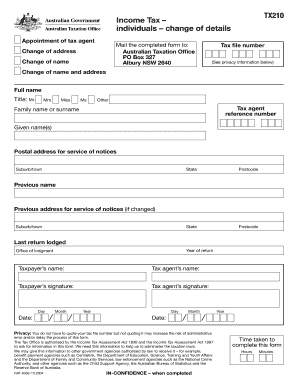

Tx210 Form

What is the Tx210 Form

The Tx210 form is a specific document used in various administrative and legal contexts within the United States. This form typically serves as a request or application for certain services or benefits, depending on the issuing authority. Understanding its purpose is crucial for ensuring compliance and proper handling of the necessary procedures.

How to use the Tx210 Form

Using the Tx210 form involves several straightforward steps. First, identify the specific purpose of the form to ensure you are completing it correctly. Next, gather all required information and supporting documents needed for submission. Once you have completed the form, review it for accuracy before submitting it according to the guidelines provided by the issuing authority.

Steps to complete the Tx210 Form

To complete the Tx210 form effectively, follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal information accurately, including name, address, and any relevant identification numbers.

- Provide any additional information requested, ensuring it aligns with the purpose of the form.

- Attach any necessary supporting documents that verify your claims or requests.

- Review the completed form for completeness and correctness.

- Submit the form as directed, whether online, by mail, or in person.

Legal use of the Tx210 Form

The Tx210 form holds legal significance, as it may be required for compliance with various regulations. When filled out and submitted correctly, it can serve as a binding document in administrative processes. It is essential to ensure that all information is accurate and that the form is signed where required to uphold its legal validity.

Key elements of the Tx210 Form

Understanding the key elements of the Tx210 form is vital for effective completion. The form typically includes:

- Personal identification information

- Details relevant to the request or application

- Signature lines for the applicant and any witnesses, if necessary

- Instructions for submission and any applicable deadlines

Filing Deadlines / Important Dates

Filing deadlines for the Tx210 form can vary based on its purpose and the issuing authority. It is crucial to be aware of any specific dates to avoid penalties or delays in processing. Check the official guidelines associated with the form to ensure timely submission.

Quick guide on how to complete tx210 form

Effortlessly prepare Tx210 Form on any device

Managing documents online has become popular among organizations and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and electronically sign your documents quickly without delays. Handle Tx210 Form on any gadget using airSlate SignNow’s Android or iOS applications and enhance any document-centric process today.

How to modify and electronically sign Tx210 Form with ease

- Locate Tx210 Form and click Get Form to begin.

- Use the tools available to complete your document.

- Highlight important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate the hassle of missing or lost files, tedious form searching, or errors that require printing new document copies. airSlate SignNow fulfills your document management requirements with just a few clicks from your chosen device. Edit and electronically sign Tx210 Form to ensure outstanding communication at any stage of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tx210 form

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the tx210 form used for?

The tx210 form is primarily used for filing claims and applications with specific regulatory authorities. Businesses often require this form to ensure compliance with local regulations. Understanding its purpose can greatly enhance your operational efficiency.

-

How can I fill out the tx210 form electronically?

You can easily fill out the tx210 form electronically using airSlate SignNow's intuitive platform. Our solution allows you to upload the form, fill it out, and eSign it securely. This saves time and reduces errors associated with manual completion.

-

Is there a cost associated with using airSlate SignNow for the tx210 form?

Yes, there are costs associated with using airSlate SignNow, but our pricing is designed to be cost-effective. We offer various plans that provide flexible pricing options based on your document needs, including eSigning forms like the tx210 form. This ensures you get great value for your investment.

-

What features does airSlate SignNow offer for the tx210 form?

AirSlate SignNow offers a variety of features for the tx210 form, including customizable templates, bulk sending, and advanced signing options. Users can also track document status and set reminders to streamline the signing process. These features enhance your efficiency and ensure timely completion.

-

Can I integrate airSlate SignNow with other software for the tx210 form?

Absolutely! AirSlate SignNow integrates seamlessly with various software applications, facilitating the use of the tx210 form. You can connect with tools such as CRM systems or cloud storage services to enhance your document management processes.

-

What benefits does eSigning the tx210 form provide?

eSigning the tx210 form using airSlate SignNow offers numerous benefits, including faster turnaround times and reduced paperwork. It enhances security through encrypted signatures and ensures compliance with legal requirements. This convenience helps you focus on your business rather than paperwork.

-

How secure is the tx210 form when signed with airSlate SignNow?

The tx210 form is highly secure when signed with airSlate SignNow. Our platform uses top-notch encryption and authentication measures to protect your documents. You can trust that your sensitive information remains safe while you manage your digital signatures.

Get more for Tx210 Form

- Noc application form ministry of interior bpakistanb

- Pain drawing symptom rating scale blyss chiropractic form

- Nc npa nonresident partner affirmation form

- Steuben county district attorneys office driver safety diversion and reduction program affidavit application please read the form

- Uss pawcatuck ao 108 military locator and reunion service form

- Shipment release authorization herbaloft form

- Complete release of liability and taos ski valley skitaos form

- Cbs1 6 15 mandatory 1 16 form

Find out other Tx210 Form

- Sign Georgia Banking Affidavit Of Heirship Myself

- Sign Hawaii Banking NDA Now

- Sign Hawaii Banking Bill Of Lading Now

- Sign Illinois Banking Confidentiality Agreement Computer

- Sign Idaho Banking Rental Lease Agreement Online

- How Do I Sign Idaho Banking Limited Power Of Attorney

- Sign Iowa Banking Quitclaim Deed Safe

- How Do I Sign Iowa Banking Rental Lease Agreement

- Sign Iowa Banking Residential Lease Agreement Myself

- Sign Kansas Banking Living Will Now

- Sign Kansas Banking Last Will And Testament Mobile

- Sign Kentucky Banking Quitclaim Deed Online

- Sign Kentucky Banking Quitclaim Deed Later

- How Do I Sign Maine Banking Resignation Letter

- Sign Maine Banking Resignation Letter Free

- Sign Louisiana Banking Separation Agreement Now

- Sign Maryland Banking Quitclaim Deed Mobile

- Sign Massachusetts Banking Purchase Order Template Myself

- Sign Maine Banking Operating Agreement Computer

- Sign Banking PPT Minnesota Computer