EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford Form

What is the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

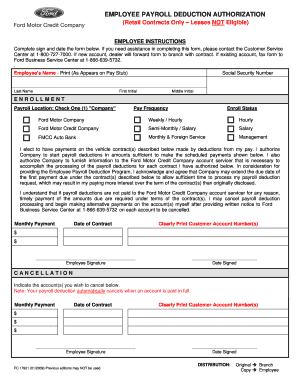

The EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford is a formal document that allows employees to authorize their employer to deduct specific amounts from their paychecks for various purposes. This may include contributions to retirement plans, health insurance premiums, or other benefits. The form serves as a legal agreement between the employee and employer, ensuring that deductions are made accurately and in compliance with applicable laws.

Steps to complete the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

Completing the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford involves several straightforward steps:

- Obtain the form from your employer or download it from a reliable source.

- Fill in your personal details, including your name, employee ID, and department.

- Specify the type of deductions you are authorizing, such as retirement contributions or health insurance.

- Indicate the amount to be deducted from each paycheck.

- Review the information for accuracy and completeness.

- Sign and date the form to validate your authorization.

- Submit the completed form to your HR department for processing.

Key elements of the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

Understanding the key elements of the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford is essential for both employees and employers. Important components include:

- Employee Information: This section captures the employee's name, ID number, and contact details.

- Deduction Types: Employees must specify which deductions they are authorizing, such as retirement savings or insurance premiums.

- Amount of Deduction: The form should clearly state the amount to be deducted from each paycheck.

- Effective Date: This indicates when the deductions will start, ensuring both parties are aware of the timeline.

- Signature: The employee's signature is crucial for validating the authorization and making it legally binding.

Legal use of the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

The legal use of the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford is governed by federal and state regulations. To ensure compliance:

- Both the employee and employer must retain a copy of the signed authorization for their records.

- The deductions must align with the employee's consent as specified in the form.

- Employers should ensure that deductions are processed accurately and timely to avoid legal disputes.

- Any changes to the deductions require a new authorization form to be completed and signed.

How to use the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

Using the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford effectively involves understanding its purpose and process. Employees should:

- Review their benefits and financial goals to determine which deductions are appropriate.

- Consult with HR or a financial advisor if unsure about the implications of specific deductions.

- Complete the form accurately to prevent delays in processing.

- Keep track of deductions on pay stubs to ensure they align with the authorized amounts.

Examples of using the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

There are various scenarios in which the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford can be utilized:

- An employee may authorize deductions for a 401(k) retirement plan to save for their future.

- Health insurance premiums can be deducted directly from an employee's paycheck, simplifying payment processes.

- Employees may choose to contribute to flexible spending accounts for medical expenses, utilizing payroll deductions.

Quick guide on how to complete employee payroll deduction authorization ford

Effortlessly Prepare EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the tools you require to quickly create, edit, and electronically sign your documents without any delays. Handle EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford on any platform with the airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The simplest way to modify and electronically sign EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford effortlessly

- Locate EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford and then click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Produce your electronic signature using the Sign tool, which only takes a few seconds and carries the same legal validity as a conventional handwritten signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searching, and mistakes that require printing new copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Alter and electronically sign EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford while ensuring clear communication throughout the entire form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the employee payroll deduction authorization ford

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

The EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford is a document used to authorize the deduction of specific amounts from an employee's paycheck for various purposes, such as insurance premiums or retirement plans. Utilizing airSlate SignNow for these documents simplifies the process with digital signatures and secure storage.

-

How can airSlate SignNow improve the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford process?

airSlate SignNow streamlines the EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford by allowing HR departments to easily create, send, and eSign these documents online. This efficiency reduces processing time and enhances compliance with payroll regulations.

-

What are the pricing options for using airSlate SignNow for EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. You can choose from various subscription tiers, making it cost-effective for handling EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford and other employee documents without breaking the budget.

-

Can I integrate airSlate SignNow with existing payroll systems for EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

Yes, airSlate SignNow easily integrates with popular payroll systems, ensuring seamless processing of EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford. This integration helps streamline data transfer, reducing manual entry and potential errors.

-

What security features does airSlate SignNow provide for EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

Security is a top priority at airSlate SignNow. Our platform employs advanced encryption and secure cloud storage to protect your EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford documents, ensuring that sensitive information remains confidential and compliant with data protection regulations.

-

How does airSlate SignNow help with compliance regarding EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

Using airSlate SignNow assists companies in maintaining compliance for EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford by providing an auditable trail of all signatures and document revisions. This feature ensures that your documents are legally binding and meets all necessary requirements.

-

Is airSlate SignNow user-friendly for managing EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford?

Absolutely! airSlate SignNow is designed with an intuitive interface that makes it easy for users to manage EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford. Regardless of your technical expertise, you can quickly navigate the platform and efficiently handle document workflows.

Get more for EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

Find out other EMPLOYEE PAYROLL DEDUCTION AUTHORIZATION Ford

- How Do I eSignature Washington Insurance Form

- How Do I eSignature Alaska Life Sciences Presentation

- Help Me With eSignature Iowa Life Sciences Presentation

- How Can I eSignature Michigan Life Sciences Word

- Can I eSignature New Jersey Life Sciences Presentation

- How Can I eSignature Louisiana Non-Profit PDF

- Can I eSignature Alaska Orthodontists PDF

- How Do I eSignature New York Non-Profit Form

- How To eSignature Iowa Orthodontists Presentation

- Can I eSignature South Dakota Lawers Document

- Can I eSignature Oklahoma Orthodontists Document

- Can I eSignature Oklahoma Orthodontists Word

- How Can I eSignature Wisconsin Orthodontists Word

- How Do I eSignature Arizona Real Estate PDF

- How To eSignature Arkansas Real Estate Document

- How Do I eSignature Oregon Plumbing PPT

- How Do I eSignature Connecticut Real Estate Presentation

- Can I eSignature Arizona Sports PPT

- How Can I eSignature Wisconsin Plumbing Document

- Can I eSignature Massachusetts Real Estate PDF