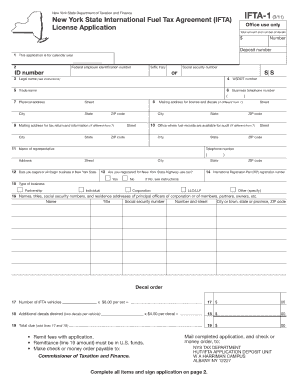

Nys Ifta Form

What is the NYS IFTA?

The New York State International Fuel Tax Agreement (NYS IFTA) is a tax collection agreement between the U.S. states and Canadian provinces. It simplifies the reporting of fuel use by motor carriers operating in multiple jurisdictions. Under this agreement, carriers pay fuel taxes based on the miles driven in each jurisdiction, rather than purchasing fuel tax permits for each state or province. This system aims to streamline the process for commercial vehicle operators, ensuring compliance with fuel tax regulations while minimizing administrative burdens.

Steps to Complete the NYS IFTA

Completing the NYS IFTA involves several key steps to ensure accuracy and compliance. First, gather all necessary information, including mileage records and fuel purchase receipts from each jurisdiction. Next, calculate the total miles driven and the total gallons of fuel purchased for each area. Once the calculations are complete, fill out the NYS IFTA form, ensuring all sections are accurately completed. Finally, review the form for any errors before submitting it to the appropriate state agency, either online or via mail.

Legal Use of the NYS IFTA

The NYS IFTA is legally binding when completed accurately and submitted on time. Compliance with the regulations set forth by the IFTA ensures that carriers are fulfilling their tax obligations. It is crucial for carriers to maintain accurate records of mileage and fuel purchases, as these documents may be subject to audit by state authorities. Failure to comply with IFTA regulations can result in penalties, including fines and interest on unpaid taxes.

Filing Deadlines / Important Dates

Carriers must adhere to specific filing deadlines for the NYS IFTA to avoid penalties. Typically, quarterly reports are due on the last day of the month following the end of each quarter. For example, the first quarter report is due by April 30, the second quarter by July 31, the third quarter by October 31, and the fourth quarter by January 31. It is essential for carriers to keep track of these dates to ensure timely submissions and maintain compliance with tax regulations.

Required Documents

To complete the NYS IFTA, certain documents are required. Carriers should have detailed mileage records that indicate the number of miles driven in each jurisdiction. Additionally, fuel purchase receipts are necessary to demonstrate compliance with fuel tax obligations. These documents not only support the information reported on the NYS IFTA form but also serve as critical evidence in the event of an audit.

Form Submission Methods

The NYS IFTA form can be submitted using various methods to accommodate different preferences. Carriers have the option to file online through the New York State Department of Taxation and Finance website, which offers a streamlined process for electronic submissions. Alternatively, the form can be mailed directly to the appropriate state agency or submitted in person at designated offices. Each method requires adherence to specific guidelines to ensure successful submission.

Quick guide on how to complete nys ifta

Complete Nys Ifta effortlessly on any gadget

Digital document management has gained traction among businesses and individuals alike. It serves as an ideal environmentally conscious alternative to traditional printed and signed paperwork, allowing you to locate the appropriate form and securely preserve it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents quickly and without hindrance. Handle Nys Ifta on any device with airSlate SignNow's Android or iOS applications and enhance any document-related procedure today.

How to adjust and eSign Nys Ifta with ease

- Locate Nys Ifta and click on Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes moments and holds the same legal validity as a conventional ink signature.

- Review the details and then hit the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs with just a few clicks from any device you prefer. Edit and eSign Nys Ifta while ensuring outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the nys ifta

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is NYS IFTA and why is it important for businesses?

NYS IFTA, or the New York State International Fuel Tax Agreement, is crucial for businesses operating commercial vehicles that travel across state lines. It simplifies the fuel tax reporting process for these businesses, ensuring they comply with tax laws while potentially lowering their tax burden.

-

How does airSlate SignNow help in managing NYS IFTA documents?

AirSlate SignNow streamlines the management of NYS IFTA documents by allowing users to easily create, edit, and eSign their forms. This efficiency reduces errors and accelerates the submission process, helping businesses stay compliant with NYS IFTA regulations.

-

What are the pricing options for using airSlate SignNow for NYS IFTA?

AirSlate SignNow offers competitive pricing plans designed to fit the needs of businesses managing NYS IFTA requirements. By choosing the appropriate plan, companies can access features specific to fuel tax documentation without breaking their budgets.

-

Can airSlate SignNow integrate with other software for NYS IFTA reporting?

Yes, airSlate SignNow provides seamless integrations with various accounting and transportation management software, enhancing your ability to manage NYS IFTA reporting efficiently. This flexibility allows users to sync their data across platforms effortlessly.

-

Is eSigning NYS IFTA documents with airSlate SignNow legally binding?

Absolutely, eSigning NYS IFTA documents with airSlate SignNow complies with legal standards, making electronic signatures legally binding. This ensures that your documentation holds up under audit and maintains integrity in tax reporting.

-

What features make airSlate SignNow ideal for handling NYS IFTA requirements?

AirSlate SignNow offers features like customizable templates, automatic notifications, and secure cloud storage specifically useful for NYS IFTA requirements. These functionalities help businesses improve their workflow and maintain organized records.

-

How can airSlate SignNow enhance the efficiency of NYS IFTA submissions?

Utilizing airSlate SignNow enhances the efficiency of NYS IFTA submissions by providing a user-friendly interface for quick document handling. This minimizes the time spent on paperwork, allowing businesses to focus on their core operations.

Get more for Nys Ifta

Find out other Nys Ifta

- Sign Minnesota Insurance Residential Lease Agreement Fast

- How Do I Sign Ohio Lawers LLC Operating Agreement

- Sign Oregon Lawers Limited Power Of Attorney Simple

- Sign Oregon Lawers POA Online

- Sign Mississippi Insurance POA Fast

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later