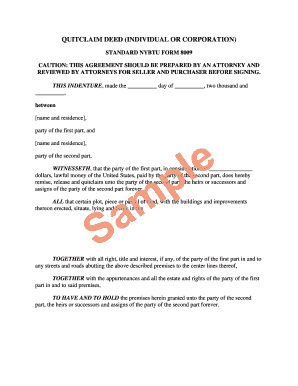

Form 8009 a

What is the Form 8009 A

The Form 8009 A is an official document used primarily for reporting certain tax-related information to the Internal Revenue Service (IRS). This form is essential for individuals and businesses that need to provide specific details regarding their financial activities. Understanding the purpose and requirements of the Form 8009 A is crucial for compliance with federal tax regulations.

How to use the Form 8009 A

Using the Form 8009 A involves accurately filling out the required fields with relevant information. Users must ensure that all data is complete and correct to avoid any issues with the IRS. The form can be filled out electronically or by hand, but electronic submission is often more efficient and secure. It is important to follow the instructions provided with the form to ensure proper usage and submission.

Steps to complete the Form 8009 A

Completing the Form 8009 A requires several key steps:

- Gather necessary information, including personal identification and financial data.

- Download the form from the official IRS website or access it through a reliable digital platform.

- Fill in the required fields, ensuring accuracy and completeness.

- Review the form for any errors or omissions.

- Submit the form electronically or via mail, depending on your preference.

Legal use of the Form 8009 A

The legal use of the Form 8009 A is governed by IRS regulations. To ensure that the form is considered valid, it must be completed in accordance with the guidelines set forth by the IRS. This includes using the correct version of the form and adhering to submission deadlines. Failure to comply with these regulations can result in penalties or delays in processing.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8009 A can vary based on the specific tax year and the type of information being reported. It is essential to be aware of these dates to avoid late submissions. Generally, forms should be filed by the designated due date, which is typically aligned with the annual tax filing deadline. Checking the IRS website for the most current deadlines is advisable.

Form Submission Methods (Online / Mail / In-Person)

The Form 8009 A can be submitted through various methods, providing flexibility for users. Options include:

- Online Submission: Many users prefer to submit the form electronically through secure platforms, ensuring faster processing.

- Mail: The form can be printed and sent via postal service to the appropriate IRS address.

- In-Person: Some individuals may choose to deliver the form in person at designated IRS offices, although this method is less common.

Quick guide on how to complete form 8009 a

Effortlessly Prepare Form 8009 A on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and electronically sign your documents promptly without delays. Manage Form 8009 A on any device with airSlate SignNow's Android or iOS applications and streamline any document-related procedure today.

How to Edit and eSign Form 8009 A with Ease

- Locate Form 8009 A and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize relevant sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you want to deliver your form, via email, text message (SMS), invitation link, or download it to your computer.

Put an end to lost or misplaced documents, cumbersome form searches, or errors that require printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8009 A and ensure effective communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 8009 a

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the form 8009 used for?

The form 8009 is utilized for specific tax reporting and compliance requirements. By filling out form 8009 accurately, businesses ensure they meet federal and state regulations efficiently.

-

How can airSlate SignNow help with form 8009?

airSlate SignNow streamlines the process of completing and submitting form 8009 electronically. With our solution, you can easily eSign and send the form securely, saving time and reducing the risk of errors.

-

Is there a fee associated with submitting the form 8009 using airSlate SignNow?

airSlate SignNow offers a variety of pricing plans to meet different business needs, including options for submitting form 8009. The pricing is competitive and designed to provide a cost-effective solution for users looking to manage their forms electronically.

-

What features does airSlate SignNow provide for managing form 8009?

airSlate SignNow includes features such as document templates, bulk sending, and secure cloud storage for managing form 8009. These tools simplify the process and enhance collaboration among team members.

-

Can I integrate airSlate SignNow with other software to handle form 8009?

Yes, airSlate SignNow offers seamless integrations with various applications, allowing you to automate the workflow related to form 8009. This enhances productivity by connecting your favorite tools and streamlining document management.

-

What are the benefits of using airSlate SignNow for form 8009?

Using airSlate SignNow for form 8009 brings numerous benefits, including faster processing times and enhanced security. Our platform ensures your documents are encrypted and compliant, minimizing the risk of unauthorized access.

-

Is it easy to learn how to use airSlate SignNow for form 8009?

Absolutely! airSlate SignNow is designed to be user-friendly, making it easy for anyone to navigate and manage form 8009. Comprehensive tutorials and customer support are available to help you get started quickly.

Get more for Form 8009 A

- Income tax return for homeowners associations for paperwork reduction act notice see page 2 form

- October 1995 department of the treasury internal revenue service application for automatic extension of time to file u form

- 1995 form 8829 expenses for business use of your home

- Ecampus fiu 1993 form

- 1993 form 990 irs

- 1993 form 1099misc

- 706 online form

- Irs notice 2008 14 form

Find out other Form 8009 A

- Validate Sign PDF Online

- How To Validate Sign PDF

- Validate Sign PDF Free

- Validate Sign PDF Secure

- Validate Sign Word Later

- Validate Sign Word Simple

- Validate Sign Word Safe

- Validate Sign Document Later

- How Do I Validate Sign Document

- Validate Sign Form Simple

- Validate Sign PPT Android

- Validate Sign Form Mac

- E-mail Sign Word Online

- E-mail Sign Word Computer

- E-mail Sign PDF iOS

- E-mail Sign Word Now

- E-mail Sign Word Secure

- E-mail Sign Document Computer

- E-mail Sign Document Free

- E-mail Sign Document Fast