Georgia Department of Revenue Form Cd 32

What is the Georgia Department Of Revenue Form Cd 32

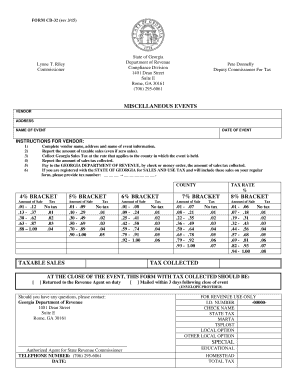

The Georgia Department of Revenue Form CD 32 is a specific document used for tax purposes in the state of Georgia. This form is primarily utilized by taxpayers to report certain types of income and deductions. Understanding the purpose of this form is essential for compliance with state tax laws. It plays a crucial role in ensuring that taxpayers accurately report their financial activities to the Georgia Department of Revenue.

How to use the Georgia Department Of Revenue Form Cd 32

Using the Georgia Department of Revenue Form CD 32 involves several steps to ensure accurate completion. First, gather all necessary financial documents, such as income statements and receipts for deductions. Next, fill out the form with the required information, ensuring that all entries are accurate and complete. Once the form is filled out, review it for any errors before submission. This careful approach helps prevent delays in processing and potential penalties.

Steps to complete the Georgia Department Of Revenue Form Cd 32

Completing the Georgia Department of Revenue Form CD 32 requires a systematic approach. Follow these steps:

- Obtain the latest version of the form from the Georgia Department of Revenue website.

- Read the instructions carefully to understand the requirements.

- Fill in your personal information, including your name, address, and Social Security number.

- Report your income and any applicable deductions as instructed.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Legal use of the Georgia Department Of Revenue Form Cd 32

The legal use of the Georgia Department of Revenue Form CD 32 is governed by state tax laws. To be considered valid, the form must be completed accurately and submitted within the specified deadlines. Electronic submissions are accepted, provided that they comply with the relevant eSignature laws. Ensuring that the form is filled out correctly and submitted on time helps avoid legal complications and penalties.

Required Documents

When completing the Georgia Department of Revenue Form CD 32, several documents may be required to support your claims. These documents typically include:

- W-2 forms from employers.

- 1099 forms for other income sources.

- Receipts for deductible expenses.

- Previous tax returns for reference.

Having these documents readily available can streamline the completion process and enhance the accuracy of your submission.

Form Submission Methods

The Georgia Department of Revenue Form CD 32 can be submitted through various methods, offering flexibility to taxpayers. You can choose to file the form electronically through the Georgia Department of Revenue's online portal. Alternatively, you may opt to mail a paper version of the form to the appropriate address provided in the instructions. In-person submissions are also possible at designated locations, ensuring that you have options that suit your needs.

Quick guide on how to complete georgia department of revenue form cd 32

Complete Georgia Department Of Revenue Form Cd 32 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without delays. Handle Georgia Department Of Revenue Form Cd 32 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related tasks today.

How to alter and eSign Georgia Department Of Revenue Form Cd 32 with ease

- Find Georgia Department Of Revenue Form Cd 32 and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Highlight crucial sections of your documents or obscure sensitive information with tools that airSlate SignNow supplies specifically for that purpose.

- Create your eSignature with the Sign feature, which only takes seconds and bears the same legal validity as a traditional wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), invitation link, or download it to your computer.

No more worrying about lost or misplaced documents, tedious form searching, or errors necessitating the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Alter and eSign Georgia Department Of Revenue Form Cd 32 and guarantee excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the georgia department of revenue form cd 32

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Georgia Department Of Revenue Form Cd 32?

The Georgia Department Of Revenue Form Cd 32 is a document used for reporting certain transactions related to sales and use tax in Georgia. Understanding this form is important for businesses to ensure compliance with state tax regulations. By using airSlate SignNow, you can easily fill out and eSign this form for a streamlined submission process.

-

How can airSlate SignNow help with the Georgia Department Of Revenue Form Cd 32?

airSlate SignNow provides an efficient platform to create, fill, and eSign the Georgia Department Of Revenue Form Cd 32. Our solution simplifies the document management process, helping businesses save time and reduce errors associated with manual paperwork. Enjoy secure cloud storage and access to your documents anytime.

-

Is there a cost associated with using airSlate SignNow for the Georgia Department Of Revenue Form Cd 32?

Yes, airSlate SignNow offers various pricing plans tailored to different business needs. Each plan includes features that enhance the signing and management of the Georgia Department Of Revenue Form Cd 32. Users can choose a plan based on their frequency of use and required features.

-

Can I integrate airSlate SignNow with other business tools for processing the Georgia Department Of Revenue Form Cd 32?

Absolutely! airSlate SignNow integrates seamlessly with numerous business applications, making it easy to handle the Georgia Department Of Revenue Form Cd 32 alongside other workflows. This integration capability enhances productivity and collaboration within teams.

-

What are the benefits of using airSlate SignNow for the Georgia Department Of Revenue Form Cd 32?

Using airSlate SignNow for the Georgia Department Of Revenue Form Cd 32 allows for quicker turnaround times, enhanced accuracy, and improved security of documents. The electronic signing process is not only user-friendly but also helps in maintaining a complete digital record of your submissions.

-

Is electronic signing of the Georgia Department Of Revenue Form Cd 32 legal?

Yes, electronic signatures on the Georgia Department Of Revenue Form Cd 32 are legally binding, provided they comply with state and federal regulations. airSlate SignNow adheres to these legal standards to ensure that your signed documents hold up in court and meet all necessary requirements.

-

How do I get started with airSlate SignNow for the Georgia Department Of Revenue Form Cd 32?

Getting started with airSlate SignNow is easy. Simply sign up for an account, select the template for the Georgia Department Of Revenue Form Cd 32, and begin filling it out. With guided steps, you'll be able to eSign and manage your documents in no time.

Get more for Georgia Department Of Revenue Form Cd 32

- Discharging indemnity secured funding bond form

- Texmason pdf form

- Mv3623 wisconsin department of transportation form

- Notice of intent to lodge documents san diego superior court sdcourt ca form

- School form 2 sf2 daily attendance report of learners

- Steadfast management company inc rental application form

- Fire pump test form hose monster

- Cigar shop reporting form form 35 7500

Find out other Georgia Department Of Revenue Form Cd 32

- eSign Kentucky Orthodontists Living Will Mobile

- eSign Florida Plumbing Business Plan Template Now

- How To eSign Georgia Plumbing Cease And Desist Letter

- eSign Florida Plumbing Credit Memo Now

- eSign Hawaii Plumbing Contract Mobile

- eSign Florida Plumbing Credit Memo Fast

- eSign Hawaii Plumbing Claim Fast

- eSign Hawaii Plumbing Letter Of Intent Myself

- eSign Hawaii Plumbing Letter Of Intent Fast

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent