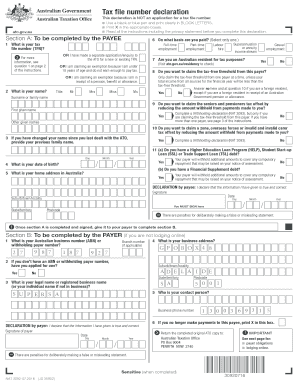

You Must Also Complete the Attached ATO Tax File Number Declaration Form and Return it to Super SA with Your Application

Understanding the Tax File Declaration Form

The tax file declaration form is a crucial document used by employees and contractors in the United States to provide their tax file number and other relevant information to their employers. This form ensures that the correct amount of tax is withheld from an individual's earnings. It is essential for compliance with IRS regulations and plays a significant role in the overall tax filing process.

Steps to Complete the Tax File Declaration Form

Filling out the tax file declaration form involves several key steps:

- Gather necessary personal information, including your Social Security number and tax file number.

- Fill out the form accurately, ensuring that all fields are completed as required.

- Review the information for accuracy to avoid any potential issues with tax withholding.

- Sign and date the form to validate your submission.

- Submit the completed form to your employer or the relevant tax authority.

Legal Use of the Tax File Declaration Form

The tax file declaration form is legally binding when completed correctly. It must adhere to the guidelines set forth by the IRS and other regulatory bodies. This includes ensuring that the information provided is truthful and complete. Failure to comply with these legal requirements can result in penalties or issues with tax filings.

Filing Deadlines and Important Dates

It is important to be aware of the filing deadlines associated with the tax file declaration form. Typically, this form should be submitted at the beginning of employment or when there are changes in your tax situation. Keeping track of important dates ensures that you remain compliant and avoid any delays in processing your tax information.

Required Documents for Submission

When completing the tax file declaration form, you may need to provide additional documentation. This can include:

- Proof of identity, such as a driver's license or passport.

- Previous tax returns, if applicable.

- Any relevant tax documents, such as W-2 forms or 1099s.

Who Issues the Tax File Declaration Form

The tax file declaration form is typically issued by the employer or the relevant tax authority. Employers are responsible for providing this form to new employees as part of the onboarding process. It is important to ensure that you receive the correct version of the form to comply with current tax regulations.

Quick guide on how to complete you must also complete the attached ato tax file number declaration form and return it to super sa with your application

Complete You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application effortlessly on any device

Online document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, modify, and eSign your documents quickly without delays. Handle You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application on any device using airSlate SignNow's Android or iOS applications and enhance any document-centric process today.

The easiest way to modify and eSign You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application effortlessly

- Find You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application and click Get Form to begin.

- Utilize the features we offer to fill out your form.

- Emphasize relevant parts of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form—via email, SMS, an invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or errors that necessitate reprinting new copies. airSlate SignNow meets all your document management needs in just a few clicks from a device of your choice. Modify and eSign You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application and foster outstanding communication at any phase of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the you must also complete the attached ato tax file number declaration form and return it to super sa with your application

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a tax file declaration form?

A tax file declaration form is a document used to collect personal and financial information from employees to determine the correct amount of tax to withhold from their pay. By using airSlate SignNow, businesses can easily create, send, and eSign tax file declaration forms securely and efficiently.

-

How can airSlate SignNow help with the tax file declaration form process?

AirSlate SignNow streamlines the tax file declaration form process by allowing users to electronically send and sign documents. This ensures faster processing times and reduces the likelihood of errors, making tax compliance simpler for businesses and their employees.

-

What are the pricing options for using airSlate SignNow for tax file declaration forms?

AirSlate SignNow offers several pricing plans tailored to fit any business size, each designed to provide an efficient way to manage tax file declaration forms. Pricing is competitive and provides access to all the essential features needed for seamless document management and eSigning.

-

Is it easy to integrate airSlate SignNow with other software for tax file declaration forms?

Yes, airSlate SignNow provides seamless integrations with various business applications, allowing for effective management of tax file declaration forms alongside other business processes. These integrations help enhance productivity and ensure that all documents are easily accessible across different platforms.

-

What security measures does airSlate SignNow implement for tax file declaration forms?

Security is a top priority for airSlate SignNow. The platform uses advanced encryption methods and secure authentication processes to protect sensitive information in tax file declaration forms, ensuring that data remains confidential and compliant with legal standards.

-

Can I track the status of a tax file declaration form sent through airSlate SignNow?

Absolutely! AirSlate SignNow provides tracking capabilities for all documents, including tax file declaration forms. Users can monitor the status of their sent forms, ensuring that they are completed and returned on time.

-

What benefits does airSlate SignNow offer for managing tax file declaration forms?

Using airSlate SignNow for tax file declaration forms offers numerous benefits, including improved efficiency, reduced paper usage, and enhanced compliance. The platform makes it easy to manage documents digitally, saving time and resources while minimizing errors in tax filings.

Get more for You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application

- Omh 471a certificate of examining physician to support an omh ny form

- Affidavit of self employment income maryland health connection form

- Benefit verification form

- 12 995 b 2015 form

- Form omh 471

- Wood destroying insect inspection report form mda maryland

- Texas department of motor vehicles form

- Child abroad general passport application child abroad general passport application for canadians under 16 years of age form

Find out other You Must Also Complete The Attached ATO Tax File Number Declaration Form And Return It To Super SA With Your Application

- eSign Mississippi Government LLC Operating Agreement Easy

- eSign Ohio High Tech Letter Of Intent Later

- eSign North Dakota High Tech Quitclaim Deed Secure

- eSign Nebraska Healthcare / Medical LLC Operating Agreement Simple

- eSign Nebraska Healthcare / Medical Limited Power Of Attorney Mobile

- eSign Rhode Island High Tech Promissory Note Template Simple

- How Do I eSign South Carolina High Tech Work Order

- eSign Texas High Tech Moving Checklist Myself

- eSign Texas High Tech Moving Checklist Secure

- Help Me With eSign New Hampshire Government Job Offer

- eSign Utah High Tech Warranty Deed Simple

- eSign Wisconsin High Tech Cease And Desist Letter Fast

- eSign New York Government Emergency Contact Form Online

- eSign North Carolina Government Notice To Quit Now

- eSign Oregon Government Business Plan Template Easy

- How Do I eSign Oklahoma Government Separation Agreement

- How Do I eSign Tennessee Healthcare / Medical Living Will

- eSign West Virginia Healthcare / Medical Forbearance Agreement Online

- eSign Alabama Insurance LLC Operating Agreement Easy

- How Can I eSign Alabama Insurance LLC Operating Agreement