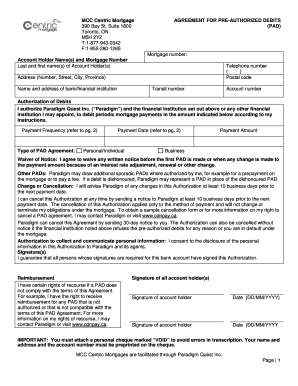

Mcc Centric Mortgage Form

What is the MCC Centric Mortgage

The MCC Centric Mortgage is a specialized mortgage program designed to assist eligible homebuyers in achieving homeownership. This program utilizes a Mortgage Credit Certificate (MCC) that allows borrowers to claim a tax credit for a portion of the mortgage interest paid each year. The primary goal of the MCC Centric Mortgage is to make homeownership more affordable, particularly for first-time buyers or those with lower incomes. By reducing the amount of federal income tax owed, the MCC can significantly enhance a borrower’s purchasing power, making it easier to qualify for a mortgage.

How to Obtain the MCC Centric Mortgage

To obtain the MCC Centric Mortgage, potential borrowers must first check their eligibility. This typically involves meeting income limits and purchasing a home within designated areas. Interested buyers should contact a participating lender who is familiar with the MCC program. The lender will guide them through the application process, which includes submitting necessary documentation such as income verification and tax returns. Once approved, the borrower can then apply for the mortgage through the lender, incorporating the MCC into their financing plan.

Steps to Complete the MCC Centric Mortgage

Completing the MCC Centric Mortgage involves several key steps:

- Determine eligibility based on income and home purchase location.

- Gather required documentation, including proof of income and tax information.

- Consult with a lender experienced in MCC programs to initiate the application process.

- Complete the lender's application for the mortgage, ensuring to include the MCC.

- Receive approval and finalize the mortgage agreement.

Each step is crucial to ensure compliance with program requirements and to maximize the benefits of the MCC.

Legal Use of the MCC Centric Mortgage

The legal use of the MCC Centric Mortgage is governed by federal and state regulations. It is essential for borrowers to adhere to the guidelines established by the Internal Revenue Service (IRS) and local housing authorities. This includes ensuring that the property purchased meets specific criteria and that the borrower maintains eligibility throughout the life of the mortgage. Failure to comply with these regulations can result in the loss of the tax credit and potential penalties.

Key Elements of the MCC Centric Mortgage

Several key elements define the MCC Centric Mortgage:

- Tax Credit: Borrowers can receive a tax credit for a percentage of the mortgage interest paid.

- Eligibility Requirements: Must meet income limits and purchase within designated areas.

- Participating Lenders: Only certain lenders are authorized to offer this mortgage type.

- Compliance: Adherence to federal and state regulations is mandatory for maintaining eligibility.

Understanding these elements is vital for prospective borrowers to maximize the benefits of the MCC Centric Mortgage.

Required Documents

When applying for the MCC Centric Mortgage, borrowers should prepare the following documents:

- Proof of income (pay stubs, tax returns).

- Credit report and score.

- Identification (driver's license, Social Security number).

- Details of the property being purchased.

- Any additional documentation as requested by the lender.

Having these documents ready can streamline the application process and help ensure a successful outcome.

Quick guide on how to complete mcc centric mortgage

Complete Mcc Centric Mortgage effortlessly on any device

Online document management has become a favored choice for businesses and individuals. It offers an excellent eco-friendly substitute for conventional printed and signed documents, as you can obtain the appropriate form and securely store it online. airSlate SignNow provides you with all the tools necessary to create, edit, and eSign your documents quickly without delays. Manage Mcc Centric Mortgage on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

How to edit and eSign Mcc Centric Mortgage with ease

- Find Mcc Centric Mortgage and click Get Form to begin.

- Utilize the tools we offer to fill out your document.

- Highlight pertinent sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and click the Done button to save your changes.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious document searching, or errors that require printing out new document copies. airSlate SignNow meets all your document management requirements in just a few clicks from any device you prefer. Edit and eSign Mcc Centric Mortgage and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the mcc centric mortgage

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is an MCC centric mortgage?

An MCC centric mortgage is a specialized type of mortgage designed to accommodate the needs of borrowers who qualify for a Mortgage Credit Certificate (MCC). This program allows eligible homebuyers to receive a federal tax credit, ultimately lowering their overall mortgage cost. By utilizing an MCC centric mortgage, you can enhance your home buying power and make informed financial decisions.

-

How does an MCC centric mortgage work?

An MCC centric mortgage operates by providing eligible homebuyers with a tax credit based on a percentage of the mortgage interest paid. This credit can be applied to your federal income tax liability, thereby reducing your tax burden and monthly payments. This innovative approach makes home ownership more accessible and affordable.

-

What are the benefits of using an MCC centric mortgage?

The primary benefit of an MCC centric mortgage is the potential for signNow savings through tax credits. Additionally, this type of mortgage can facilitate access to home ownership for first-time buyers or low-income families. By utilizing this option, you can improve your financial stability while obtaining your dream home.

-

What qualifications are needed for an MCC centric mortgage?

To qualify for an MCC centric mortgage, applicants typically need to meet specific income limitations and occupancy requirements set by the program. Furthermore, first-time homebuyer status is often a prerequisite, along with purchasing a home within designated geographic areas. Consulting with a qualified lender can help clarify your eligibility.

-

Can I use an MCC centric mortgage with other types of loans?

Yes, an MCC centric mortgage can often be combined with various loan types including FHA, VA, or conventional loans. Doing so can help enhance your financing options and maximize savings. It's essential to work with a knowledgeable lender who understands how to integrate an MCC with your chosen mortgage program.

-

How does an MCC centric mortgage impact my down payment?

An MCC centric mortgage does not directly affect your down payment requirements, which are generally dictated by the mortgage program you select. However, the tax credit provided can ease the financial burden of home buying, potentially allowing you to allocate more funds toward your down payment. This flexibility can support your overall financial wellness.

-

What fees are associated with an MCC centric mortgage?

The fees associated with an MCC centric mortgage can vary based on the lender and the specific mortgage terms. Common costs include loan origination fees, appraisal fees, and processing fees. It’s advisable to review these details upfront, ensuring they align with your budget and financial goals.

Get more for Mcc Centric Mortgage

Find out other Mcc Centric Mortgage

- How To Integrate Sign in Banking

- How To Use Sign in Banking

- Help Me With Use Sign in Banking

- Can I Use Sign in Banking

- How Do I Install Sign in Banking

- How To Add Sign in Banking

- How Do I Add Sign in Banking

- How Can I Add Sign in Banking

- Can I Add Sign in Banking

- Help Me With Set Up Sign in Government

- How To Integrate eSign in Banking

- How To Use eSign in Banking

- How To Install eSign in Banking

- How To Add eSign in Banking

- How To Set Up eSign in Banking

- How To Save eSign in Banking

- How To Implement eSign in Banking

- How To Set Up eSign in Construction

- How To Integrate eSign in Doctors

- How To Use eSign in Doctors