary information and ensure documents are signed and filed on time. This helps businesses streamline their tax compliance workflows.

-

Is there a cost associated with creating SALES AND USE TAX REPORTS using airSlate SignNow?

While airSlate SignNow offers a range of pricing plans, generating SALES AND USE TAX REPORTS comes at no additional cost once you subscribe. All necessary features to create and manage these reports are included in our plans, making it an affordable solution for your business's tax reporting needs.

-

What features in airSlate SignNow support SALES AND USE TAX REPORT management?

airSlate SignNow includes features such as customizable templates, automated workflows, and e-signatures, all of which support efficient SALES AND USE TAX REPORT management. These tools enable users to gather data quickly, ensure accuracy, and keep track of important deadlines related to tax reporting.

-

How secure is airSlate SignNow when handling SALES AND USE TAX REPORTS?

Security is paramount at airSlate SignNow, and we take measures to ensure that your SALES AND USE TAX REPORTS are protected. Our platform utilizes encryption, secure data storage, and compliance with industry standards to safeguard your sensitive tax information. You can trust that your reports are safe with us.

-

What integrations does airSlate SignNow offer for automating SALES AND USE TAX REPORT workflows?

airSlate SignNow offers integrations with various accounting and financial software, enhancing your ability to automate SALES AND USE TAX REPORT workflows. This means you can easily connect our platform with tools you already use, ensuring smooth data sharing and reducing manual data entry.

-

Can airSlate SignNow help with multiple state SALES AND USE TAX REPORTS?

Yes, airSlate SignNow can assist in managing multiple state SALES AND USE TAX REPORTS. Our solution allows users to create and store distinct reports for various states, maintaining compliance across jurisdictions. This is particularly beneficial for businesses operating in multiple locations.

Get more for SALES AND USE TAX REPORT

Find out other SALES AND USE TAX REPORT

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer